If you've ever wondered if Wall Street's sophistication could get a little taste of blockchain magic, you're not alone. Let's unravel the story of Ondo Finance—a platform that’s giving traditional finance a sleek, decentralized makeover courtesy of tokenization. Now, tokenization sounds fancy, but honestly, it’s all about representation. Think of it as turning real-world assets, like US Treasuries, into little digital tokens you can swap or use on-chain. Pretty wild, right?

Painting the Big Picture: What Is Ondo Finance, Anyway?

The heart of Ondo Finance is straightforward: make institutional-grade financial products available to anyone with an internet connection and a dash of curiosity. They’re not doing it alone, either. Picture a thriving neighborhood—Ondo’s ecosystem breaks out into:

- Flux Finance: This partnership makes cross-chain magic a lot more seamless than your average crypto swap.

- Ondo DAO: Imagine a community-powered council. Here, everyone pitches in decisions about the protocol’s future.

- Ondo Foundation: These are the folks fanning the flames of protocol growth and supporting other DeFi projects.

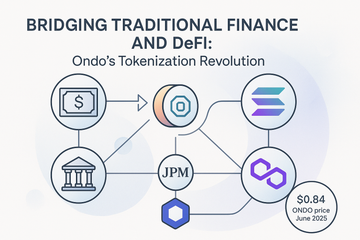

With notable blockchain tie-ups—Solana and Polygon, to name a couple—Ondo aims for flexibility and liquidity. When people talk about the future of interoperable finance, this is what they’re pointing to.

Tokenization: The Not-So-Secret Ingredient

If you’re a fan of bite-sized, tangible examples, here’s where Ondo’s tokenization really shines. Their headlining asset, OUSG, literally stands for tokenized US Treasuries—traditionally locked away for big institutions and accredited investors. Ondo breaks them into digital shares you can move around the blockchain. Suddenly, accessing treasury-like risk profiles doesn’t require a pinstriped suit.

There’s also USDY, a tokenized cash equivalent aimed at folks who want stable yields with less red tape. Then there’s OMMF—that’s the money market fund, tailor-made for institutions. Each product has its own flavor profile and investor target, just like different kinds of whiskeys (only here, you’re shopping for yield, not peatiness).

Real Collaborations: Chainlink, JP Morgan, and Cross-Chain Settlements

Now, watch this for a minute—big banks like JP Morgan and heavy hitters like Chainlink have teamed up with Ondo for some significant tech demonstrations. Back in June 2025, they pulled off something called a cross-chain DvP (that’s “delivery versus payment”) settlement. Here’s the lowdown:

- Ondo’s tokenized Treasuries (OUSG) were moved in exchange for fiat currency.

- Chainlink’s tech ensured both sides of the trade completed securely, so nobody got stuck with the short end of the stick.

- JP Morgan’s Kinexys handled the payments, blending old-school trust with new-school efficiency.

You know what? This is one of those moments that crypto historians might mention years from now—proof that the gap between traditional finance and blockchain isn’t as wide as we thought. Seeing banks and DeFi architects sitting at the same table? That’s a milestone a lot of folks have waited for.

Ondo’s Strategic Path: Not Just Hype, But a Plan

Anyone can promise to change finance, but Ondo’s approach walks the talk with a roadmap split into clear phases:

- Phase 1 (now): Get US Treasuries and cash equivalents flowing on-chain. Focus on broad adoption and making all the plumbing work across major blockchains.

- Next Up: Start layering in new asset classes—equities, commodities, and the sort of stuff that keeps traditional traders up at night with excitement (or maybe nerves).

This isn’t just a list of buzzwords. Already, OUSG and its friends have drawn in funds, and each token launch or partnership adds a new piece to Ondo’s expanding universe.

Prices, Tokens, and That ONDO Magic

Let’s sprinkle in some numbers before we get lost in the tech. As of mid-2025, ONDO, the native token, trades around $0.84. Sure, prices can bounce and sway, but the token itself isn’t just a speculative vehicle—it’s used for governance, protocol fees, and incentivizing ecosystem growth. Think of ONDO as your membership badge at a futuristic investment club where every member actually gets a say in how things are run.

Security and Hardware Wallets: Trezor, Ledger, and Peace of Mind

Now, if reading about moving real-world trillions on a decentralized ledger makes your palms sweat, you’re not alone. Security in DeFi can be hair-raising. Here’s the reassuring news: major digital vaults like Trezor and Ledger comfortably support assets on blockchains used by Ondo. So whether you’re a cold storage enthusiast or just security-cautious, your tokens—even tokenized Treasuries—can sit safely offline, far from curious hackers and digital pickpockets.

User experience, too, is becoming less intimidating. Ondo’s interface borrows cues from both traditional banking apps and crypto’s more playful UI trends. A few taps or clicks, and you can window shop for institutional-grade assets before settling your tokens in your favorite wallet.

Ondo Versus the Status Quo: Why It Matters Now

Comparing traditional and decentralized finance sometimes feels a bit like comparing vinyl records to streaming playlists. Sure, classic systems have charm and stability, but DeFi brings ease, flexibility, and a dash of excitement. What’s exciting with Ondo is the seamless “on-chain” experience—no paperwork, no gatekeepers, and global access 24/7. The catch? Regulatory nuances still need to catch up, so sometimes it’s still a patchwork depending on your jurisdiction.

Everyday Use and Future Trends

Ondo’s tokenized assets are already being used for:

- Simple yield generation on decentralized platforms

- Cross-chain trading strategies (for folks who like puzzles and arbitrage)

- Building liquidity pools accessible by anyone, anywhere

With the likes of Chainlink and major banks starting to experiment with the tech, there’s every sign that products like OUSG and USDY could soon become common in every crypto-savvy portfolio.

Parting Thoughts: Has DeFi Grown Up?

So, has Ondo managed to bridge the old world and the new? The evidence feels compelling. They’re making institutional tools accessible, creating products for both pros and casual dabblers, and setting up infrastructure for the future. Of course, the journey’s full of twists. Regulations, security, and mass education are hurdles. But as blockchain and banks shake hands, Ondo Finance stands as one of the more convincing attempts to blend safety, access, and innovation on the blockchain.

You know what? Maybe it’s time we all asked not just if DeFi can go mainstream, but when we should start paying attention to the new rails being laid by projects like Ondo. Because when even Wall Street gets curious, you know something big is brewing.