Let’s be real—when was the last time you wondered where your data actually goes once you’ve pressed ''save'? Online storage often feels like magic. Your digital life, zipped and tucked away somewhere in the vastness of the internet, ready to be summoned from a phone or laptop at a moment’s notice. But the story takes a sharper turn when you’re dealing with crypto. In this wild world, online storage isn’t just about photos or documents—it's about holding the cryptographic keys to your financial future. And that, honestly, can keep people up at night.

So, What Exactly is Online Storage?

At its simplest, online storage is just this: keeping your data—whether it’s a selfie from your last trip, work PDFs, or something as valuable as cryptocurrency—on a system you can only reach through the internet. Companies like Dropbox, OneDrive, and Google Cloud have turned online storage into a household utility. But, let me toss you a tough question: What happens when we talk about online storage in crypto?

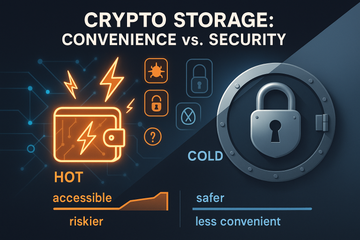

Here’s the thing—crypto online storage isn’t just 'anywhere-your-files-go' kind of storage. It refers to what's commonly called a hot wallet. A hot wallet is a software wallet, always connected, always online. It manages your private keys digitally, letting you interact with the blockchain any time, from anywhere. It’s undeniably convenient, but, as you’ll see, it’s a trade-off.

Hot Wallets: The Double-Edged Sword

Hot wallets are what most newbies in the crypto space use first. Picture your trusty MetaMask extension or a simple exchange wallet. They're easy to use—just set a password, record the recovery phrase, and you’re off to the races. But here's a nagging thought: Would you leave your cash in your unlocked car overnight?

Now, I'm not knocking hot wallets entirely. They're fast, flexible, and perfect for trading, staking, or grabbing NFTs on the fly. If you need liquidity or transact often, there’s simply no beating the convenience. But, and it’s a big one, they're more vulnerable than their so-called ''cold'' counterparts. Hackers have their eyes glued to hot wallets like hawks. Phishing, keyloggers, and exchange breaches? Sadly, these risks come with the territory.

Cold Storage: The Classic,” Better-Safe-Than-Sorry” Approach

People like talking about peace of mind—cold wallets are where it starts. Devices like Trezor and Ledger popped up in discussions for good reason. They're like that locked safety deposit box at the back of a solid bank vault. You keep your private keys offline, far away from hackers lurking in digital alleyways. When you want to move your coins, you have to physically connect the hardware wallet. Annoying at times? Sure. But if you sleep better, maybe it’s worth the pause.

The Everyday Analogy

Imagine your hot wallet is like your real wallet—easy to grab, ready for coffee or a quick payment. Cold wallets? That’s your savings locked in a safe at home. You don’t bring that on a stroll in the park. There’s wisdom here: keep a little spending money handy, but stash the rest somewhere safe.

Security—The Elephant in the Crypto Room

Let’s cut through the noise. Security isn’t optional in crypto. With online storage, especially hot wallets, you’re only as safe as your passwords, device hygiene, and sometimes... pure luck. Two-factor authentication, strong passphrases, and hardware backups? They become your new best friends. Yet, even giants trip. Just ask anyone who’s ever watched a major exchange get breached—storing large amounts online is, honestly, playing with fire.

- Risks: Malware, phishing attacks, exchange shutdowns, and unreliable recovery mechanisms can all lead to devastating losses.

- Precautions: Setting up multi-layered security and keeping backup recovery phrases (ideally offline, maybe scribbled in a trusted notebook, never a screenshot!) is crucial.

- Peace of Mind: If you worry just thinking about hackers, consider storing the bulk of your holdings in cold storage. Only keep what you need online for daily moves.

Convenience or Safety? The Ongoing Tug-of-War

Here’s a conundrum: The more convenient something is, the more open it is to risk. Online storage is a godsend for accessibility, especially on the go. Need to swap ETH for BTC on a whim? Hot wallets make it effortless. But quick access comes at a cost. If your phone or laptop takes a sudden swim or catches a bug, you could lose everything in a flash.

Meanwhile, cold wallets aren’t totally worry-free, either. Lose (or forget) your backup phrase and there’s no customer service to call. Crypto is ruthlessly neutral. The system is trustless, but the stakes are all on you. Honestly, that’s liberating and terrifying at once.

Examples: Beyond Dropbox and Old-School Cloud

Yes, cloud storage solutions like Dropbox, Google Drive, and OneDrive have changed how we share and keep files. They’re fine for work docs and vacation photos; in fact, Google and Microsoft have even launched tools to help businesses with document management and collaborative workflows. But, and this is crucial, no crypto-savvy advisor recommends relying on such mainstream cloud storage for private keys.

Instead, crypto folks lean towards dedicated wallets. While browser wallets like MetaMask offer quick access, pros and cautious investors turn to hardware wallets. Trezor and Ledger, for example, store keys off the cloud—making physical theft, not digital snooping, the main worry. For organizations that need high-volume crypto management, there are even multisig wallets requiring several people to approve transactions; it’s like old-fashioned checks, just on the blockchain.

Trends and the Road Ahead

There’s a subtle shift as the crypto community matures. Security-first approaches are taking center stage as more people learn the hard way. Developments like social recovery wallets (imagine your friends vouching for you if you lose access) are on the horizon. Hybrid solutions—blending the responsiveness of hot wallets and the ironclad safety of cold ones—are making headway. Still, the best advice? Treat online storage for crypto like actual cash in public. Carry only what you’d be okay losing, and lock away the rest.

In the End, It’s About Balance

Let’s be honest: There’s no one-size-fits-all answer. If you’re a daily trader, online storage is unavoidable. If you’re a patient HODLer, then cold wallets, tucked away offline, will call your name. As the landscape evolves, new tools and practices will emerge, tempting us all with the promise of both convenience and peace of mind. Until then, stay informed, stay cautious, and remember—crypto never forgives, but it sure rewards those who respect its quirks. You know what? Maybe that’s just how it should be.