If you’ve ever peeked beneath the surface of crypto chatter, you’ll hear the phrase 'on-chain' tossed around like everyone knows exactly what it means. Honestly, it sounds pretty epic—like something out of a hacker movie. But what’s really baking under the hood of on-chain transactions, and why should all this ledger business matter to you? Pull up a chair, and let’s break it down in plain English.

Why Do People Keep Talking About On-Chain Stuff?

Let me explain. Imagine you’re splitting pizza with friends, but instead of shouting out who owes what, you all write down each slice’s payment in a shared notebook everyone can read. That’s the vibe: every on-chain transaction gets logged in a huge, distributed ledger called the blockchain, and, get this—anyone (yes, even your neighbor or a stranger across the globe) can check those logs because they’re public. No secrets, just math, and code.

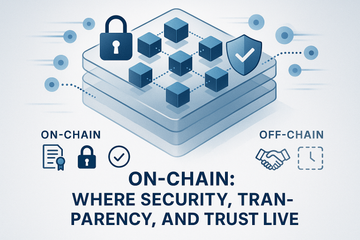

This ledger is what powers every transaction in cryptocurrency that actually hits the chain. It’s the opposite of those off-chain chats or side deals that never get recorded and, to be frank, sometimes vanish into thin air.

So, What Exactly Are On-Chain Transactions?

Simply put, an on-chain transaction gets immortalized on the blockchain’s distributed ledger. Everyone with access to the blockchain can see it, verify it, and, most importantly, trust it happened. This transaction is verified by a network of nodes (think: a mob of accountants with computers), making it impossible to go back and fudge the numbers. That’s transparency served with a side of cryptographic security (Investopedia).

For every crypto transfer or smart contract activation that’s on-chain, the movement of coins, tokens, or data gets hashed, timestamped, and locked away where no single person can alter it without sending red flags to the whole community.

On-Chain vs. Off-Chain: Is It Really a Big Deal?

You bet it is. Think of on-chain as sending a certified letter with a postmarked receipt—there’s a permanent, public record. Off-chain, by comparison, is like exchanging cash with a handshake in a dimly lit back alley. Sure, it’s fast, but if someone walks off with the cash, good luck proving it.

- On-Chain: Secure, transparent, and validated by everyone on the network. It’s a bit slower and you’ll pay a fee (think Bitcoin network fees or Ethereum gas).

- Off-Chain: Quick, little to no fees, but you’re trusting a third party or future settlement to make things right. No instant public record, either. If trust breaks, you might just be out of luck (Coinbase).

This trade-off explains the giant buzz around scaling solutions like Lightning Network (for off-chain Bitcoin) or Arbitrum (for off-chain Ethereum). But nothing beats the peace of mind that comes from a transaction set in digital stone.

Why’s Everyone Obsessed With Security?

Well, in crypto, there’s no bank hotline to call when you mess up. The buck stops with you. That’s why so many hardcore users—maybe you’ve met them—swear by hardware wallets like Trezor and Ledger. Every time you send coins from your Trezor, it records the transfer on-chain, locking up your proof of ownership where everyone can see, but nobody can change.

If your assets are slipping through exchanges or stored on off-chain platforms, you’re placing trust in someone else’s security. But when you settle on-chain and tuck your crypto into a hardware wallet, you’re as close to being your own bank as it gets. (Sure, it’s nerve-wracking the first time you see the words 'Transaction Pending'—but that’s just the network nodes confirming your place in the digital history books!)

Isn’t On-Chain a Little… Slow?

You caught me! On-chain has a reputation for being a tad sluggish, especially when networks get overloaded. Remember those times Bitcoin fees spiked or Ethereum gas prices shot up, making it cost a small fortune to move a few dollars? That’s the trade-off for radical transparency and ironclad security (Binance Academy).

When millions want in, the network’s consensus system (that’s just a fancy way of saying 'the crowd checks every transaction') gets jammed up. Think of it like rush hour traffic on the system’s digital highway. That’s when off-chain solutions step in, bundling smaller transactions so only the final sum lands on-chain.

Everyday Life Meets the Ledger: Where Do On-Chain Transactions Shine?

Smart contracts firing off on Ethereum? That’s on-chain. Swapping Bitcoin between friends for a weekend trip? Still on-chain. Decentralized apps—those magic little programs running everywhere from gaming to finance—live and breathe by recording every play, move, or swap right on the chain.

These moments matter, especially for big-ticket dealings, where you want a record that holds up worldwide. Institutions moving millions, NFT artists publishing fresh digital art, and even governments dabbling in public ledgers—on-chain is where it counts.

What About the Drawbacks? Come On, There Must Be Some!

Of course. Nothing’s perfect. On busy days, fees can spike and confirm times crawl. Layer-2 solutions help, but they’re a patch, not a perfect fix. And let’s not forget, if you make a mistake on-chain (like sending your coins to the wrong address), there’s no undo button. That’s why wallet protection—think Trezor and Ledger again—matters as much as ever.

Still, the trade-off for this public, permanent transparency is worth it for those who—like many in the crypto community—believe trust should be built on code, not just promises and handshakes.

Tying It All Together: The Ledger Doesn’t Lie

So next time you’re sending ETH, swapping tokens, or just pondering if you want your transaction on the digital record forever, remember: on-chain is the backbone of everything dependable in crypto. It’s slower, sure, and sometimes pricier—but that’s the price for trust, clarity, and security you can’t erase.

And if you’re holding your keys in hardware wallets like Trezor or Ledger, give yourself a pat on the back. You’re part of an ever-growing club of folks who know where their money is, how it got there, and that, at least as far as the blockchain is concerned, nobody can say otherwise. Now, isn’t that something worth logging off and thinking about?