Let’s talk about something that’s changed the way we move value around the Ethereum ecosystem—not with bells or whistles, but with a simple concept called Wrapped Ether (WETH). If you’ve been tossing around phrases like “DeFi yields” or “swapping tokens,” odds are you’ve crossed paths with this clever cryptocurrency stand-in. And if you haven’t? Well, buckle up, because WETH is one of those ideas that sounds quirky at first but ends up making a lot of sense… sort of like ordering pancakes for dinner. It just works.

Why Does Ether Need a Wrapper Anyway?

Here’s the thing: Ethereum’s native coin, Ether (ETH), is a bit of a lone wolf. While Ether is used to pay transaction fees and flex as digital gold, it’s not an ERC-20 token; that’s the technical standard nearly every other token on Ethereum follows. Crazy, right?

So, when decentralized apps (dApps) and exchanges built around the ERC-20 standard wanted to work with ETH, things got awkward. You could swap ERC-20 tokens, but ETH just stood there, arms crossed—uncooperative. Enter Wrapped Ether, the go-between, turning ETH into something every app on Ethereum can recognize and work with, no awkwardness involved (source).

How Do You “Wrap” ETH? It’s Not Gift Paper, But It’s Close

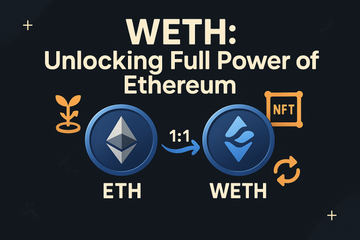

Alright, so how does the wrapping happen? Imagine trading ETH for a WETH token, at a perfect 1:1 ratio. You send your ETH to a smart contract—it’s like checking your coat at the door—and out pops an equal amount of WETH. The ETH gets tucked away safely inside the contract. Whenever you want your original ETH back, you “unwrap” by returning WETH; the contract hands your ETH back, perfectly one-for-one.

It’s a bit like trading in your cash for casino chips. You’re not losing value, just swapping to play a different game (source).

Where Wrapped Ether Really Shines: Not Just a Pretty Face

Wrapped Ether isn’t some novelty. It’s the workhorse of Ethereum DeFi. You’ll see WETH everywhere—here’s why:

- Swapping on DEXs: Decentralized exchanges like Uniswap or SushiSwap work only with ERC-20s. Want in on the action? You need WETH for trading pairs.

- Lending, Borrowing, and Yield Farming: Protocols such as Aave and Compound need ERC-20s, too. WETH lets you lend or borrow against your stash with a click.

- Collecting NFTs: If you’ve ever made an offer on OpenSea, you’ve noticed—you bid with WETH, not ETH. Don’t ask why, just know it’s about compatibility with their backend.

- Crossing Chains: Sometimes you want your ETH to play on other blockchains; WETH makes it much easier to bridge across networks.

Suddenly, Ether gets invited to every DeFi party.

ETH vs. WETH: Same Value, Different Buttons

Here’s a classic crypto question: “If WETH and ETH are pegged 1:1, aren’t they basically the same?” Yes and no. Value-wise, sure—they’re in lockstep. But practical differences make WETH the social butterfly of your token collection:

- Gas Fees: ETH is still the only show in town for paying those notoriously pesky fees.

- ERC-20 Compatibility: WETH gets along with all ERC-20-based protocols—ETH, not so much.

- Smart Contract Utility: Most DeFi protocols simply require ERC-20 for technical reasons; WETH gets you in the door.

Picture WETH as a passport; you’re still you, just with more stamps and fewer bureaucratic headaches.

Let’s Talk Security: Are My ETH and WETH Really Safe?

Honestly, no one wants to find out their coins got magicked away. WETH is considered safe—here’s why: every WETH minted is backed by a real ETH sitting in a smart contract. It can be unwrapped at any time, so the “exchange rate” never falters. But, and here’s the part that matters, the system depends on the code behind the wrapping contract. If those smart contracts have been rigorously audited—and the big ones, like WETH on Ethereum, really have—there’s very little risk of anything going sideways (source).

But remember: any time you interact with contracts, double-check that you’re using the official, original versions. If something smells phishy, trust your gut and double-check. And don’t store huge amounts in any single DeFi contract without understanding the risks.

Hardware Wallets: Trezor, Ledger, and Your Peace of Mind

Thinking about storage? If you own a Trezor or Ledger wallet, you’re in good company. Both devices let you store and manage ERC-20 tokens—including WETH—safely and offline. The process is delightfully straightforward: add the token’s contract address, and it appears right in your portfolio, ready to send, receive, or hold for a rainy day. While you can’t initiate the wrapping right on the hardware wallet, any WETH you wrap or unwrap through a reputable dApp is fully secure as long as your private keys stay put on your device.

Quick tip: If your wallet interface doesn’t list WETH by default, just add it manually. Easy as pie.

Drawbacks and Oddities—It’s Not All Sunshine

Even with all the positives, WETH isn’t perfect. Sometimes, you’ll pay extra fees to wrap or unwrap, especially if the network’s busy. And, like I hinted before, you can’t use WETH itself to pay for Ethereum gas; you’ll still need a stash of ETH for that. Yes, it’s a little circular, but that’s blockchain life.

There’s always the underlying risk that smart contract bugs or unexpected exploits could mess with wrapped tokens, though WETH on Ethereum is as battle-tested as they come.

So, Is Wrapped Ether Worth Your Attention?

If you’re even glancing at DeFi, NFTs, or DEXs, you’ll likely need WETH. It’s not some obscure sidekick—it's the bridge making ETH as usable as any big-name ERC-20 token in the market. It brings flexibility, opens up doors, and, honestly, makes the Ethereum experience a lot smoother for everyone involved.

In the end, while wrapped tokens might sound a bit redundant on paper, they’re the grease that keeps the machinery of decentralized finance running smoothly. Next time you’re swapping, staking, or shooting for that NFT grail, you’ll know—sometimes it pays to bring a little extra wrapping.