Ever feel like your Bitcoin is just sitting around, gathering digital dust, while the rest of the crypto world is bustling with action on Ethereum and Solana? Well, you’re not alone. The thing is, while Bitcoin remains the king of the crypto castle, its blockchain—much like a vintage car—isn’t exactly known for speedy, adaptable, or DeFi-powered drives. That’s where Wrapped Bitcoin, or WBTC, rolls in, wearing two hats and seamlessly bridging worlds that once felt galaxies apart.

So, What’s the Deal with Wrapped Bitcoin?

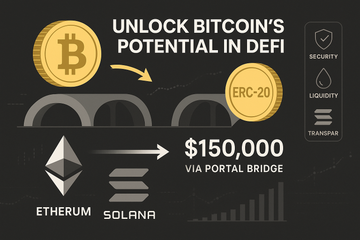

Imagine if your Bitcoin could masquerade as an Ethereum token (an ERC-20 token, for those keen on details) yet still be backed fully, 1:1, by real Bitcoin sitting safe in custody. Like having a loyalty card that works at every store in the mall—even those old-school Bitcoin joints and all the flashy Ethereum shops. That’s exactly what Wrapped Bitcoin offers: the best of both worlds.

The beauty of it doesn’t stop there. WBTC’s roots are firmly planted on the Ethereum blockchain, but thanks to innovations like the Wormhole protocol and a handful of smart bridges, you’ll now find WBTC bustling across the Solana ecosystem too. In fact, Solana’s low costs and high speeds are proving to be a siren song for Bitcoin’s vast liquidity reserves. Not to get ahead of ourselves, but as of recently, about $150,000 got swept into Solana DeFi apps through the Portal bridge—just a taste of what’s coming down the pike.

How Does Wrapped Bitcoin Actually Work?

Let’s break it down. Owning WBTC isn’t magic; it’s actually a matter of careful custody and clear processes:

- Deposit: You send real Bitcoin to a designated custodian (think BitGo—a name you’ll hear often in WBTC circles).

- Mint: The custodian then issues you an equal number of WBTC tokens on Ethereum or Solana.

- Trade & Use: Move, trade, lend, or stake your WBTC in DeFi apps just like any native crypto token.

- Redeem: When you’re ready to convert back, you simply return your WBTC, the token gets burned, and you get your original Bitcoin back. No sleight of hand—just straightforward swaps.

It feels a bit James Bond, right? Swapping suits, strolling between different crowds—but always the same person (or rather, Bitcoin) at heart.

Why It Actually Matters (No, Really)

You might be wondering, 'Okay, but why not just stick with good ol’ Bitcoin?' Here’s the thing: the crypto ecosystem is expanding. If Bitcoin wants to dance at the DeFi party—whether it’s lending, yield farming, or automated trading—being wrapped is its invitation. It’s like finally getting your VIP wristband. And let’s not gloss over this—Ethereum and Solana both have thriving decentralized exchanges (DEXs), lending pools, and all kinds of clever protocols that originally snubbed Bitcoin just because it didn’t ‘speak’ their language.

Wrapped Bitcoin makes Bitcoin liquid in places it never could be before, effectively turbocharging DeFi adoption while leveraging Bitcoin’s brand trust. Now, those who swear by cold storage—in, say, a Trezor or Ledger hardware wallet—get to keep their asset security habits but also dip a toe (or a whole foot) into new decentralized pools of possibility.

Isn’t This Just Another Wrapped Token?

Well, yes and no. Sure, you’ll hear about wrapped Ether (WETH), wrapped Solana (soBTC), and a parade of others. But Wrapped Bitcoin is a bit of a showstopper—simply because Bitcoin holds the most value, moves the biggest markets, and historically has sat outside the Ethereum funhouse.

Here’s a quick comparison for context:

- WETH: Let’s you use ETH in dApps, but since ETH is already Ethereum’s native currency, it mainly smooths out technical bumps.

- soBTC: Like WBTC but specifically tailored for Solana—brings Bitcoin onto Solana but isn’t as widely accepted yet.

- WBTC: Unites Bitcoin’s store-of-value safety with Ethereum and Solana’s endless utility. The custodian and transparency mechanisms here have been repeatedly battle-tested over billions of dollars.

Real-World Action: Not Just Theoretical

It’s not just about the tech—people are actually using this thing. Take the story of DeFi Pulse, a site that tracks the volume of Bitcoin locked in DeFi protocols. Thanks to WBTC, Bitcoin can suddenly be collateral in MakerDAO, earn yields in Aave, or participate in high-frequency automated trading bots. And remember that Portal bridge on Solana I mentioned earlier? That kind of cross-chain setup isn’t science fiction anymore; it’s a weekly reality.

Let’s Get Real: Are There Risks?

No free lunch in crypto. The biggest concern? Counterparty risk. Since there’s a custodian holding all that real Bitcoin, you’re putting a fair bit of trust in companies like BitGo to manage it securely. Then there’s smart contract risk—bugs or exploits have haunted DeFi many times. And, as with all things crypto, market volatility plays a role: one large investor dumping WBTC can, and has, sent ripples through the price, sometimes with painful results for the folks on the wrong side of the trade.

Smart Tips for WBTC Users (Don’t Wing It)

- Security First: If you’re moving significant WBTC, use a Trezor or Ledger hardware wallet. Really—it’s your vault in the digital Wild West.

- Stick with Trusted Custodians: Stick to well-audited projects and always check if the custodial BTC reserves are transparently tracked. WBTC publishes proof of reserves—a must-check every now and then.

- Understand Bridge Fees: Moving WBTC across Ethereum and Solana? Watch those gas or bridge fees—they can add up, eating into yields or profits.

- Plan Your Exit: It's tempting to jump in, but also sketch out how—and when—you’d want to swap back to Bitcoin if the going gets rough.

Wrapping Up: Bitcoin’s New Bag of Tricks

Here’s the heart of it: Wrapped Bitcoin isn’t just another token on another chain. It’s a solution to an old riddle with a very modern twist. Bitcoin now gets to party on Ethereum and Solana, unlocking possibilities all while keeping its legendary core value. For the security hawks and DeFi thrill-seekers alike, WBTC is the key that turns your hardware-wallet savings into something endlessly more dynamic.

You know what? Change is the only constant in crypto. But for once, Bitcoin doesn’t have to change who it is to join in; it only needs a new kind of wrapper. And honestly, for anyone who’s ever watched from the sidelines thinking, “when’s my day to play?”—that day is already here. Time to unwrap those opportunities and see what’s inside.