Ever heard the word “rollups” flung around by your blockchain-savvy friends, and wondered if they were talking about sushi, fancy cigars, or maybe some kind of digital gymnastics? You’re not alone. In crypto lingo, ‘rollups’ aren’t snacks or smokeables, but they're almost as satisfying—at least if you care about network speed, fees, and the future of digital cash. Let’s unravel what rollups are, why everyone’s buzzing about them, and if you should start caring just yet.

So, What’s a Rollup? Let’s Cut the Jargon

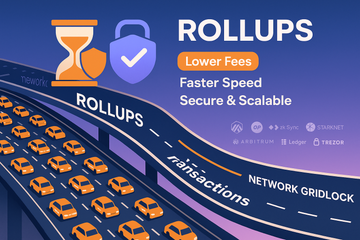

In plain English, a rollup is a clever solution to the oldest problem in public blockchains: scalability. Imagine Ethereum (or any big blockchain you like) as a giant city road. At rush hour, it jams, nobody moves, and tempers flare. Rollups act like express lanes built above the traffic—they let you zip past the gridlock, paying less and getting to your destination faster.

But how? Simple in theory, beautiful in practice: rollups bundle, or 'roll up', hundreds or thousands of transactions off the main blockchain, process them elsewhere, and then send a single, condensed record back to the main chain. That way, the network secures everything without having to do all the heavy lifting itself.

Why Did Crypto Even Need Rollups?

Remember last time Ethereum gas fees spiked? Sending ten bucks cost twenty. Not great. Public blockchains only process so many transactions per second—think of it as an old dial-up modem compared to fiber optic. Enter rollups: they let you do loads of the work off the main network, then pass along the final results for safe keeping. With rollups, fees shrink, robots (and humans) don’t have to wait in line, and blockchains suddenly feel zippy again.

Honestly, without solutions like rollups, mainstream adoption would be a pipe dream. Who wants to pay more in fees than in coffee? Not this writer.

Rollups: The Two Big Flavors

Optimistic Rollups: The Trust-but-Verify Type

Optimistic rollups are the laid-back cousins in this family. They assume all off-chain transactions are legit unless someone says otherwise. But here’s the twist—there’s a window (maybe a week or so) when anyone can shout 'Wait, that's not right!' and challenge a transaction. If they catch something fishy, the incorrect transaction gets booted out. Otherwise, the whole bundle sticks.

Projects like Arbitrum and Optimism are the poster children here. They speed things up and keep fees low, but withdrawals can take a while due to that 'challenge period.' Patience is a virtue, or so they say.

Zero-Knowledge Rollups (ZK Rollups): Wizards of Proof

ZK rollups are the meticulous, proof-loving types. Instead of hoping no one cheats, they mathematically prove every transaction is valid before sealing the deal. It’s a bit like having every move double-checked by a robot accountant before it hits the blockchain. Quicker finality, less waiting, and maybe a hint more privacy.

zkSync and StarkNet are real-world examples. Their secret sauce is generating cryptographic 'proofs' that the batched transactions are valid—the chain just needs to check the proof, not every single trade. Turbo-charged and secure, that’s the dream.

Does This Mean Rollups Are Perfect? Not Exactly

Now, it’s tempting to think rollups are magic bullets. They’re not. Let’s play devil’s advocate for a sec. What can trip up these scaling saviors?

- User Experience: Sometimes, you’re forced to wait (especially with optimistic rollups). Getting assets back to layer-1 isn’t always instant bliss.

- Complexity: More moving parts mean more can go wrong. Bugs, contract risks, the occasional curveball from hackers—developers never sleep easy.

- Centralization worries: Some rollup systems lean on trusted parties or sequencers to post data. Critics aren’t always thrilled about that.

Still, the upsides are hard to ignore. Lower fees, speedier transactions, and the sense that maybe—just maybe—crypto won’t stall during the next meme coin frenzy.

Rollups & Wallets: Keeping Your Coins Safe

Let’s shift gears for a minute. All this talk about bundled transactions is great, but how does any of this affect your hardware wallet? Good news: companies like Trezor and Ledger make sure you don’t have to sweat these technical details too much. Whether your assets are chilling on a layer-1 or zipped over to a rollup, these wallets are designed to keep your keys safe from both physical and digital troublemakers.

Just remember, security isn’t automatic. Even the sturdiest safe can’t protect your valuables if you leave the door open! Always double-check where you’re sending your coins, especially when moving assets between different blockchain layers or scaling solutions.

Rollups in the Wild: Are They Worth Your Trust?

Okay, so rollups are fast and cheap. But are they ready for prime time? Here’s the thing—adoption is growing, features get better every month, and more exchanges and apps are adding rollup support. Projects like Uniswap and Aave are already building on rollup-based chains. Even seasoned traders agree: it feels a bit like the early days of the internet—sometimes clunky, but getting smoother every year.

If you like trying new tech, the experience is already pretty slick. You might have to bridge assets between networks or read up on which rollup is safest for your needs, but these are small hurdles for a comfortable ride in the fast lane.

Looking Ahead: The Rollup Marathon

Rollups aren’t just a quick fix—they’re the backbone of Ethereum’s 'layer-2 vision.' As more users pour into DeFi, NFTs, and gaming, we’ll rely on these clever bundles of transactions to keep the gears turning without breaking the bank. The best part? You don’t need to be a cryptography wizard to reap the benefits. Just keep your software up to date, pick a reputable wallet (did I already mention Ledger and Trezor?), and don’t be afraid to ask questions.

At the end of the day, rollups mean more freedom, lower fees, and the promise that your next blockchain transaction might feel as smooth as tapping a contactless card. And if that’s not worth rolling with, I don’t know what is.