Picture this: you're weighing up whether to stash your money in a government bond or push it into the wild world of cryptocurrencies. Sure, government bonds are about as thrilling as waiting in line at the bank, but you know they're solid, steady, predictable. Crypto on the other hand? The risks and rewards bounce around like a cat chasing a laser pointer. So why would anyone ever mess with riskier stuff, especially when safety is so tempting? The answer: risk premium.

What Actually Is a Risk Premium Anyway?

You might've heard experts muttering about risk premiums on podcasts or in articles, but if they've ever explained it in plain English, that's a rare treat. Simply put, a risk premium is the extra bit of return you expect to snag for parking your cash in something that could zig or zag dramatically, compared to something pretty much guaranteed not to make you sweat — like U.S. Treasury bonds. According to Wikipedia and just about every finance pro, it’s the difference between the expected return on a risky asset and the return from a so-called “risk-free” one.

Let me explain in even plainer terms: if government bonds promise you 3% a year, but some tech stock or token might give you 9%, that 6% extra is your risk premium. It’s a kind of reward for putting your nerves (and your savings) on the line.

A Formula Simpler Than You’d Think

There’s even a snazzy formula for it:

- Risk Premium = Expected Return - Risk-Free Rate

Easy, right? Yet the simplicity masks a tug-of-war between fear and greed. The riskier the bet, the juicier the premium you want (or at least, that’s the theory).

Street Examples: From Bonds to Bitcoin

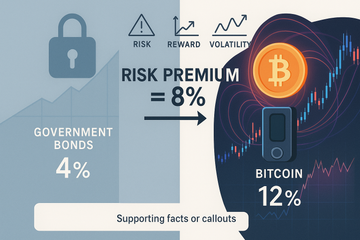

Let’s take a stroll through a real-world scenario. Imagine Trezor or Ledger — you know, those hardware crypto wallets everyone’s buzzing about? Folks who stash their Bitcoin on these devices are in it for the hope of killer returns, but they know the rollercoaster can get rough. The U.S. government isn’t about to default on its debt anytime soon, so Treasuries are considered 'risk-free.' Last year, say the Treasury bond offered a steady 4%. Meanwhile, the price of Bitcoin could swing wildly — let’s say the expected return for Bitcoin (if you average risky speculation and wild optimism) is 12%. The risk premium here? That’s 8% (12% - 4%), and it’s what makes people think twice before plopping all their cash into safe stuff and calling it a day.

This isn’t just some academic curiosity. Big investment banks and even solo day traders watch the risk premium closely. Why? Because it says a lot about whether there’s enough upside to brave the storms that can hit any market, crypto or otherwise.

Changing Seasons: Why the Risk Premium Fluctuates

Ever notice how people aren’t always rational, especially with money? They pile into stocks or crypto during bullish frenzies, then dash for the exits if there’s even a hint of bad news. This emotional rollercoaster can pump up or shrink down risk premiums. During economic slowdowns or political chaos, risk premiums tend to swell, like a river after heavy rain, because the future feels scarier, and you want extra payoff. In booms, the opposite happens, and people might take less premium for the ride, sometimes blindly.

So next time some analyst on CNBC barks about 'elevated risk premiums,' just picture folks all over trying to figure out how much more pain they’re willing to put up with in exchange for a shot at riches.

Okay, But What’s the Catch?

Here’s where things get messy. While the formula is neat, actually estimating the expected return isn’t so simple. Investors look at everything: past performance, volatility, macro trends, even gut feeling. Some swear by rigorous models like CAPM (Capital Asset Pricing Model), plugging in market returns and using things like the equity risk premium — that’s just another way to say the risk premium you’d expect from stocks over government treasuries. It’s a favorite among financial pros, but ask ten of them to calculate it and you might get ten slightly different numbers [Wall Street Prep].

Crypto complicates things even more. Expected returns in traditional markets are tough enough to pin down, but cryptocurrencies? Prices can rocket or nosedive on rumors, tweets, or regulation news from halfway around the globe. No spreadsheet in the world can tame that kind of chaos, making the actual risk premium as much about intuition (and nerves of steel) as about math.

Why Risk Premium Really Matters

Think about it — would you ever lend your cousin money for their wacky startup idea with zero extra reward, considering you might never see that cash again? Same logic plays out with risk premium. If the premium isn’t high enough, smart investors just won’t bite. That’s why companies, cryptocurrencies, and even whole countries have to pay up (in higher returns or yields) to lure folks into handing over their precious dollars.

The risk premium also acts as a kind of weather vane. Spiking premiums can mean fear is spreading, while shrinking ones might hint that optimism (sometimes reckless optimism, honestly) is taking over. For example:

- When markets get super jittery (think pandemic announcements or bank collapses), premiums shoot up.

- If things seem calm or hype is high (like the last bull run in crypto), premiums can drop as everyone chases quick wins.

Who needs a crystal ball when you have risk premiums giving clues about investor sentiment?

Just Don’t Forget About Safety Nets

Not everyone is chasing wild returns, and that’s okay. Many folks sleep better sticking with safer bets, even if the risk premium looks tempting somewhere else. And with hardware wallets like Trezor or Ledger in the mix, the game changes a bit — they reduce some risks (like hacking), but market risks, sadly, don’t go away.

Wrap-Up: The Price of Anxiety (And Opportunity)

Risk premium isn’t some abstract Wall Street buzzword. It’s the real extra you get, or at least hope to get, for saying 'I’ll take that risk.' Whether you’re grilling over Treasury yields, S&P 500 dreams, or the next cryptocurrency moonshot, risk premium is your reminder that fortune rarely favors the timid — but even the brave demand their cut.

So, next time you’re weighing a move, remember: that spicy return you’ve got your eye on? Don’t forget to figure in the nerves, the rollercoaster rides, and maybe, just maybe, the real payoff that comes with putting it all on the line.