Some people stack sats. Others build companies. A Bitcoin maximalist does both in spirit. They bet their trust on math, not on promises. In short, a bitcoin maxi believes Bitcoin is sound money, and they treat BTC as a safer store of value than fiat or stocks. That belief can sound stubborn. You know what? It often comes from hard lessons about inflation, custody, and broken incentives.

What makes a Bitcoin maxi tick?

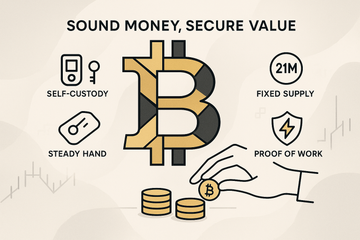

Let me explain. Money that holds purchasing power lets people plan. If your money bleeds, your time bleeds with it. Maxis see Bitcoin as a fixed supply asset with rules that do not bend for politics. Twenty one million, no CEO, public code, and a network that anyone can audit. Simple ideas, but they change behavior. Save first, speculate less, verify more.

Sound money, plain and simple

Sound money is a big phrase with a small promise. It should be hard to create and easy to check. Gold did that for centuries, but it is heavy and slow to move. Bitcoin uses proof of work to secure issuance, plus a public ledger that settles value across the world in minutes. Not perfect, but clear. Hard to change rules, easy to verify receipts.

Why fiat makes them nervous

Fiat currencies can work for a while. They fund schools, roads, and wars. Then a shock hits, or a slow leak grows, and the printer hums louder. Prices rise. Wages lag. Savings thin out. If you grew up in Argentina, Nigeria, or Turkey, you might not need a lecture on inflation. You felt it at the checkout line. Maxis are not calm about that risk. They prefer money that fights dilution with math.

The playbook, HODL, verify, self-custody

Culture matters. A bitcoin maxi will tell you to stack sats on a schedule, hold your own keys, and run your own node. It sounds strict. It is also practical. Without self custody, you have a promise, not a coin. Without a node, you accept someone else’s view of the chain. With both, you gain clarity. You do not need permission to move value, and you can check your own balance on rules you control.

Cold storage is culture

Here’s the thing. Self custody lives or dies with habits. Maxis praise hardware wallets like Trezor and Ledger because they keep private keys off laptops and out of reach from malware. Write the seed on paper or steel, never in the cloud. Test a small send before moving a stack. If the device fails, you can restore with the seed. If an exchange fails, you have your coins, not a claim number.

Do maxis ignore everything else? Not exactly

This part gets noisy online. Maxis reject most tokens. They see central teams, shifting rules, and a moving goalpost that weakens trust. They do not hate research or software. They just want money that cannot be steered by a founder group. Ethereum holders will push back with smart contracts and rich apps. Fair point. Maxis answer with the same line every time, money should be boring and neutral. Build on top, settle in base.

The social layer, memes, and patience

Culture fills the gaps that code cannot. Laser eyes, stack sats, have fun staying poor, all of it is loud and sometimes rough. Underneath the memes sits a simple rhythm, save a little each week, stay humble, think in cycles, and touch grass. Halvings set the beat. Bear markets test your nerves. A bitcoin maxi treats those seasons like training. You show up, you learn, you breathe, and you keep your keys close.

Curious? Start with simple moves

You do not have to sell your life to Bitcoin on day one. Try small. Buy an amount you can forget, then learn how to send and receive. Read a chapter of Mastering Bitcoin or skim the docs on bitcoin.org. Watch mempool.space when a fee spike hits, and see how miners sort transactions. If you like the feel of that clarity, add a hardware wallet and move coins off a custodian.

A short starter list helps. Keep it boring, keep it repeatable.

- Dollar cost average a fixed amount each week, then stop checking price every hour.

- Use a new address for every receive, and label sends so your future self understands the history.

- Back up your seed twice, store copies in separate places, and practice a clean restore before you need it.

- Run a node when you can, even on a tiny computer, so you learn how rules look in practice.

A quick note on energy and miners

This topic brings heat, no pun. Proof of work uses energy by design. Maxis argue that strong money must cost something to produce, or it can be printed for free. The nuance is changing. Many miners chase cheap power at the edges, from hydro spills to waste gas to curtailed wind. Some sites even help balance grids by turning on and off with market signals. It is not perfect, but it keeps getting cleaner per hash.

So, are you a maxi yet?

Maybe you hold a little bitcoin and still keep stocks and cash. That is fine. Maximalism is not a club with dues. It is a stance that money should respect your time. If you feel that tug, follow it at your own pace. Learn, practice, and set good habits. If you never cross the river, the steps will still help your safety online. And if you cross it, you might sleep better when headlines scream.

Risks, blind spots, and real life

Let’s be honest. Maximalism can feel rigid. Some folks need liquidity, or yield, or a tool that works with a bank login. That is life. Bitcoin covers money well, yet it will not replace a gaming token or a content platform by itself. Maxis admit that with a shrug, then they return to first things. If money is broken, most other tools suffer. Fix money, increase planning, and see patience return.

Where emotion meets code

There is a human side here. People who lived through a currency crunch do not need a chart. They remember parents counting bills at the kitchen table. They remember lines and limits at banks. A bitcoin maxi carries those stories like a quiet anchor. The code matters, sure, but the feeling of control matters too. When you hold keys, your savings feel less fragile. That calm has value, even before price moves.

So take your time. Read, test, and keep notes. Ask a friend to review your backup. Over a season, you will know if the maxi frame fits mind.