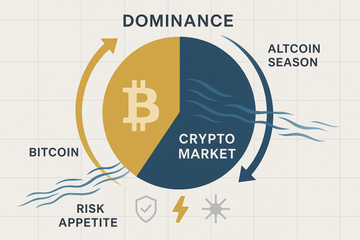

Bitcoin dominance sounds fancy, yet the idea is simple. It is the share of Bitcoin’s market cap compared to the entire crypto market’s value. If total crypto is the ocean, Bitcoin is the tide setter. When its slice of the pie grows, the market is saying something. When it shrinks, it is saying something else. You know what? That one number often captures the mood better than a dozen charts.

What Bitcoin Dominance Really Measures

Here’s the thing. Dominance is calculated as Bitcoin’s market cap divided by the total crypto market cap. That’s it. You can check it on TradingView with the BTC.D chart, or on CoinMarketCap and CoinGecko. A higher reading means Bitcoin holds more of the market’s value. A lower reading means altcoins and stablecoins are taking more space.

Simple ratio, big implications. It reflects risk appetite, liquidity flow, and narrative strength. When investors want safety, they huddle in BTC. When they chase new narratives, they spread into altcoins. Dominance becomes a compass, not a crystal ball, but a decent compass.

Why Traders Care, Even If They Pretend They Don’t

Bitcoin dominance tends to rise during uncertainty. Liquidity moves to the asset with the longest track record and the strongest brand. It slips when the market grows confident and starts exploring smaller caps. Price action alone can fool you. Dominance tells you where the money is rotating, not just whether it is up or down.

Think of it like a stadium crowd. When a risky play is coming, the noise shifts, people lean forward, and you can feel the change. Dominance captures that lean. Not perfectly. Just enough to help you plan.

Rising Dominance vs. Falling Dominance

Rising dominance often points to a Bitcoin-led rally or a defensive phase. BTC might climb while altcoins lag, or everything could drop with BTC simply holding up better. Either way, capital concentrates.

Falling dominance often signals an altcoin season, where ETH, SOL, and other majors stretch their legs. Momentum trickles down to mid caps and then small caps. That euphoria can be fun, and also tricky. Liquidity can vanish fast when the music stops.

So, Is Low Dominance Good or Bad?

Both. Low readings can mean innovation is thriving and risk is being rewarded. It can also mean excess. High readings can show caution, or simply the return of focus on Bitcoin’s core story, like halvings or macro hedging. Context is everything.

How People Use Dominance Without Overthinking It

Let me explain with a simple approach. Some investors use dominance to nudge their allocations, not to overhaul them. If dominance climbs for weeks, they might trim alts a bit and add to BTC. If dominance slides and alt setups look strong, they tilt back toward majors like ETH or liquid L2 tokens. Nothing extreme. Just small tilts.

- Watch the trend, not one-day spikes.

- Pair dominance with price structure on BTC and ETH.

- Consider liquidity conditions, like stablecoin inflows.

That last point matters. When new stablecoins flood in, total market cap rises even if prices hold steady. Dominance can fall without a classic alt season. It is a quirk. Keep it in mind.

Where Nuance Trips People Up

There is a mild contradiction you will see. Some say dominance rising is bullish for BTC. Others say it is bearish for alts. Both can be true at once. If you trade altcoins, rising dominance is a yellow light. If you accumulate BTC, rising dominance can be a green one, especially if BTC is setting higher highs.

Another wrinkle. Different data sources handle stablecoins and wrapped assets differently. CoinMarketCap, CoinGecko, and TradingView can show small variations. The signal still holds, but do not fixate on one exact number.

Seasons, Cycles, and Storytelling

Markets love stories. In 2017, dominance collapsed during a classic altcoin mania. In 2020 and 2021, dominance swung as DeFi summer, NFTs, and later L1 rotations moved capital around. In 2022, fear returned and dominance steadied as investors looked for shelter. In 2023 and beyond, new narratives keep bubbling, from ordinals to restaking to real-world assets. Each wave changes how capital spreads.

Halving cycles add another layer. In the months around a Bitcoin halving, attention can snap back to BTC. Not always. Often enough to watch.

Risk Management Tied To Dominance

Dominance is not a signal you follow blindly. It is a weather report. You still decide whether to carry an umbrella. Position sizing, time horizon, and liquidity matter more than a single ratio.

- Use BTC.D to inform, not to dictate, allocation shifts.

- Keep clear invalidation levels on trades.

- Respect liquidity. Thin books can magnify moves in small caps.

For long-term holders, a slow plan can be enough. Dollar-cost averaging into BTC or large caps while watching dominance helps you stay calm. If the ratio rises and your altcoin exposure feels heavy, lighten it. If it falls and your BTC stack looks light, add some. Keep it boring. Boring is underrated.

Securing the Bag, Literally

One quick but important tangent. Whether dominance is rising or falling, custody is non-negotiable. If you hold BTC or alts for the long haul, consider a hardware wallet. Trezor and Ledger are the names most folks know. Trezor Suite makes sending, receiving, and labeling addresses simple. Ledger Live gives an all-in-one view and supports a wide range of coins. Cold storage gives you time, which is the most valuable asset when volatility spikes.

I have seen people nail the top, then lose funds to sloppy security. That stings more than any red candle. Whatever your strategy, keep your keys safe, back up your seed, and store it somewhere sensible.

Reading Short-Term vs. Long-Term Signals

Short bursts in dominance can be noise, like a gust of wind rattling a window. The trend over weeks tells the story. Some traders even add a moving average on BTC.D to smooth it out. If the ratio glides higher while BTC sets higher lows, the path of least resistance might favor Bitcoin-led moves. If the ratio sinks while alts outperform on volume, rotation is in play.

One more detail. Watch how new listings and narratives change the denominator. When hundreds of small tokens pop up, total market cap can swell even if they barely trade. Dominance falls, but the signal is thinner. Quality matters more than quantity.

Practical Checklist You Can Use

- Check BTC price structure and volume.

- Look at BTC.D trend over at least two to four weeks.

- Scan ETH and a few majors for relative strength.

- Watch stablecoin supply growth on dashboards like Glassnode or The Block.

- Adjust allocations slowly rather than flipping the table.

This checklist will not catch every move. It will help you avoid the worst traps, which is half the game.

Common Myths Worth Clearing Up

Myth one. High dominance means altcoins cannot rally. Not true. Alts can rally even if BTC is strong, especially majors with their own catalysts.

Myth two. Low dominance means Bitcoin is weak. Sometimes it means alts are overheating. Sometimes it means fresh capital is broadening the market. You need price confirmation.

Myth three. Dominance always leads price. Sometimes it lags. Sometimes it moves with price. It is a companion signal, not the conductor.

A Quick Coffee Analogy

Imagine a busy coffee shop. When the line is long and people want something reliable, they pick a classic drip. That is Bitcoin. When the mood loosens, you see more cortados, matcha, and seasonal specials. That is the alt market. Both have a place. The mix tells you the vibe of the day.

Final Thoughts, With One Gentle Nudge

Bitcoin dominance will not make your decisions for you. It will help you read the room. Use it with price action, volume, and a sense of narrative. Keep your security tight with a hardware wallet like Trezor or Ledger. And keep your plan simple enough that you can stick to it on a noisy Tuesday morning.

Honestly, that is the whole pitch. Measure where attention and money are settling. Notice when that balance shifts. Move with care. And ask yourself, do you want to chase every sprint, or would you rather stay in the game long enough to see the marathon play out?