You check a decentralized exchange, tap a token pair, and a price appears. No order book, no market maker screaming on a trading floor. So who is setting the price? The answer is simple, yet clever. An automated market maker, or AMM, is the protocol under the hood that supplies liquidity to decentralized exchanges and determines asset prices with a clear rule. No middleman. Just math, pools, and incentives.

Let me explain how this works, why it matters, and how to use it without getting tripped up. We will keep it friendly. We will also touch on security, because signing swaps from your Ledger or Trezor is not just smart, it is sanity.

So what is an AMM, really?

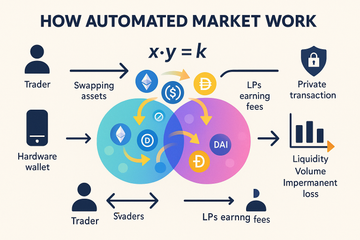

An AMM is a smart contract that holds two or more assets in a pool. Traders buy one asset from the pool and add the other. The AMM keeps a balance by adjusting the price with a formula. This gives continuous liquidity, even if no one posts a limit order.

The classic model is the constant product formula. It goes like this: x * y = k. If x is the amount of ETH and y is the amount of USDC in the pool, the product must stay the same. When you buy ETH, you take some ETH out and add USDC back. The pool raises the price a bit so the product stays constant. Simple, but powerful.

Think of it like a vending machine that charges a little more for each soda you take in a row. The shelf gets emptier, so the price nudges up to reflect demand. That is slippage in plain terms. The bigger your trade compared to the pool, the more the price shifts as you move along the curve.

Price discovery without an order book

Here is the thing. The pool itself sets the price based on its asset ratio. If a pool holds more ETH than USDC, the implied price of ETH falls, and vice versa. Arbitrage traders watch prices across exchanges. When there is a gap, they trade against the pool, push the ratio back, and collect the difference. That constant tug keeps AMM prices close to the broader market.

So yes, an AMM both provides liquidity and determines prices. It does so with code that anyone can audit. No phone calls. No gatekeepers. Just incentives that line up well most of the time.

Liquidity providers, fees, and the dreaded impermanent loss

Pools do not fill themselves. Liquidity providers, or LPs, deposit tokens in pairs. On Uniswap v2, that means equal value of both sides. In return, LPs earn a share of trading fees. If the pool is active, those fees can be nice. Still, there is a catch that has scared more than a few people.

Impermanent loss happens when the price of one token moves a lot. The pool rebalances your deposit toward the underperformer. If you withdraw after a big move, you may end up with less value than simply holding. The loss can be offset by fees, but not always. It depends on volatility, volume, and how long you provide liquidity. It is called impermanent because the effect can fade if prices come back. But let us be honest. Sometimes they do not.

If you want calmer waters, look at stablecoin pools. Curve’s stableswap formula keeps slippage low when both assets should track the same price, like USDC and DAI. The risk of impermanent loss is smaller there, though not zero if a stablecoin breaks.

AMM flavors you will actually see

Not all AMMs are the same. A few popular designs make different trade-offs.

- Uniswap v2 style constant product. Great for simplicity. Works for many long tail pairs.

- Uniswap v3 concentrated liquidity. LPs choose a price range, which focuses capital. Traders get less slippage if LPs choose well. The flip side is more upkeep for LPs.

- Curve stableswap. Built for assets that should move together. Lower slippage near the peg.

- Balancer weighted pools. More than two tokens, with custom weights like 80/20. Nice for index-like pools.

- Bancor and others try features like single-sided deposits or impermanent loss protection. Always read the fine print.

You know what? The design that suits you depends on what you trade and how you earn. There is no one ring to rule them all. And that is good for the ecosystem.

Slippage, fees, and why your swap got worse by a hair

Every AMM swap has slippage. You are moving along a curve, so the final price is a bit different from the quoted one. You can set a slippage tolerance in your wallet or on the DEX. Tight settings reduce bad fills, but they may cause failed transactions if the market moves. Wide settings raise your risk of sandwich attacks.

Fees matter too. Uniswap v3 has fee tiers like 0.01%, 0.05%, 0.3%, and 1%. Aggregators such as 1inch and Matcha route across pools and chains to find a better total price. Sometimes your best route is not the biggest pool. Strange, but true.

Front‑running, MEV, and simple protection

Public mempools let bots see your transaction before it lands. They can jump ahead, move the price, and sell back after you buy. That is a sandwich. It feels bad because it is. You can lower the risk by using a private relay, setting a sane slippage limit, and avoiding trading during wild spikes. Some wallets offer private send. Flashbots Protect RPC is one option many traders use.

Networks, gas, and seasonality

Ethereum is the home base for many AMMs. Gas can spike. Layer 2 networks like Arbitrum, Base, and Optimism cut costs. They feel fast and cheap for most swaps. There are also AMMs on other chains, like Orca on Solana and Trader Joe on Avalanche. Routes differ, but the core idea is the same. Pools, formulas, and a steady stream of arbitrage keep prices in line.

Trends come in waves. Meme seasons add noise and slippage. Restaking points and incentive programs pull liquidity around like the tide. During hype, stable pools may feel like quiet coves. During calm, broader pools can pay more in fees. Rhythm matters.

Security first, then yield

Here is the part people skip, then regret. Keep keys on a hardware wallet. A Ledger or Trezor lets you review real transaction data on the device screen. That small pause saves headaches. Connect with WalletConnect, confirm the contract, and read what you are signing. If an approval looks odd, stop. Approvals grant spending rights. Grant only what you need, and revoke later with Etherscan, Revoke.cash, or DeBank.

On Ledger, enable blind signing only when a dapp needs it, then disable it. On Trezor, check the token contract address each time. Always bookmark the official Uniswap or Curve site, or use a trusted mobile app. Phishing loves a typo. Yes, it is boring. Yes, it matters.

A quick checklist

- Use Ledger or Trezor for swaps and LP deposits.

- Set slippage low during calm periods, reasonable during fast markets.

- Prefer private transactions when possible.

- Revoke old approvals now and then.

- Start small when testing a new pool, then scale only if it behaves as expected.

Common myths, with a gentle correction

Myth 1. AMMs always give worse prices. Not quite. With deep liquidity and smart routing, you can match or beat many order books on the pairs that matter. Thin pools are a different story.

Myth 2. Impermanent loss makes LPing pointless. Also not true. In high volume pools, fees can offset the loss. It is a trade, not a scam. Still, you need to know what you are getting into.

Myth 3. More liquidity always means safer trades. Usually yes, but not always. If fees are high or a pool is mispriced for a while, your net result can lag. Context wins.

How to read a pool like a pro, without getting lost

Check three things. First, depth. Big pools let you trade more with less slippage. Second, volume. Fees come from volume, so LPs care. Traders do too, since volume attracts arbitrage and keeps prices fresh. Third, volatility. If one token whips around, expect more slippage and more risk of impermanent loss.

On Uniswap, you can view live charts and fee tiers. On Curve, look at the pool’s balance. A skewed stable pool can be a warning. On Balancer, check the weights and the number of assets. And if anything seems off, walk away. There is always another trade.

Where AMMs go next

We keep seeing fresh ideas. Dynamic fees that respond to volatility. Hybrid pools that blend stable and constant product math. On chain intents that match orders more fairly. Even under the experiments, the core stays clear. A pool, a rule, and open access.

Honestly, that clarity is the charm. Anyone can become an LP. Anyone can trade at 2 a.m. with no desk in the way. It is messy sometimes, but it is also resilient.

Final thoughts you can use

Start with a pool you understand. Try a small swap. Note the quoted price, the minimum received, the fee, and the final fill. Adjust slippage. Use your Ledger or Trezor for every signature. When you feel ready, add liquidity in a size that would not ruin your week if it goes sideways. Review results after a few days. Repeat or step back.

AMMs are not magic. They are reliable machines that turn incentives into markets. If you respect the curve, watch your approvals, and keep your keys safe, you will feel at home. And if a trade feels rushed, it probably is. Take a breath. Prices will still be there in five minutes. So will the pool.