Stable value is the quiet hero of crypto. Traders want it. Builders need it. Everyday users count on it when rent is due or tax season hits. That promise of calm inside crypto’s storm is why stablecoins exist. Now, an algorithmic stablecoin takes a bold swing at that promise. It uses code, game theory, and market incentives to keep a token near one dollar. No bank account stuffed with cash. No custodian holding T-bills. Just math, smart contracts, and liquidity. Sounds neat, right? It can be, and also a little tricky. You know what? Let’s walk through how it works, where it breaks, and what you can do if you plan to touch one.

What an Algorithmic Stablecoin Tries to Do

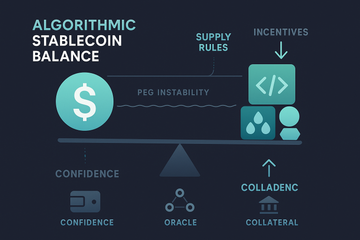

An algorithmic stablecoin aims to keep a steady price, usually one dollar, using rules that expand or shrink the token’s supply. Think of a thermostat. If the room is too warm, the system cools it. If the price is too high, the protocol encourages more tokens to enter the market. If the price is too low, it nudges supply down. The job is simple enough in theory, but markets have moods, and moods move fast.

Key idea: the protocol creates incentives. It makes it attractive to mint or burn the token when the peg drifts. Traders respond to those incentives, and their trades push the price back.

Two Classic Designs, Plus a Twist

Seigniorage shares. This model uses two tokens. One is the stablecoin. The other is a risk token, often called a share or bond. When the stablecoin trades above one dollar, the system prints more of it and hands some to share holders. When it trades below, users can buy discounted bonds or shares that later redeem for more stablecoins if the peg recovers. It is a carrot and stick routine.

Rebasing. Here, everyone’s wallet balance scales up or down at set intervals. If the price is above one, balances increase. If below, they shrink. Supply changes at the wallet level, not just the protocol level. Ampleforth made this approach famous, even though it targets a different kind of stability over time.

Hybrid or overcollateralized twists. Designs like FRAX blended collateral with algorithmic signals. MakerDAO’s DAI began with a crypto collateral engine and later leaned into real world assets. Many newer stable ideas are not pure algorithms anymore. They use partial collateral, hedging, or both to steady the boat.

How the Peg Machine Actually Works

Let me explain the moving parts, because small details matter here.

Mint and burn rules. If the stablecoin trades at 1.02, the protocol lets arbitrageurs mint new tokens at one dollar and sell them. That extra supply should pull the price down. If it trades at 0.98, users get rewarded to burn tokens or lock them, which removes supply and nudges the price up.

Arbitrage loops and liquidity. These rules only bite if there is deep liquidity. If most trading happens in pools like Curve or Uniswap, the protocol needs enough reserves or incentives around those pools. A shallow pool is like a small grocery aisle. One big shopper clears the shelf, and prices swing.

Oracles. The protocol reads the market price. Many use Chainlink or a time-weighted average from DEXs. Bad data creates bad reactions. If the oracle lags or gets manipulated, the system may expand when it should contract, or freeze when it should move.

Confidence. This last piece is not code. It lives in the heads of traders. If people believe the peg will hold, they do the trades that help it hold. If they doubt it, they rush for the exit. Reflexivity is the quiet boss of every peg.

Why Liquidity and Timing Decide Everything

Pegs wobble during stress. Weekends, holidays, and thin order books make things worse. If a protocol pays incentives slowly, but the market sells quickly, the peg slips farther before the fix lands. Timers, epoch windows, and redemption queues can help smooth the ride, but they also slow reactions. That trade off is always there.

The Hard Part, Bank Runs on Code

Here’s the thing. The same incentives that keep a peg can also flip. If a design depends on a second token, like a share coin, that token must hold value when times get rough. If it collapses, the stablecoin has nothing sturdy to lean on. TerraUSD and LUNA showed this pain in 2022. Anchor yields pulled in capital, then fear pulled it out, and the loop unwound. When belief broke, the market moved faster than any formula.

Death spiral in plain words: stable trades below one. Protocol says burn stable, receive more of the risk token. Risk token price falls, so redemptions give you less real value. More selling follows, and the spiral deepens. The math still runs, but the market walks away.

This sounds harsh, but it is the honest risk of designs that lean mainly on incentives, rather than hard collateral. When it works, it feels almost boring. When it breaks, nothing feels boring.

Smarter Experiments on the Table

New models try to learn from the past. Some use partial collateral, like liquid staked ETH or short perps, to counter swings. Others hedge delta with futures and options, so the system earns carry when rates are right. Ethena’s USDe is one example, though it is not a classic stablecoin with on-chain redemptions. It uses a synthetic approach with hedging. FRAX shifted across versions as markets changed. MakerDAO turned to a blend of crypto collateral and real world assets, plus managed yields.

There is a mild contradiction here. People want a dollar-like coin that is free from custodians. Yet the designs that held up best use custody or heavy collateral. We all want clean code that does everything. We also want boring reliability. Most projects split the difference.

How to Use Algorithmic Stablecoins Without Losing Sleep

First, know your terms. Read the docs. Scan the Discord. Follow the governance forum. If a protocol hides the redemption path in fine print, that is a clue. If yields look like a summer fireworks show, ask who pays for the colors.

Self-custody matters. If you hold any stablecoin, keep your keys safe. A hardware wallet like Trezor or Ledger reduces phishing risk and keeps your seed offline. You can connect a Ledger or Trezor to Web3 apps through WalletConnect or browser bridges, then confirm transactions on the device. It takes a few extra clicks, but fraud takes fewer.

- Start small. Test redemptions with tiny amounts. See the slippage. Feel the flow.

- Watch the pools. Check Curve and Uniswap balances. If one pool is heavily imbalanced, the peg is stressed.

- Check the oracle. Look for Chainlink feeds or TWAP settings. See how fast they update.

- Track incentives. If the system pays with a volatile token, those rewards may not cover the risk.

- Plan exits. Keep a path to fiat on-ramps and other stablecoins. Have a plan before you need it.

Honestly, boring process beats hot tips. When markets get loud, quiet checklists keep you steady.

Regulation, Words Matter

Regulators care about stablecoins. In the EU, rules under MiCA draw lines around e-money tokens and asset referenced tokens. Pure algorithmic designs face tighter limits on how they can present themselves. In the United States, the policy picture keeps moving, and banking regulators focus on reserves, disclosures, and custody risks. The takeaway is simple. Projects now talk more about how pegs work, where collateral sits, and how redemptions clear. That clarity helps.

Why Names Can Mislead

Some tokens say stable, but depend on farms, emissions, or thin liquidity. Others do not call themselves stable, yet hold near a dollar with clear redemption. Labels can lag reality. Check the mechanism, not just the marketing.

Design Principles That Actually Help

If you are evaluating an algorithmic stablecoin, a few practical signals can guide you:

- Redemption first. Can you redeem for one dollar value, at scale, within minutes, without a human?

- Diverse backing or hedges. Even partial collateral, or strong hedges, can turn a wobble into a nudge.

- Oracle hygiene. Multiple feeds, sensible delays, and on-chain sanity checks reduce surprises.

- Thick liquidity. Healthy Curve and Uniswap pools, plus market makers on CEXs, give the peg room to breathe.

- Transparent incentives. Emissions that taper, not spike, tend to invite patient capital.

These are not guarantees. They are the basics, the kind you revisit when the market feels edgy or when a headline starts trending on a Sunday night.

Everyday Uses, With a Grain of Salt

Can you pay freelancers with an algorithmic stablecoin? Maybe, if both sides understand the risk and the coin has deep liquidity. Can you park a month of expenses there between trades? You could, though many prefer fiat backed coins for that short window. During holiday shopping or a market selloff, spreads widen, so a cautious approach helps.

For yield seekers, rewards can look appealing. Just remember, high APR often reflects real risk. If you chase it, use a hardware wallet, stage your transactions, and set sane limits. Ledger Live and Trezor Suite help you keep track of accounts, and both work with popular DeFi dashboards that show positions without exposing your seed phrase.

What Comes Next

New designs will keep arriving. Some will lean on hedging and term structure. Some will plug into liquid staking and restaking. Others will use clever auctions to absorb shocks. Seasonal cycles play a role too. Summer liquidity can be thin, and tax deadlines move flows. Markets breathe, and pegs breathe with them.

You know what? That is fine. Stability is a goal, not a guarantee. Code helps. Collateral helps. Community helps. The best systems mix all three, keep clear exits, and treat humility as a feature.

Final thought: use algorithmic stablecoins like a tool. Check the mechanism. Store keys on a Trezor or Ledger. Keep an eye on oracles and pools. If the peg holds, the experience feels refreshingly ordinary. If it wobbles, your preparation turns a panic into a plan.