The ask price sounds simple. It is the lowest price a seller is willing to accept for an asset, whether that asset is a stock, a bond, or a cryptocurrency. Yet once you start placing orders on Binance, Coinbase, or Kraken, the ask begins to feel like more than a number. It is where your order meets reality. It is where intent becomes a fill. You know what? It can also be where emotions sneak in.

So, what is the ask price, really?

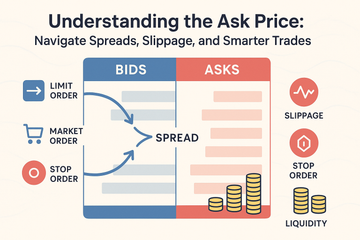

Let me explain. In every market, buyers post bids and sellers post asks. The bid is the highest price a buyer is willing to pay. The ask is the lowest price a seller is willing to take. The gap between them is the spread. When you hit Buy with a market order, you lift the ask. When you hit Sell with a market order, you hit the bid. Simple enough, but there is a twist. That ask can move the moment you touch it.

Here is the thing. Order books change fast. If the best ask on BTC is 67,000 and you place a market buy for a large size, you might chew through the first few sell orders. Your average fill could land higher than 67,000. That extra cost, often called slippage, is not a fee. It is the price of taking liquidity that was not there at one level.

Where you see the ask

On centralized exchanges, the ask sits at the top of the red side of the order book. You will see stacked prices and sizes. The top level is the lowest ask. Tap it with a market order, and it disappears, then the next one becomes the new ask. On charts, the ask can show up as the top of a spread overlay. On TradingView, many brokers show bid and ask lines if you enable them. On crypto apps, some hide it behind the scenes, but the effect is the same. Market buys pay the ask.

Limit orders, makers, and takers

If you place a limit buy below the current price, you become a maker. Your order adds to the bid side. If your limit buy sits at the current ask, you will likely get filled right away, and that acts like a taker order. Many exchanges use maker and taker fees, with makers paying less. Not always, but often. That fee structure can nudge you toward patience, because waiting on a limit can reduce costs. Patience does not guarantee a fill though. That is the game.

Ask price on DEXs works a little differently

On Uniswap, Curve, or Sushi, you do not face a classic order book. You face a pool. The pool price acts like a floating mid price. Your trade shifts the ratio in the pool, which shifts the price you pay. So the 'ask' is not a posted number from a single seller. It is a function of pool liquidity and your trade size. Trade a large amount against a small pool, and you feel the price impact. Aggregators like 1inch or Matcha try to route your order across pools to lower that impact. Still, the logic holds. Bigger order, thinner liquidity, worse effective ask.

Spreads tell a story about liquidity

When spreads are tight, the market is deep and busy. When spreads widen, something changed. Maybe it is a holiday weekend. Maybe a CPI release just hit. Maybe funding rates spiked and market makers pulled back a bit. In crypto, spreads often widen at odd hours or during volatile news. That widening is not random. It is a risk signal.

For stable pairs, like BTC-USDT or ETH-USD, spreads are usually tighter than obscure alt pairs. On small-cap tokens, a one cent spread can be huge in percentage terms. That is why the ask is not just a price; it is a clue about the market’s mood and depth.

A quick number example, just to ground it

ETH order book shows:

- Best bid: 2,510 for 8 ETH

- Best ask: 2,512 for 5 ETH

You send a market buy for 12 ETH. You will lift 5 ETH at 2,512, then the next ask might be 2,513 for 4 ETH, and maybe 2,515 for 10 ETH. Your average price could land around 2,513.7, depending on what sits behind the top level. The ask keeps changing as you eat through it.

What about Trezor and Ledger holders?

If you store coins on a hardware wallet like Ledger or Trezor, you probably think long term. You secure the keys offline, then move funds when you trade or rebalance. Here is where the ask matters. When you send coins from Trezor Suite or Ledger Live to an exchange to sell, you face the current bid. When you send stablecoins or fiat to buy, you face the ask. If you want control, use limit orders. If you need a quick fill, accept the ask, but size your order so slippage stays in check. Some wallet apps include built-in swap partners. Those quotes bake in the ask and a spread, so compare quotes and fees before you press Confirm. Honestly, a small test trade can save you from surprises.

Why emotions hang around the ask

The ask is a boundary. Cross it, and you commit. That is why fear, FOMO, and impatience cluster there. Big green candle, rush to buy, pay the ask without thinking. Then the market cools. Been there. A simple rule helps. If the move already ran far, use a limit and let price come to you. If it does not, that is information too. You did not miss the market. You learned where others are willing to sell.

Order types that shape how you meet the ask

Market

Fast and simple. You pay the current ask. Good for small trades on liquid pairs. Watch slippage and fees.

Limit

Price control. You set your level. If the market trades to your price, you fill. If not, you wait. This works well when you have time and a plan.

Stop

Protective tool. A stop market order turns into a market order once triggered. That can hit a thin book and lead to a worse fill during spikes. A stop limit gives you control, but it can go unfilled during sharp moves.

Reading the book without getting lost

You do not need to stare at every line. A few checks help:

- Depth: Look at size near the top of book. Plenty of size close by usually means tighter fills.

- Spread: A tight spread is a green light for market orders. A wide spread suggests caution.

- Recent trades: Tape speed tells you if buyers are lifting asks or sellers are hitting bids.

- Fees: Maker and taker fees can tip the balance. Sometimes waiting pays.

Common slip-ups around the ask

- Buying size into a thin market without checking depth.

- Chasing a breakout with market buys during news spikes.

- Ignoring maker fees that could lower costs for planned entries.

- Placing a limit right at the ask, getting filled, then realizing you paid taker fees anyway.

- Trading on a DEX pool with low liquidity and getting hammered by price impact.

Small tactics that make a big difference

Break a large order into smaller clips. Place limits at several levels to average in. Use alerts on TradingView to catch pullbacks. If you need to buy now, use a percentage of your size at market, then set limits for the rest. On DEXs, compare routes with 1inch or Matcha, then set a slippage tolerance you actually accept. If spreads look weird, wait for the book to refill. No need to force it.

What moves the ask, moment to moment

Liquidity providers adjust. If volatility spikes, they widen spreads. If news is quiet and volume is steady, they tighten. During events like the Bitcoin halving, CPI releases, or big ETF headlines, expect the top of book to thin out. That does not mean you cannot trade. It means your plan should fit the conditions. You may pay more to cross the spread, so either size down or switch to limits.

Yes, the ask looks simple. No, it is not tricky

That sounds like a contradiction. The definition is simple. The behavior is not complex either, it just changes with context. Once you learn to glance at spread, depth, and recent prints, the ask becomes a friend. It tells you if you are early, late, or just fine. Over time, you will build a feel for it. That feel keeps you from clicking buy into a hollow book, which keeps money in your pocket.

Quick reference, when you need a nudge

- Ask: lowest price a seller will take.

- Bid: highest price a buyer will pay.

- Spread: ask minus bid. Tight is good for market orders.

- Slippage: the difference between expected and actual fill price when the book moves.

- Maker vs taker: makers add orders, takers remove them.

Bringing it back to your wallet and your plan

If you hold with a hardware wallet like Ledger or Trezor, your edge is security and patience. You are not chasing every tick. When you do trade, respect the ask. Move funds early, check the book, and choose the right order type. If you are swapping in-app, compare quotes and fees. If you are sending to an exchange, consider a small probe order to see how the book responds. Keep it simple, keep it calm.

Markets breathe. The ask breathes with them. Learn its rhythm, and your entries, exits, and even your nerves will feel steadier. Not perfect, but steadier. And sometimes that is more than enough.