Uniswap made swapping tokens feel like sending a text. No sign-ups, no gatekeepers, just connect a wallet and trade. It looks simple on the surface. It is, and it is not. Under the hood, a clever market design keeps prices fair, moves liquidity around, and pays the folks who provide it. If you are new or you have been around since V2, a quick, human take on how Uniswap really works can save you time, fees, and a little frustration.

What Uniswap Is, in Plain Terms

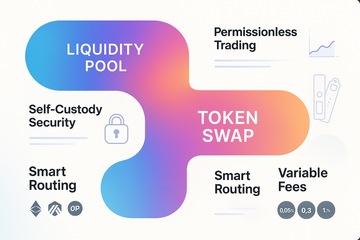

Uniswap is a decentralized exchange that runs on smart contracts. Instead of order books, it uses liquidity pools. Traders swap one token for another, and the price updates based on a formula that keeps the pool balanced. That formula, the constant product rule, nudges prices as trades happen. The more you pull from one side, the more it costs.

There is no custodian holding your funds. You keep your keys and send a transaction to the pool contract. That is the big draw. Control stays with you, which is why people call it permissionless trading.

Why Traders Actually Use It

The obvious reason is access. New tokens often show up on Uniswap before centralized exchanges list them. You can move fast when markets move fast. You also get transparency. All pool reserves, fees, and addresses live on-chain. If you want to check a pool, you can read it on Etherscan or a dashboard like DeFiLlama.

There are trade-offs. You pay gas. You handle slippage. You watch for fake tokens. You also think about MEV, the unseen shuffle of transactions by searchers and builders. That sounds heavy, but there are tools and settings that help, and you do not need a PhD to use them well.

How a Swap Finds a Price

Every pool keeps two tokens in reserve. The product of the reserves is kept constant, so buying one token pushes the price up. That is the V2 mental model. With V3, liquidity gets concentrated into price ranges. Liquidity providers decide where to place their capital. That makes trades more efficient, since more liquidity sits near the current price. Fees can be lower, and price impact can be smaller.

You also pick a fee tier on V3. Common tiers are 0.05%, 0.3%, and 1%. Blue chip pairs often sit in lower fee pools. Exotic or volatile pairs often use higher fees. The router usually finds a path across multiple pools to get you the best outcome.

UniswapX, Aggregation, and Fewer Headaches

UniswapX adds an intent-based layer. You sign an order, solvers compete to fill it, and they can route across many sources. The goal is better prices and less gas, sometimes with MEV protection features. It feels like a quiet upgrade, since you still click swap, but the path can be smarter.

Slippage, Gas, and That One Setting Everyone Ignores

Slippage is the difference between the price you see and the price you get. Set your slippage tolerance too tight, and your trade fails. Set it too loose, and you might overpay in a fast market. A common starting point is 0.5% to 1% for liquid pairs, with short deadlines. For smaller or volatile tokens, you may need more, and that is fine, just watch the minimum received field closely.

Gas is easier now on Layer 2s. Uniswap runs on Ethereum mainnet, Arbitrum, Optimism, Base, and others. Mainnet gives you depth and security, but it can be pricey when traffic spikes. L2s cut costs and speed up confirmations. If you are swapping small amounts, L2s make sense. If you are moving size, mainnet depth can still matter.

Liquidity Providers, Fees, and Impermanent Loss

Providing liquidity sounds like easy yield. You put two tokens in a pool and earn a cut of trading fees. The catch is impermanent loss. When price moves, your position rebalances, and you end up with more of the token that went down and less of the one that went up. If fees do not cover that difference, your value lags behind just holding.

Think of it like running a fruit stand. You stock apples and oranges. If oranges moon in price, you sell oranges and hold more apples. You made sales and earned fees, which is good. But compared to simply holding the oranges, you may be behind. The loss is called impermanent because, if price returns, the gap can shrink. In practice, trends persist, so model first, then deposit.

Where LPs Actually Win

LPs do well when volume is high and price chops in a range. Tight ranges in V3 can boost fee earnings a lot, but you have to watch your position. If price escapes your range, your capital sits idle until you rebalance. Some folks automate this with tools that read volatility and move ranges for them. Others keep it simple and use wider ranges for less maintenance.

Security That Feels Boring, Until It Saves You

Here is the thing. Self-custody makes you the admin, which is empowering and a little nerve-wracking. Hardware wallets like Ledger or Trezor help by keeping private keys offline. Sign swaps from the device, confirm the token and amount, and take a second to check the contract address. It is a small pause that prevents big headaches.

Allowances matter too. When you approve a token, you grant the contract permission to spend it. Set a custom spend limit, not infinite, when the wallet allows it. If you have old approvals, revoke them with Etherscan, Revoke.cash, or your wallet’s built-in tools. These habits feel fussy. They are not. They are normal for on-chain life.

Spotting Fake Tokens Without Losing Your Cool

Copycats use the same name and a different address. Always verify the token address from a trusted source, the project’s site, a reputable explorer, or a known list. The Uniswap interface flags common scams, but you still make the call. You know what, keeping a small whitelist in your notes app helps more than you would expect.

A Quick Path to a Clean Swap

- Use the official Uniswap interface or the mobile Uniswap Wallet. Avoid random links.

- Pick the chain based on gas and depth. L2 for speed, mainnet for size.

- Check the token address. Do not rely on the logo or name.

- Set a realistic slippage tolerance and a short deadline.

- Confirm the minimum received or maximum sold before you click swap.

- Sign with a hardware wallet when possible. Ledger and Trezor both work well.

- Revoke old allowances once a month, especially for newer projects.

Fees, Hidden and Not So Hidden

You pay a few types of costs. Trading fees, which go to LPs. Gas fees, which go to the network. Router or aggregator costs, usually small, that can show up in route details. Sometimes a slightly higher pool fee still ends up cheaper than a lower fee pool with bad depth. The router does that math for you, and you can still view the route and tweak as needed.

One more thing that confuses people. Price impact is not a fee. It is the market telling you how much the trade moves the price. Large trades in shallow pools will move the needle. If you care about precision, split the order or use an L2 with better depth for that pair.

UNI, Governance, and the Culture Around It

UNI is the governance token. Holders can vote on protocol changes, fee settings, and treasury actions. The forum is where proposals start, then voting happens on Snapshot or on-chain. The culture has a builder vibe. Ship improvements, review code, debate, then ship again. You do not have to join the debates to use the product, but it is nice to know the doors are open.

What Is New and Worth Watching

Uniswap continues to expand across chains. L2 volume keeps growing, and fees there are friendly for smaller balances. Developers are also experimenting with new pool logic through hooks, strategies that customize behavior at certain moments. Think dynamic fees or built-in protection features, all while keeping the core AMM feel. It is early, but the direction is clear, more flexibility without losing the simple swap experience.

Seasonal Note, Markets Have a Mood

During hype cycles, token launches hit fast, gas jumps, and slippage widens. During calm periods, fees feel tiny, and liquidity sits tight. The playbook changes with the season. In fast times, keep limits tight and size modest. In quiet times, you can be patient and picky. Honestly, patience pays in both.

A Short, Real Example

Say you want to swap USDC for ETH on Base. You connect a wallet, select the pair, and set slippage at 0.5%. The route suggests a single pool with a 0.05% fee. You check minimum received, looks good, then sign with a Ledger. The transaction clears in seconds, gas is a few cents, and your balance updates. No drama. If you were moving a larger size on mainnet, you might split the order, use a 0.3% pool, or let UniswapX source a better route. Same logic, different context.

Final Thoughts, Keep It Simple, Keep It Yours

Uniswap thrives because it keeps the hard parts under the hood and leaves control in your hands. There is nuance in fees, slippage, and liquidity ranges, yet the rhythm is steady. Connect wallet, review details, sign with care. Repeat. With a few habits and a bit of curiosity, you trade with confidence and sleep fine.

If you remember only one thing, let it be this. Self-custody is freedom with responsibility. A hardware wallet like Trezor or Ledger, sensible approvals, and a minute of verification turn a fragile setup into a robust one. The market will do what it does. Your process, that stays steady.