What happens if the United States treats Bitcoin like oil, gold, or foreign currency reserves? That is the heart of the Bitcoin Reserve Act, often called the BITCOIN Act. It sketches a path for the federal government to hold Bitcoin as a long term strategic asset. If you stack sats on a Ledger or a Trezor, this is not just DC theater. It touches liquidity, custody standards, and the way people think about cold storage. You know what? It might even nudge adoption in a surprisingly practical way.

So, what is the Bitcoin Reserve Act?

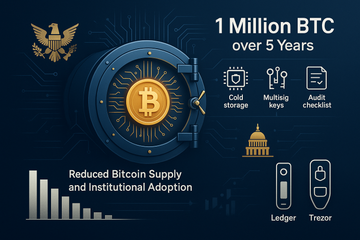

In plain terms, the bill proposes a Strategic Bitcoin Reserve for the United States. It lays out a schedule to acquire a large amount of Bitcoin over several years, then hold it for the long haul. Public summaries have cited totals up to one million BTC over five years, roughly two hundred thousand per year, with a holding period of at least twenty years. That long lockup is the point. It signals commitment, not quick trades.

The bill is often linked to Senator Cynthia Lummis and has been discussed in the 119th Congress as S.954. Separate from the bill, there has also been an executive order outlining a policy to establish a Strategic Bitcoin Reserve and a broader digital asset stockpile. Put those together and you get a clear theme. Federal Bitcoin, managed like a reserve, with rules, reporting, and secure storage.

Why a strategic reserve, anyway?

Think of the Strategic Petroleum Reserve, but digital. Governments hold reserves to manage shocks, build confidence, and hedge risks. With Bitcoin, the pitch is simple. Fixed supply, global settlement, no central issuer. Supporters argue it can hedge inflation or currency risk over long horizons. Critics point to volatility, liquidity crunches, and the weird moves that can happen around halvings.

Both sides are right in parts. Bitcoin is volatile in the short term. Over longer cycles, supply caps and adoption trends have told a different story. A reserve program stretches the time frame. It behaves more like a strategic stash than a trading desk.

How would the government actually hold it?

Cold storage, of course. The bill language and related policy notes describe secure, offline custody with distributed locations and detailed controls. If you have ever set up a Trezor Model T or a Ledger Nano X, you know the vibe. Seed generation, private keys offline, strict checks before any spend. Now scale that up with institutional tooling, multiple signers, and airtight audit trails.

- Cold storage in segregated vaults, not connected to the internet.

- Multi signature schemes, so no single actor can move funds.

- Hardware security modules and tamper evident processes.

- Clear accounting for forks and airdrops, including labeling and UTXO hygiene.

- Independent audits, plus continuous access controls and monitoring.

It sounds heavy, and it is. But the basic idea mirrors good self custody. Write down the seed, protect it, use multiple signers or multiple locations, and keep your attack surface small.

Market impacts, the part everyone asks about

Does a federal buyer soaking up hundreds of thousands of BTC change the price path? Probably. A scheduled, public buyer with a multi year plan reduces available float. It adds a baseline bid. Miners, ETFs, and large treasuries already shape liquidity. A strategic reserve adds another anchor. That said, it is not a magic recipe. Markets still swing. Macro shocks still hit. A reserve program tames supply pressure, it does not erase human behavior and risk.

There is a contradiction here, so let me explain. A buyer this large sounds bullish, yet it could also create strange incentives. Traders front run, narratives run hot, and political headlines whipsaw sentiment. Over time, though, the steady drumbeat of accumulation and a long hold period point in one direction. Scarcity gets more concrete.

What does it mean for self custody people?

Short answer, it validates your instincts. If a government is willing to hold Bitcoin for decades, it says something about durability. It does not replace personal sovereignty. It does not give you access to those keys. Not your keys, not your coins still applies. What changes is the center of gravity. Security norms move closer to what hardware wallet users already do.

If you hold your own keys, this news is a nudge to tidy up. Rotate passphrases if needed, review your backup, consider multi sig with different hardware brands for redundancy. Ledger and Trezor have mature stacks, strong user flows, and large communities. Many holders pair a Ledger for day to day cold storage and a Trezor for longer storage with a passphrase. Different strengths, fewer single points of failure.

Custody standards might level up

One quiet win here could be clear rules on forks, airdrops, and reporting. The bill text and policy notes mention accounting for forks and airdrops separately. That sounds dry, but it shapes how institutions label UTXOs, how they treat chain splits, and how they keep paper trails for auditors. For the industry, boring clarity can unlock bigger participants who were waiting for a blueprint.

There is a small digression worth noting. If federal custody standardizes reference architectures for multi sig and key ceremonies, we may see better open documentation for safekeeping. More transparent checklists, clearer incident response plans, and a baseline for tamper tests. That trickles down. Wallet makers improve guides. Security teams adopt similar playbooks. Everyone wins a little.

States want in, and that matters

Several states have floated their own Bitcoin reserve ideas. Texas has debated a state level program. Other states, like Oklahoma, have explored digital asset investment rules for treasuries and pensions. The federal bill even mentions pathways for states to participate through segregated accounts. If that expands, custody will not sit in one bunker. It will live across controlled vaults, each with local reporting and oversight.

Decentralized storage is not just a crypto slogan. It is also a smart operational idea. Separate sites, separate signers, staggered procedures. A failure in one place should not ripple everywhere. That design principle is old school security, and it maps cleanly to Bitcoin.

How fast could this happen?

Legislation takes time. Hearings, markups, amendments, and budgets, yes, they all matter. Even with an executive order outlining policy, implementation steps are gradual. Procurement, site prep, staff, audits, and key ceremonies take months. Realistically, any large acquisition program would roll out in phases. It would likely move on a transparent schedule so markets are not stunned by sudden buys.

There is also the money question. Some summaries discuss budget neutral approaches, like repricing gold reserves or reallocating from recovered digital assets. Others look at swap structures or long dated purchase windows. The point is not to raid taxpayers. The point is to build a durable reserve without short term shocks to the budget.

If you are a builder, read between the lines

Long holding periods push the conversation toward resilience. That means better key management services, more robust multisig coordination, and clean integrations with auditors and regulators. Startups focusing on policy grade custody, supply chain verified hardware, and open source recovery flows will find air. If you work on wallet firmware, threat models that consider state level adversaries will get more attention. And yes, that spills into consumer wallets over time. A safer stack benefits everyone.

Risks you should keep on your radar

Policy swings can whipsaw plans. A change in leadership might slow or reframe the program. Centralized stockpiles can be tempting targets. Even with split custody and strict controls, concentration risk exists. Transparency must be handled with care. Too much detail invites threats, too little detail undermines trust.

On the market side, a large buyer can distort signals. Price discovery stays healthy when buyers and sellers are diverse. A reserve should be steady, not dominant. The bill’s long hold rule helps, since it removes sale pressure rather than trading on every wiggle.

What should you do now?

Nothing dramatic. Keep stacking responsibly. Use secure hardware like Trezor or Ledger, protect your seed, and consider a second device for redundancy. Track the bill’s progress, especially language on custody, accounting, and the treatment of forks. If you run a business, tighten your coin control policies, document key ceremonies, and map your recovery steps. The same habits that keep a national stockpile safe can keep your stack safe too, just scaled down to the weekend hodler level.

Quick recap, no fluff

- The Bitcoin Reserve Act proposes a US Strategic Bitcoin Reserve with multi year accumulation and long holding periods.

- Cold storage, multisig, audits, and clear accounting are the backbone of the plan.

- Market effects likely include reduced float and stronger institutional signals, with volatility still present.

- Self custody remains king. Hardware wallets like Ledger and Trezor continue to be essential for personal sovereignty.

- States are exploring their own reserves, and federal policy has outlined a path to establish a national stockpile.

Honestly, the most interesting part is cultural. A decade ago, the idea of a government saving Bitcoin seemed like a punchline. Now it feels like a spreadsheet line. If that does not tell you how far the space has come, I do not know what will. Keep your keys safe, keep your head cool, and watch how a strategic reserve reshapes the conversation, slowly, then suddenly.