Ever tried squeezing too many cars onto a single, narrow highway? It slows everything down, and honestly, tempers tend to flare. The world of blockchain isn’t much different. As more and more people clamber onto popular networks like Bitcoin or Ethereum, things get congested. Suddenly, sending a simple transaction feels like waiting in line at a busy airport security checkpoint. Enter, sidechains—a concept that just might save your next crypto experience from gridlock and confusion.

So, What is a Sidechain, Anyway?

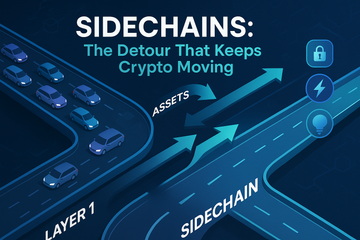

Picture this: Your main blockchain (like Ethereum) is the packed interstate. A sidechain is like a local detour road running parallel, letting you zip around traffic and avoid the logjam. In more technical terms, a sidechain is a separate blockchain network attached to a primary chain (Layer 1) by a two-way 'bridge.' It’s not just a shortcut for speed, though. It’s a clever playground where developers can test new features or tailor services to specific communities—without cluttering up the main network.

The beauty of a sidechain? It can operate with its own set of rules, tokens, and even consensus mechanism. Meanwhile, it’s connected tightly enough to the main chain so users can send assets back and forth almost seamlessly. It’s like exporting your crypto to a side quest, where the stakes are real, but the risks to the main network are lower.

Why Should You Care About Sidechains?

Alright, you might be wondering, “That’s cool, but why’s everyone buzzing about these lately?” Let me explain. Sidechains aren’t just technical trickery—they’re fundamentally reshaping what blockchain can do:

- Scalability solutions: When a main chain is jammed, a sidechain lets you offload transactions, cutting down fees and delays. Think of it as ordering takeout during rush hour so you don’t have to wait for a table.

- Innovation playground: Developers can try out wild new crypto ideas or experiment with smart contracts—without risking the security and stability of the main blockchain.

- Custom utility: Different communities need different tools. Sidechains allow for tailored tokens, privacy tweaks, or even new governance systems suited to special needs, like gaming or financial services.

Honestly, without sidechains, many networks would crumble under their own success. Just look at periods of high NFT activity or meme coin frenzies—main chains buckle, but sidechains help keep things humming along.

How Do Sidechains Actually Work?

Technically speaking, a sidechain is maintained by its own validators or miners, separate from the main chain. But here’s the linchpin: a two-way peg. This peg lets users “lock” assets on the primary network, thereby unlocking equivalent value on the sidechain. When you’re done with the side adventure, just reverse the process to release your funds back into the main event.

You know what’s fascinating? Sidechains can choose consensus models you won’t find on the main chain. For example, while Ethereum runs Proof of Stake, a sidechain could go wild with its own flavor of Proof of Authority or something else entirely. It’s a bit like letting siblings have their own house rules, even if they all live on the same street.

Famous Sidechains: Not Just for Show

If you’re deep in the crypto scene, you’ve probably tripped over names like Polygon (Matic), Liquid, or Rootstock. These aren’t just buzzwords—they’re actual sidechains handling real money and, sometimes, real drama. Take Polygon, often described (sometimes inaccurately) as an Ethereum Layer 2. It’s actually a sidechain, providing faster and cheaper transactions for DeFi apps, NFT marketplaces, and even gaming platforms.

Liquid Network gives Bitcoin a turbo boost, making transfers faster and more private for big traders or those handling complex financial contracts. And Rootstock? It lets Bitcoin’s sturdy chain flex some Ethereum-style smart contract muscle. The best part: users often don’t really notice when their assets trek onto sidechains—it all feels smooth, if a bit magical.

Natural Tangent: Where Do Hardware Wallets Like Trezor and Ledger Fit In?

Let’s go on a little tangent. With all these new chains swirling around, how do you keep your assets safe? You guessed it—hardware wallets are still king. Trezor and Ledger are practically household names among crypto veterans. They let you stash your coins and tokens offline, away from prying eyes or raging hackers.

But here’s the quirky bit: not all hardware wallets support every sidechain out of the box. While Ethereum, Bitcoin, and the largest sidechains often get the royal treatment, lesser-known projects might need custom integrations or advanced setup. So, before you send that NFT or stablecoin wandering to a new sidechain, check if your trusty wallet can actually track it—or you might find yourself on a treasure hunt without a map.

Are There Risks? Naturally.

It’s not all sunshine and fast lanes. Sidechains make tradeoffs. They can be less secure than the main chain, especially if their validator set is tiny or if they rely on a centralized bridge. Imagine handing house keys to just a couple of friends while the rest of the neighborhood trusts a big alarm company—the risks aren’t identical.

Bridges especially have proven vulnerable to hacks. The crypto news cycle turns frantic each time a major exploit drains millions from a poorly secured sidechain or bridge. So as always: double-check, use established platforms, and don’t move your entire crypto nest egg until you understand the lay of the land.

So What’s Next For Sidechains?

The future's looking bright—but also a bit chaotic. Developers are racing to build even zippier, more flexible, and specialized sidechains. We’ve already seen communities form around gaming, decentralized finance, and even art ecosystems. Over time, hardware wallets like Trezor and Ledger will almost certainly keep expanding their support, but there will always be a lag between innovation and rock-solid security integrations.

Frankly, sidechains are starting to feel less like an add-on and more like a necessity as crypto heads toward mainstream adoption. It’s a bit like WiFi at the airport—no longer a luxury, just an expected part of the experience. Will sidechains finally end blockchain congestion for good? Not likely. But they sure make the journey smoother for now.

Final Thoughts: Are They Worth the Hype?

If you’re dreaming of a world (or even just a wallet) where blockchains don’t freeze and fees aren’t sky-high, sidechains might be your new favorite detour. Just keep your eyes on your assets, lean on solid tools like Trezor or Ledger, and never put all your eggs in one basket—no matter how appealing the shortcut looks. Sidechains won’t solve every crypto headache, but they sure can make the ride a lot more enjoyable.