Let’s talk about something that’s finally starting to make blockchains, well… faster than a sloth in winter. Ever feel like blockchain transactions crawl along, one after another, like a checkout line when everyone’s paying with coins? Here’s where sharding jumps into the conversation. Do you know that whimsical word you’ve probably heard tossed around by crypto folks? It’s more than tech jargon – it’s changing how blockchains handle the crunch of a growing crowd.

How Sharding Works: Think Slices, Not Whole Pies

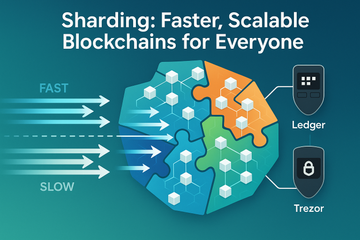

Imagine a bustling pizza shop. If one person makes every pie from start to finish, customers wait forever. But what if the chef divides tasks – dough here, sauce there, toppings on that counter? Suddenly, everyone gets fed in record time. In blockchain, sharding works the same way. Instead of every validator processing each transaction for the entire network, sharding splits the workload into smaller pieces called shards.

Each shard is like its own little checkout line, processing transactions independently. Want your transaction handled fast? Now, your request could zip down a shard that's free, rather than jostling with every other user for its turn.

Scaling Up: From Cozy Town to Booming City

Blockchains have a reputation for being slow when the crowd shows up. Bitcoin, for example, has famously low transaction throughput. Ethereum has struggled too, gas fees spiking when the party heats up. Sharding directly tackles the bottleneck. How? By splitting the net into smaller partitions, the network can process drastically more transactions at once—think hundreds or thousands per second, not handfuls.

Let me explain with a real-world touch: Ethereum is in the process of implementing sharding as part of its roadmap—sometimes called 'Ethereum 2.0.' The goal? Make the network as lightning-quick and cost-effective as your average web app. Zilliqa was another early adopter, carving out its own reputation as the first high-throughput public sharded blockchain.

But Wait, Isn’t Splitting Risky?

You might be thinking, doesn’t carving up the network introduce security headaches, or create islands of information? That’s a fair point. Each shard only stores part of the data, so clever cryptography steps in. Randomness and committees of validators help guard against attacks that target just one shard. Does it add complexity? Absolutely. But it’s a trade-off most networks are willing to make to keep up with global demand.

Why Sharding Isn't Just a Fancy Word

We toss around lots of buzzwords in crypto, but sharding has tangible perks:

- Speed: More shards mean more transactions zipping through, not waiting in a traffic jam.

- Efficiency: Validators don’t need to know the entire state of the universe, just their patch.

- Scalability: Like adding more lanes to a highway, sharding keeps blockchains nimble as they grow.

And, as with all things, there’s a flip side. If shards aren’t coordinated well, some might get flooded while others barely break a sweat. Balancing shards, picking secure validator committees—these are the details teams like Ethereum’s spend years perfecting. Plus, sharing data between shards ('cross-shard communication“) isn’t trivial. Imagine trying to settle up a dinner bill split among different tables speaking different languages. Coordination is everything.

So, Does Sharding Change How I Use My Ledger or Trezor?

Here’s where it gets relevant for hardware wallet fans—yes, that’s you with your trusty Trezor or Ledger device. For everyday users, sharding happens behind the scenes. Your hardware wallet still signs transactions the same way, and you don’t really need to know which shard your transfer lives on. Your keys are as safe as always (assuming you keep your seed phrase somewhere special).

But here’s a twist: as sharded blockchains take off, your hardware wallet’s software will quietly keep up. Wallet apps need to understand how to talk to sharded networks—fetching balances, tracking coins, and making sure transactions don’t get lost between shards. When Ethereum finally rolls out full sharding, expect firmware updates so your Ledger or Trezor can handle all the new routing behind the curtain.

Everyday Analogy: Coffee Shop Conversations

Ever try catching up with friends at a packed café? If it’s one giant table, everyone talks over each other. Split into smaller groups, and every conversation flows better. Sharding brings that same dynamic to blockchains—splitting a noisy room into manageable circles. Sure, sometimes you need to pass a message between groups (cross-shard calls), but overall it keeps things friendly and efficient.

Who’s Already Using Sharding? Quick Glance

- Ethereum: The headline act. Sharding is central to its long-term hopes for scaling and lowering transaction fees.

- Zilliqa: One of the OGs. Has been sharding its chain for years now, focusing on high throughput from the get-go.

- NEAR Protocol: Newer but built from the ground up to use sharding for smooth scalability and usability.

These aren’t just experiments either—each uses slightly different methods, but the common thread is more room for everyone to transact, play, and build.

Pros and Cons: The Honest Details

- Pros: Less congestion, faster confirmation, and a path to global-scale blockchains. For users? Lower fees and quicker transactions make crypto far more pleasant.

- Cons: Complicated design, potential security blind spots at the edges of shards, and difficult upgrades. For network nerds, it’s a tricky juggling act to keep everything humming along smoothly.

But here’s the thing: sharding isn’t a magic bullet. It’s more like a new toolkit—one that’s essential as more folks queue up to use the same blockchain highway. Projects like Ethereum and Zilliqa show it’s practical, but the details are always shifting as teams iron out kinks.

Looking Ahead: Bet on Sharding?

Is sharding going to solve all blockchain pain points? Probably not overnight. Yet the march towards larger, faster, and friendlier chains means this concept isn’t leaving the stage. If you’re holding your keys in a Ledger or Trezor, rest easy—your devices are built for the long haul, absorbing changes beneath the surface so you don’t have to worry about missing a beat.

As adoption grows, you can expect sharding to become as familiar as staking rewards or gas fees. By the time your favorite crypto explainer makes coffee analogies about shards, you’ll know exactly what they mean. And hey, isn’t that a little satisfying?