There’s a quiet thrill in the air when a long-awaited upgrade finally lands on a major blockchain network. If you’ve been anywhere near the Ethereum ecosystem lately—whether as a seasoned validator, a curious staker, or even just an observer who likes reading Reddit threads with a side of popcorn—the term Shanghai Upgrade probably popped up like an eager friend with big news. And trust me, for both the passionate crypto crowd and the quietly ambitious investors, this upgrade is anything but ordinary. Why? Well, let’s chat.

Staking, Waiting… and Finally Withdrawing: The Main Event

Ask anyone who staked their ETH when the Beacon Chain launched back in December 2020. There was excitement—but also a nagging question: 'When can I finally get my hands back on my locked funds?' As Ethereum shifted from Proof of Work to Proof of Stake in The Merge (September 2022), validators found themselves with a shiny new job but no direct way to retrieve their staked ETH. While earning rewards was nice, not being able to withdraw sometimes felt like investing in a promising startup where exits are rumor, not reality.

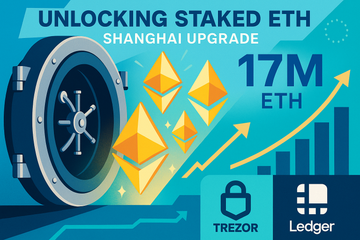

The Shanghai Upgrade, rolled out on April 12, 2023, finally answered that question, letting everyone breathe a sigh of relief (and maybe uncross their fingers). For the first time, more than 17 million ETH—locked away for years—was up for grabs. That's not a small bag of change; it's an economic shift that echoed all across the market, splashing headlines and Twitter feeds alike.

The Showcase Feature: Withdrawals at Last

So what’s the big deal with being able to withdraw staked ETH? For starters, it's flexibility. Imagine parking your car at the airport, but the attendant keeps your keys until the 'network' says you can take them home. No amount of waving your ticket helps, either. Shanghai unlatched the gates. Validators could now retrieve not just their original staked funds, but also any juicy rewards earned since the Beacon Chain’s debut. This change, guided by EIP-4895 (Ethereum Improvement Proposal), essentially stitched up one of the biggest holes in Ethereum’s PoS tapestry.

What Does This Mean for Validators, Stakers, and the Market?

Let’s be real. Crypto folks are pragmatists with a touch of FOMO. The second staked ETH became liquid, the entire calculus changed. Validators—who had to front 32 ETH just to get in the game—could now rebalance, cash out, or maybe just play it safe during uncertain macro cycles. If you’re using a hardware wallet like Trezor or Ledger, you probably saw some updates streaming in, as both companies raced to roll out firmware taking advantage of this upgrade. (By the way, if you’ve never sent your validator keys to cold storage ‘just to be sure,’ have you even lived?)

Now, could this sudden release of staked ETH have tanked the price? Some predicted a waterfall selloff, but markets are never so easily spooked—or are they? The reality was much more nuanced. Ethereum’s underlying demand, combined with thoughtful withdrawal limits and network incentives, kept things shockingly steady, at least for a while. That said, for anyone who’s been through a proper crypto market cycle, you know how quickly things can swing from serene to a full-on roller coaster. The Shanghai Upgrade just changed who could get in and out of their seat.

Decentralization Takes Center Stage

There’s another piece here that’s easy to miss if you look only at numbers. By freeing up locked ETH, Shanghai lowered the psychological and financial barriers for everyday users to become validators. It quietly encouraged newcomers, making Ethereum’s ecosystem less a gated community and more open to the regulars—bonus points for decentralization, security, and community pride. You know, that familiar feeling when a pub adds outdoor seating and suddenly the atmosphere just feels more inviting? Yeah, kind of like that.

- Validator participation increased as stakers grew more confident.

- Risk management became possible; validators could finally act on their gut feeling when the market wobbled.

- Liquidity for stakers soared; folks using platforms or hardware wallets now actually had options.

Execution Meets Consensus: The Shapella Fusion

Let me explain this point because it tends to trip up even relatively advanced users. Shanghai wasn’t just a single upgrade—it worked hand in hand with its cousin, Capella. Together, they were affectionately (and somewhat geekily) labeled Shapella. Shanghai handled the execution layer (where transactions actually happen), while Capella tuned up the consensus layer (the guts making sure everyone plays by the rules). It was a bit like tuning both the engine and tires before race day. You want power, sure, but traction matters, too.

Notably, this combo pushed Ethereum even further down its scaling roadmap, setting the stage for upgrades like Danksharding and the fabled Surge. See, in crypto, progress is both step-by-step and occasionally a giant leap, depending on whether you’re catching up or looking ahead.

Why All This Matters—Beyond Just Tech

The Shanghai Upgrade isn’t just another tweak. It fundamentally changed user psychology, made staking more accessible, and reinforced Ethereum’s philosophical shift toward greater decentralization. The hard fork also signaled that Ethereum’s developers can arguably deliver on long-term promises, which, in this space, earns a rare and justified round of applause.

Let’s pause a moment: even if you don’t hold ETH, this kind of measured upgrade sets industry standards. The lessons ripple across other blockchains, influencing how future staking systems and withdrawal mechanisms will be structured.

Security, Hardware Wallets, and a Bit of Peace of Mind

If you’re the cautious type (or just someone who never clicks suspicious links), hardware wallets like Trezor and Ledger are practically non-negotiable. These storied brands upgraded their systems around Shanghai to help users safely interact with validator keys and withdrawal credentials. It’s a little like remembering to put on your helmet before you finally drag your old bike out for a gorgeous spring ride.

Yet, even with these safety nets, human error remains the wild card. Don’t worry, though; with proper education and tools, more people now have the power to take control—whether staking, withdrawing, or just watching from the sidelines. Maybe that’s the most exciting part: Shanghai took what was once reserved for the in-crowd and made it accessible, clear, and just a little less intimidating.

So, What’s Next?

Ethereum rarely stands still. With Shanghai now behind us, stakers and validators are eyeing the next big enhancements, from Danksharding (which promises major scaling) to more nuanced tweaks in consensus and execution layers. The dream of an ultra-scalable, secure, and decentralized global computer is inching closer—sometimes quickly, sometimes with infuriating patience.

So whether you’re managing a tiny nest egg on a Ledger, deploying smart contracts, or just here for the culture, the Shanghai Upgrade proved one thing: Ethereum continues to evolve, and everyone has a chance to be part of the ride. After all, as any old-school validator might say, it’s not just about staking coins, but staking your place in the web’s next chapter.