If you’ve ever watched a cat stalk its prey, moving in quick, calculated bursts, you might get an idea of what scalping in trading truly feels like. The crypto market, with its often wild, unpredictable swings, is the perfect hunting ground for those traders who thrive on speed, agility, and a razor-sharp focus. So, what exactly is this whole scalping thing, and why do so many folks swear by (or, let’s be honest, sometimes at) this frenetic trading style?

Getting Right to the Point: What Is Scalping?

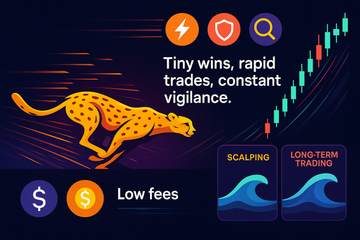

Let’s cut through the jargon. Scalping, or scalp trading, is all about nabbing tiny profit margins from minuscule price movements, usually within seconds or minutes. It’s like the espresso of trading strategies: quick, intense, and not everyone’s cup of tea. Traders who call themselves scalpers might jump in and out of dozens, or even hundreds, of trades in a single day. They’re not trying to predict the ‘big move’—they just want a little piece, over and over.

The goal? Instead of waiting around for a massive wave, scalpers ride small, consistent ripples, letting modest wins add up. If you’re the impatient type who feels itchy just holding a position for hours, let alone days, this approach probably sounds appealing. But before you get visions of easy, unlimited profits, there’s a bit more to it, and plenty of pitfalls too.

Why Scalpers Might Love the Crypto Market

The crypto market is practically tailor-made for scalping. Why? Simple: it never sleeps. No annoying closing bells or weekends off. Whether you want to jump into Bitcoin, Ethereum, or some spicy altcoin you discovered at 2 a.m., there’s always action.

But with round-the-clock trading comes round-the-clock volatility. Crypto prices can lurch up or down without warning, which means opportunity for the nimble—and danger for the unprepared. If you’re trading with tools like the Ledger Nano hardware wallet or Trezor, you’re probably extra careful with your coins, but remember: scalping requires not just security, but also lightning reflexes and nerves of steel.

Scalper’s Toolkit: What Do You Need?

Let’s say you’re sold on the idea of scalping. How do you actually get started without feeling like you’re just guessing? Here’s the lowdown on what you need to make those tiny wins add up:

- Super-Fast Execution: Speed is your friend. A trading platform with laggy execution or clunky interfaces is the scalper’s worst nightmare.

- Low Fees: The bread and butter of scalping is volume. If your exchange charges an arm and a leg for every trade, you’re already behind before you even start.

- Real-Time Data: You need charts that update fast, and technical analysis tools that let you spot breakouts or reversals in the blink of an eye.

- Solid Risk Management: One bad move or distraction could wipe out a week’s worth of hard-fought gains.

- Discipline (and Maybe an Espresso): Let’s not kid ourselves—staring at the screen, poised to pounce, is mentally exhausting. The temptation to chase losses or ‘just try one more trade’ can be overwhelming.

Pro Tip:

If you’re using a hardware wallet like Trezor or Ledger during your crypto trading, consider keeping only your active trading funds on exchanges and the rest safe offline. Imagine the heartbreak of a hacked account after hours of careful scalp trading!

How Does Scalping Compare to Other Strategies?

Here’s the thing—scalping isn’t the only fish in the trading sea. Plenty of folks prefer swing trading or just holding on for the long haul. So why choose this approach?

It’s a bit like fishing with a net versus a single line. Day traders and swing traders wait for bigger catches, maybe a 5% move in a week or two. Scalpers, on the other hand, are happy scooping up dozens of tiny fish all day long. Both can work, but you need to know what kind of personality (and patience level) you bring to the table.

Common Misconceptions—And a Reality Check

Scalping sounds glamorous, doesn’t it? Fast trades, quick profits—it’s easy to imagine a fast-talking trader living the high life. But you know what? It’s not always a party.

-

Myth: Scalping is easy money.

Reality: Most scalpers lose money, especially if they don’t watch out for fees—or their own impulses. -

Myth: Anyone can scalp successfully.

Reality: It takes practice, focus, and sometimes, letting your ego take a backseat. Quick hands don’t always mean quick wins. -

Myth: You need a massive bankroll.

Reality: Smaller accounts can scalp too, but the risks (and headaches) get higher if you’re using leverage.

In all honesty, scalping can be downright stressful. If you get anxious over a couple bucks’ loss, imagine seeing that happen dozens of times daily. Some folks get a thrill from it; others end up burnt out, promising to “never touch crypto again”—at least until tomorrow.

Pep Talk Time: Can You Really Pull This Off?

Maybe you’re wondering if you’ve got what it takes. Here’s a reality check. Scalping isn’t just about technical skills; it’s a test of emotional stamina. You’ll need to set realistic goals, accept losses with grace, and know when to step away from the screen (to eat, sleep, or, let’s face it, just breathe).

If you’re new to crypto or trading in general, start with small amounts, use demo accounts, and don’t get caught up chasing others’ gains. The best traders—scalpers or otherwise—are students before they’re masters. They learn from botched trades and keep their cool under pressure.

Let’s Talk Tools: The Platforms and Products That Matter

There’s no shortage of platforms promising to turn you into a scalping wizard, but not all exchanges are created equal. Think fast order execution, simple charting tools, and, above all, security. That’s why plenty of traders sing the praises of combining active trading with hardware wallets from brands like Ledger and Trezor. Your profits are worth nothing if your security is shaky.

Speaking of tech, some traders will use algorithmic trading bots for high-speed execution. But don’t be fooled—automating trades isn’t a magic shortcut, and bots are only as good as the person programming them. If you’re really serious, get hands-on first, then experiment with automation later.

To Wrap It Up... Or Do We?

So, is scalping the path to riches? For a select few, perhaps. For most, it’s a challenging, fast-paced strategy that’s as much an emotional roller-coaster as it is a technical puzzle. If you decide to step onto the scalper’s stage, make sure you’ve got your wits—and wallets—about you.

Honestly, if you like the thrill of action and have the stamina for rapid-fire decisions, scalping could be your ticket. Just remember: fortune may favor the bold, but it tends to stick with the prepared. And if things get too hot in the trading kitchen? Well, remember there’s always tomorrow, and maybe even a more laid-back trading style that lets you sleep (and dream) a little easier at night.