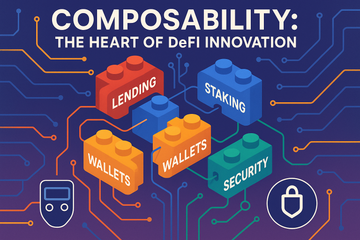

Let’s be real for a second—almost everyone who’s spent time with decentralized finance (DeFi) has, at some point, marveled at how these applications work together so smoothly. There’s something a bit magical, almost like snapping together LEGO bricks to build a fortress, a bridge, or whatever your mind can imagine. That magic? It’s called composability, and honestly, it’s at the very heart of why DeFi is so adaptable, innovative, and downright fun to play with.

Wait, What’s Composability—And Why Should Anyone Care?

Okay, picture this: you’re standing in front of a sprawling pile of LEGO bricks. Each brick is unique, but they all fit together. You can build a spaceship, take it apart, and the next day whip up a castle with the same pieces. Composability in tech—and especially in DeFi—works the same way. It’s about making building blocks (think: smart contracts or protocols) that slot together without a fuss.

It makes sense why folks get excited about this. Unlike traditional finance, where systems are closed loops, composable DeFi breaks down barriers so apps can borrow, lend, trade, or secure assets by working together seamlessly. If you’ve ever used a DeFi aggregator for the best swap rate or layered a lending protocol atop a stablecoin platform, you’ve tasted composability firsthand.

Getting Into the Nitty-Gritty: What Makes Composability Tick?

Let me explain some of the nuts and bolts—er, bricks. Developers build composable systems using self-contained modules. Each module does a job and talks to the others through standard APIs or interfaces. It’s like cars with universal parts; you can replace, upgrade, or swap pieces without rebuilding the whole engine.

- Modularity: Each component is its own island, doing one job really well. If it’s a lending contract, it just… lends. No nosing into other business.

- Interoperability: Different apps need to speak the same language, which in crypto means standardized interfaces (think ERC-20 for tokens).

- Reusability: If someone’s already built a great swapping or staking smart contract, why write it again? Just use what’s there.

- Discoverability: Components are built to be found and plugged in. No hunting in the dark—good projects make their pieces easy to pick up and reuse.

Believe it or not, composability isn’t new. Software engineers love modularity because it means more agility, fewer headaches, and, frankly, fewer late nights stuck fixing monolithic code. But in DeFi, things scale like crazy when any developer can chain protocols together and spin up entirely new products in a weekend.

Let’s Talk Perks: The Real Power of Composability

Here’s the thing—composability isn’t just a developer’s dream. It brings a whole buffet of benefits for everyone:

- Speed: Projects launch faster, upgrades roll out quicker, and bugs patch more easily.

- Innovation: New protocols build atop old ones, combining tools in unexpected ways to create stuff nobody saw coming—like flash loans!

- Cost Savings: Less time reinventing the wheel means more resources for actual problem-solving.

- Resilience: Problems in one area don’t sink the whole ship. If one module messes up, the rest keep running.

You get the picture. DeFi’s wild growth wouldn’t be possible without this kind of plug-and-play setup. Almost every big shift in crypto owes a debt to composability.

Real-World Examples—Not Just Abstract Jargon

Feeling like this is a bit too conceptual? Let’s ground it in reality.

Imagine you’re using Yearn Finance, which bundles lending protocols to maximize yield. Or maybe you’re stacking income streams—using Aave to borrow, Uniswap to swap tokens, and then staking somewhere else, all in one click. That’s composability in action. Even wallets, like MetaMask or hardware heavyweights such as Ledger and Trezor, now integrate with multiple DeFi protocols, letting you manage assets and sign transactions safely across a web of interconnected apps.

You know what’s cool? Some folks even joke that using DeFi today feels like being a digital DJ, layering beats, mixing samples, and building something unique for your own portfolio. The music might skip if a protocol hiccups, but for the most part, composability lets you groove along.

Security and Hardware Wallets—The Guardrails of DeFi Playgrounds

You’re probably wondering: “This sounds awesome, but isn’t plugging together lots of parts a security risk?” That’s a fair point. The open nature of composability means bugs or hacks in one protocol can ripple through others. It’s a bit like stacking dominoes—knock one over, and you could tip the whole line.

That’s why secure storage (hello, Ledger and Trezor!) is so important. Hardware wallets keep your private keys offline and safe, even as you connect to a smorgasbord of apps. They act almost like a firewall, requiring you to manually approve each transaction. With hardware wallets, you can explore the DeFi sandbox while keeping your assets guarded—think of them as the strongbox in a pirate’s treasure chest, only much less dusty.

Some Tangents, Because We’re Only Human

Let’s sidestep for a moment. People sometimes romanticize composability as a panacea for all tech problems, but, truth be told, it comes with wrinkles. For example, protocols sometimes upgrade in incompatible ways, which can break integrations. Standards make life easier, but the landscape keeps shifting as new token types and governance models pop up like weeds after a rainstorm.

Still, when composability works, there’s no denying its impact. New DeFi ecosystems spring up, borrowing the best ideas and remixing them. Developers get creative “without permission,” as the phrase goes. And regular users? They get more control and choice than ever before.

Looking Ahead: Modular Magic Isn’t Slowing Down

The story of DeFi, and really Web3 as a whole, is just getting warmed up. Composability is fueling the shift from siloed, rigid digital systems to open, composable networks where anyone can join the party. If you’ve ever tinkered with an app built from someone else’s open-source code, you’re part of the movement.

From the core of DeFi to hardware wallets like Ledger and Trezor—each piece fits where needed, then can be swapped for something fresher tomorrow. So next time you swap tokens, automate your yield, or sign a transaction with your trusty wallet, remember: you’re building, piece by piece, on a foundation shaped by composability. Now that’s what I call progress.