Let’s be real for a second — the world of cryptocurrency is about as chaotic as a Saturday night at a packed ramen bar. New coins, crazy memes, rival chains; it’s easy to lose track. But beneath all that froth, something subtle is quietly steering the ship: consensus mechanisms. And lately, all eyes seem to linger on Proof of Stake, or PoS. Curious why everyone keeps chatting about this thing? Take a virtual seat. Grab a coffee. Let’s walk through PoS, why it matters, how it stacks up against the old-guard Proof of Work, and why your fancy Trezor or Ledger wallet might just love it too.

This “Proof” Business: Playing the Blockchain Referee

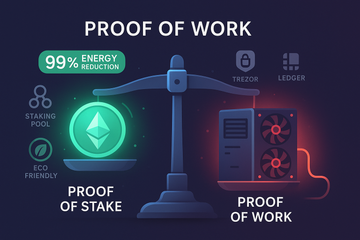

If you’re used to thinking about crypto, you probably know Bitcoin, that OG coin, runs on Proof of Work (PoW). It’s sort of like an Ironman contest: computers all over the world flex their muscles and burn through electricity to solve puzzles, all to earn a shot at validating the next block of transactions. It’s secure, for sure, but also wildly energy-hungry. You could probably toast some marshmallows just from standing too close to a mining rig.

PoS, though? It says, “Why sweat all that?” Instead of making thousands of machines grind away, the network picks its validators based on how much crypto they’re willing to stake, or lock up, as skin in the game. It’s financial skinflint wisdom: the more skin, the more you stand to lose, so you’re nudged to play fair. Randomness keeps things honest, and even little fish have a shot at getting picked — it’s a bit like drawing straws, just with digital savings accounts.

Wait, how do they keep it secure?

Here’s the kicker: to cheat, you’d have to own a giant chunk of the whole network’s coins, which would be absurdly expensive and, honestly, self-defeating. Plus, when networks use tricks like slashing (confiscating a cheater’s tokens) or finality (making blocks irreversible), the incentives work. Almost all major PoS networks layer on extra penalties for bad behavior, keeping things in line without the smoky server farms.

Getting Staked: What’s Involved?

So, in practical terms? On PoS blockchains like Ethereum, you need 32 ETH staked to become a full validator. Not exactly chump change, but hey, you don’t need to do all this solo. Liquid staking and staking pools let you join forces, pooling assets with others to share in the rewards (and risks). Suddenly, you’re not stuck with expensive hardware — just a bit of courage and a cold wallet helps.

- Staking tokens: You lock your coins up for a while. Kind of like a security deposit.

- Random selection: Algorithms toss names in the digital hat based on your stake — more coins, better odds, but randomness means everyone gets a ticket.

- Rewards: If you’re picked, you help validate and secure the network, pocketing transaction fees or new tokens for helping out. It’s passive income with a crypto twist.

And here’s something lots of folks miss: you don’t need to be an expert. Many exchanges and wallets, Ledger and Trezor included, now offer easy paths for ordinary folks to stake without needing to memorize command-line scripts. That kind of accessibility has drawn everyday enthusiasts and careful investors alike.

The Energy Conversation Just Won’t Quit

I get it. Everyone’s worried about the earth — and, yes, Proof of Work’s gnawing appetite for electricity makes headlines. But Proof of Stake turns the volume down. Since validators don’t need to run power-hungry servers 24/7, PoS slashes carbon footprints. Ethereum’s switch famously cut its energy consumption by over 99%, which is bananas. That kind of shift makes crypto greener, helping shake the industry’s reputation as an energy hog. Who ever thought blockchain would be the hero at a climate summit?

Mixing It Up: PoS Flavors for Every Taste

One thing to love about crypto — it’s never boring. Proof of Stake isn’t just one recipe. Different networks tweak the formula:

- Byzantine Fault Tolerance (BFT): Projects like Cosmos work on a strict 2/3rds rule: a supermajority of validators have to agree on the next block. It’s a bit like a jury trial with a hefty requirement for consensus.

- Chain-based PoS: Think of it as validators chosen in turn, block by block — Ethereum used this model for a while.

- Committee-based PoS: Algorand, for one, picks small panels of validators every round, fast-tracking decisions by splitting up responsibility.

- Delegated PoS (DPoS): Here, token holders don’t validate themselves; they pick reps to do it for them. That’s the playbook for EOS and TRON, where you can just back someone else’s expertise.

- Liquid PoS (LPoS): This one’s all about flexibility — staked tokens can still circulate, helping out in DeFi projects while securing the network, too. Tezos fans will know all about this one.

Each system has quirks, but at their core, they stress accessibility and decentralization — with security, of course, never far behind.

And What About Those Wallets?

Let’s wander — for a moment — into the world of crypto wallets. If you’re staking big on PoS chains, security is everything. Here’s where hardware legends like Trezor and Ledger step into the spotlight. These gadgets don’t just look cool sitting on your desk; they safeguard your keys, keep your assets out of hackers’ claws, and even support staking functions for coins like Ethereum, Cardano, and Tezos. Not saying you need one, but in an era where phishing scams feel as common as cat memes, a solid hardware wallet adds peace of mind. You know what? If you’re serious — or just tired of sleep-sapping anxiety — it’s easy to see why so many self-custody fans go this route.

Still Room for Snafus: The Human Side of Crypto

Don’t let the calm vibes fool you. The early days of PoS had hiccups — smart people noticed potential for “nothing at stake” attacks, where mischievous validators could try to confirm every possible chain without risk. PoS networks responded by inventing slashing and finality, basically making it costly and pointless to misbehave. It’s a reminder: any fast-moving tech is gonna have growing pains, but that’s how it gets strong.

Trends: Where’s PoS Headed Right Now?

One word: adoption. PoS is enjoying the crypto limelight. Ethereum completed its long-awaited transition. Cardano keeps touting transparency and academic rigor. Networks like Polkadot and Cosmos experiment with hybrid flavors. And as environmental concerns nudge the industry, PoS keeps grabbing attention as the ‘greener’ and more democratic direction.

Staking-as-a-service pops up everywhere now. Exchanges let you stake from your phone. Even mainstream banking giants are poking around the edges. If you've ever thought crypto was too niche, well, things are changing. Honestly, watching PoS evolve is like seeing your once-geeky high school friend become the popular one everyone wants to hang out with.

So, Is Proof of Stake the Real Deal?

If you made it this far, congrats — you’re already ahead of most. Proof of Stake isn’t perfect, but it’s pushed crypto into a new era: less energy drain, more inclusivity, and dynamic safeguards that bend but don’t break under pressure. The fact that you can participate, earn, and sleep well at night with your assets tucked behind a Trezor or Ledger? That’s what makes PoS truly stand out from the crowd.

Certainly, debates will swirl, and new twists will emerge. But for now, PoS sits comfortable at the table, reshaping the future of money, one block at a time. Next time someone asks about that ‘consensus craze,’ you’ll have a thing or two to share — maybe over an actual coffee, instead of a virtual one.