If you’ve ever found yourself scratching your head at terms like ‘permissioned blockchain’, relax—you’re definitely not alone. For folks knee-deep in crypto, these buzzwords can sound like old news, but for everyone else, it’s like hearing snippets of a new language. So, let’s break down what permissioned blockchains actually mean, why they matter, and where they fit in (especially if you're clutching a hardware wallet like a Trezor or Ledger).

Setting the Stage: What’s a Permissioned Blockchain, Anyway?

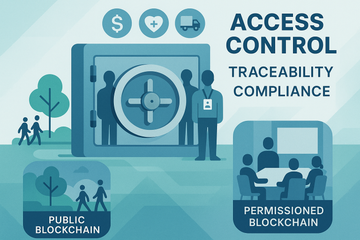

Picture a bustling highway—but only certain drivers are allowed past the on-ramp. That’s the gist of a permissioned blockchain. Unlike public blockchains where anyone can jump in, these networks are gated communities. Only pre-approved individuals or organizations get the keys to enter, transact, or even peep at the record books. The rules here aren’t just for show; they’re baked into the system with digital invites, identity checks, and role-based access. That’s a big reason why banks and healthcare giants are all ears about this tech (Investopedia).

Why Permissioned? The Logic Behind the Locks

Honestly, sometimes an open door policy is more trouble than it’s worth. Not every group wants all their eggs out in the open basket. Permissioned blockchains give that sweet spot—familiar blockchain transparency, but only between the folks who’ve passed security. Here’s the thing: everyone has a name badge, so gone is the wild anonymity you see in Bitcoin. Traceability is built right in, which is a dream for auditors and a nightmare for fraudsters.

But Wait, Aren’t Blockchains Supposed to Be Open?

This is where most people squint and ask, “Isn’t the whole point of blockchain about being wide open and trustless?” Yes and no. Public blockchains like Ethereum or Bitcoin are open fields—everyone is welcome. Permissioned blockchains, on the other hand, are more like a private conference room. Perfect for scenarios needing tighter reins and clear accountability, like interbank settlements or patient record sharing (CFTE).

Core Features That Set the Tone

- Access Control: Only approved participants can join the party. Organizations often hand out digital certificates, not unlike giving someone a backstage pass.

- Known Players: No masks, no aliases—everyone’s identity is clear, making coordination and compliance a whole lot easier.

- Central Oversight: There’s usually an orchestrator or governing group calling the shots, unlike public chains where consensus is democratic, for better or worse.

- Custom Rules: Each user can have a different role—maybe Alice can view and edit, while Bob can only peek.

Permissioned vs. Public: Apples to Oranges (But Both Are Fruit)

Let’s put it plainly—comparing permissioned and public blockchains is like comparing a members-only golf club to the city park. Both have grass, sure, but the rules (and crowd) are worlds apart.

- Openness: Public chains = anyone can read/write. Permissioned chains = you need the invite.

- Decentralization: Permissioned blockchains aren’t fully decentralized. They spread out responsibility but keep it among familiar faces.

- Speed: Less traffic, faster lanes. Transactions can be quicker when not everyone in the world is trying to play along.

- Privacy and Compliance: Rules can be made to fit regulations (hello, GDPR!), giving enterprises a fighting chance at legal compliance.

Leading Examples: Not Just Theory

Enough with the generalities. Let’s talk shop—who’s actually using permissioned blockchains?

- Hyperledger Fabric: An IBM-led project, it’s the darling of the enterprise space. Banks, supply chains, and even airlines use it to share data safely and efficiently.

- R3 Corda: Geared towards financial institutions, it handles everything from complex trades to insurance claims.

- Quorum: JPMorgan’s spin on Ethereum, but with the velvet rope. Aimed at internal business settings.

- Ripple: It’s the backbone for speedy, cross-border payments between accredited financial players.

Each of these projects is a testing ground for what happens when you take blockchain and add guardrails. Not everyone gets to play, but everyone who does is accountable.

Real-World Use Cases: Less Hype, More Utility

- Finance: Think cross-border transfers with Ripple—money zips from one country to the next, but only between licensed banks. Fraud risk plummets, efficiency soars.

- Healthcare: Patient records zipping from hospital A to clinic B without nurses fretting over leaks or hacks. Access is on a need-to-know basis, tracked and auditable.

- Supply Chains: Track a crate of avocados from Peruvian farm to supermarket shelf. Retailers, shippers, and regulators all chip in, but your neighbor can’t just snoop on the ledger.

And here’s something to keep in mind: hardware wallet users (yeah, folks with Trezor or Ledger) rarely interact with permissioned blockchains. Instead, these wallets keep your crypto keys on lock for public blockchains. Permissioned networks are for organizations—think company accounts, not private ones.

The Bumps In the Road

Now, not everything’s peachy keen. Permissioned blockchains can get clunky as you need central administrators and trusted setups. That control is reassuring but also means no absolute decentralization, which can feel like heresy to blockchain purists. The ‘who watches the watchers?’ question pops up regularly—plus, there’s always the risk of bottlenecks or single points of failure if someone in the central group slips up (Kaleido).

So, Who Really Needs Permissioned Blockchains?

It’s a fair question to ask, especially with the constant chatter about public blockchains revolutionizing finance or art (hello NFTs!). But permissioned chains fill a crucial gap—businesses and institutions that need trust, speed, and privacy without broadcasting their moves worldwide. They’re not for personal crypto wallets, but for behind-the-scenes collaborations: banks, hospitals, logistics—places where a little privacy and a lot of responsibility go a long way.

It’s a bit like the difference between a family dinner and a public picnic. Sometimes, you want control over the guest list. Sometimes, you need to know exactly who brought dessert. That’s the world of permissioned blockchains—less “everyone’s invited,” more “please RSVP.”