If you’ve ever felt impatient waiting for a crypto transfer to settle, or flinched at watching transaction fees nibble away at your Bitcoin, you’re not alone. The world of crypto is full of flash and buzz, but sometimes the most interesting things happen in the quiet corners—like off-chain transactions.

What Even Is an Off-Chain Transaction?

Let’s break it down, minus the jargon. An off-chain transaction is any transfer of value or data that happens outside the actual blockchain. That means, rather than waiting for miners to grind through confirmations or watching gas fees spike during some hot NFT drop, the transfer is handled off the main ledger and, often, settled instantly. Only later, maybe much later, does it get reported back to the blockchain (if at all). Think of it as swapping IOUs—with rules and infrastructure, of course—rather than hauling cash around in plain sight.

The Whys and Hows: Are Off-Chain Transfers Really That Special?

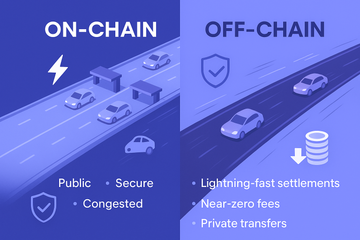

Honestly, yes. Why? Because they speed things up. Picture rush hour on a city freeway; on-chain transfers are like every car forced to crawl along the same route, while off-chain transactions let you hop on a shortcut through a side street. No traffic, no toll booths. The key perks?

- Lightning-Fast Settlements: Without the drag of on-chain validation, payments can zap through in a heartbeat.

- Near-Zero Fees: Since you’re not competing for limited block space or paying miners, the costs often drop to next to nothing.

- Privacy Upgrades: Off-chain transfers are, by design, much less visible. No one’s peering over your metaphorical shoulder here.

But, let me explain—this isn’t just smoke and mirrors. There’s real tech under the hood.

So How Do Off-Chain Transactions Actually Work?

This is where things get clever. There are a few main flavors:

- Layer-2 Solutions: Think of the Bitcoin Lightning Network or Ethereum’s rollup chains. These are like special express lanes layered above the main road, handling dozens or hundreds of little payments out of sight, before bundling the result onto the main ledger later.

- Payment Channels: Got two people who transact all the time? Open a direct channel (think: a bar tab between friends), make as many off-chain exchanges as you like, and only settle the final tally to the blockchain when you’re done.

- Custodial Exchanges: The likes of Binance, or even PayPal’s crypto wing, keep everyone’s coins in big communal wallets, updating the balance sheet off-chain. It’s fast, but you’ve got to trust the middleman—much like leaving your wallet in someone else’s safe.

- Decentralized Escrows/Multi-Signature Wallets: For the more careful crowd, services (and even some DEXs) let groups sign off on transfers together, keeping things secure while dodging hefty on-chain fees.

But Wait, Are There Downsides?

You know what? Of course there are. The promise of instant, nearly free transfers is tempting, yet off-chain systems usually demand a little trust. With custodial services, you’re betting that the exchange won’t go bust or play funny with your funds. Even payment channels like Lightning need folks at both ends to act fairly, or at least predictably. Sometimes the need for trust feels a bit old-school—doesn’t crypto exist to get rid of the middleman?

Then there’s complexity. Opening and closing payment channels can feel like a hassle for beginners, and more technical solutions (like zk-rollups) are, let’s face it, nowhere near as easy as just sending ETH between wallets. Still, for regular users, off-chain is often invisible, humming along in the background and saving you time and money.

On-Chain vs. Off-Chain: A Quick Showdown

Let’s run a quick comparison, because this often stumps even seasoned crypto fans:

- Transparency: On-chain is public and permanent. Off-chain? Shadier in a good way—more private, less noise.

- Speed: On-chain’s a snail when fees are high or networks are busy. Off-chain’s your hare, darting ahead.

- Security: On-chain wins for trustlessness. Off-chain? Well, caveat emptor—trust the platform or channel, at least for a little while.

- Fees: Off-chain takes the prize here, especially when the network’s congested.

Want a real analogy? On-chain is like a notary stamping every transaction for the public record. Off-chain’s more like you and your friend swapping lunch money under the cafeteria table—no witnesses needed, unless there’s a dispute.

Where Do Trezor and Ledger Hardware Wallets Fit In?

Now, you might be wondering, “What about my beloved Trezor or Ledger wallet?” Good question! Hardware wallets, like those from Trezor or Ledger, excel at storing your crypto and securely signing transactions before they ever reach the blockchain. They’re your digital safe in this wild west. But here’s the nuance: off-chain transactions, by definition, happen outside the main chain and are often managed through software or in-app accounts—so your hardware wallet isn’t usually involved until it’s time to finalize or settle a transaction on-chain. When you finally close a payment channel or withdraw from an exchange, that’s when your hardware wallet steps in, signing off and ensuring security for the part the blockchain will remember forever.

Real-World Uses: Not Just Theory

Off-chain moves aren’t only for crypto geeks or high-speed traders. Everyday folks meet these in peer-to-peer payments through exchanges, or in microtransactions for content (yes, pay-by-the-article is still a thing). Emerging economies also lean on speedy off-chain swaps where slow networks would get in the way, especially for cross-border remittance. And let’s not ignore gaming: think NFTs and upgrades whizzing between players so fast you’ll hardly notice.

What’s New and Trending?

Fresh out of the digital oven, several advances are reshaping off-chain life. Layer-2 networks are getting easier to use, with platforms like the Lightning Network ramping up both speed and reliability for Bitcoin. Ethereum’s scaling boom means cheaper rollups and zippy swaps. Exchanges keep refining custodial solutions, cutting wait times and beefing up consumer protections. There’s even buzz around hybrid wallets that let you flip between on-chain and off-chain, unlocking more flexibility than ever.

Wrapping Up: Should You Care?

You know what? Even if you’re not mining your fortune or coding smart contracts, if you do anything with crypto, off-chain quietly smooths the ride. Your transfers are faster, your fees are lighter, and your wallet—whether it’s Trezor, Ledger, or that old phone app—is a little easier to use. Sure, there are risks, but the blend of speed, cheapness, and sometimes surprising privacy makes off-chain worth understanding. No fireworks, just the smart shortcut that keeps crypto running in the background, right where it belongs.