If you ask crypto folks where they try new coins first, KuCoin often pops up. It has a reputation for early listings, deep markets, and plenty of trading toys, yet it still feels quite approachable. The interface is clean, the order books move fast, and the fees are low. KuCoin is not perfect, and critics bring up past security drama and regional limits, but the exchange keeps shipping features, and that momentum shows. If you want an exchange that rewards curiosity and supports solid risk controls, KuCoin deserves a look.

Why KuCoin gets traction

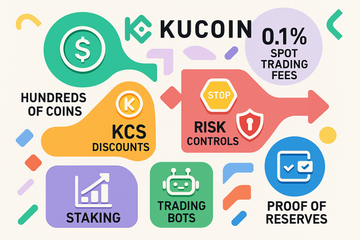

Here is the short version. KuCoin lists hundreds of assets, from blue chips like BTC and ETH to small caps that just started trending on Crypto Twitter. Spot, margin, and futures trading are all there. Fees on basic spot tiers sit at 0.1 percent, and holders of the KCS token get discounts that bring it lower. Liquidity on major pairs is solid, and the matching engine feels quick, even during busy hours.

Beyond trading, KuCoin runs a broad menu of features. KuCoin Earn covers staking, savings, and promotions with fixed or flexible terms. There is a built in trading bot for grid, DCA, and smart rebalancing, handy for folks who like rules based strategies. A P2P market connects buyers and sellers of USDT with local payment methods. Fiat gateways let you buy coins with cards or bank transfers, depending on your region. You can also use Convert for one click swaps when you do not want to post an order.

Security deserves more than a headline. KuCoin suffered a hot wallet breach in 2020, and the team covered user losses through insurance, recovery, and treasury funds. Since then, the exchange has leaned on cold storage, address whitelists, and a dedicated trading password as extra friction. Standard tools like 2FA, device management, and anti phishing codes are there as well. KuCoin also publishes a proof of reserves page with Merkle tree data to show reported balances. It is not a cure all, but it gives you a reference point when you assess counterparty risk.

Regulation is a moving target, so check your local rules. KuCoin made identity verification a core requirement for new users in 2023, and limits apply to accounts that skip it. Some countries restrict access altogether. In the United States, KuCoin faces legal pressure, and services can be limited. None of this means you cannot trade, it just means you should know which features are allowed where you live.

How it feels to trade

So, how does it feel once you are inside the terminal. The spot interface is tidy, with TradingView charts, a depth chart, and toggles for market, limit, and stop orders. Futures comes in two flavors, Lite for beginners and Pro for heavy users. The app mirrors the web layout, and navigation is simple. Order execution has been stable in my experience, even when bids and asks are flying.

The KCS token plays a practical role. Holding KCS can lower trading fees, and larger balances help you climb VIP tiers with better maker and taker rates. There are also occasional campaigns that pay extra rewards to KCS users in Earn or promotions. If you trade a lot, those small cuts add up over a busy month.

Risk and custody

Let me explain why risk tooling matters here. KuCoin supports stop loss and take profit triggers, cross and isolated margin, and clear funding rate displays on futures. You can see liquidation prices before you submit. The portfolio page shows unrealized PnL and a heat map of holdings, so you can spot concentration. None of this replaces plan and discipline, but it nudges you in the right direction.

Here is the thing that seasoned traders repeat. Keep trading funds on the exchange, keep savings in cold storage. KuCoin is a trading venue, not your forever vault. For long term coins, move them to a hardware wallet like Ledger or Trezor, then whitelist those addresses on your account. Back up your seed phrase, store it safe, and test a small send before larger transfers. It feels slow the first time, but that habit pays for itself.

No platform suits everyone, and KuCoin has tradeoffs. Fast listings bring opportunity, but they also bring volatile coins that can crash without warning. Liquidity on minor pairs can thin out during stress. Regional rules may limit features, and KYC steps take time for some users. Customer support has improved, though tickets still queue during rush hours. If you use the P2P market, follow guidance from the help center, and only release funds after payments clear.

So who actually benefits here. Newer traders get a gentle on ramp with Convert, Lite futures, and simple Earn products. Intermediate users appreciate the range of order types, the bot library, and fee tiers that reward volume. Advanced traders get depth on majors, strong API support, and enough pairs to run quant ideas across sectors. If you like choice, you will probably feel at home.

Tips for smoother trading

A few simple habits can make KuCoin feel even smoother.

- Enable 2FA, set a trading password, and turn on withdrawal whitelists for your main addresses.

- Use Reduce Only on futures when you scale out, so you do not flip your position by accident.

- Keep a small USDT buffer for fees and sudden entries, it reduces friction during fast moves.

- When testing a new pair, start with a tiny order to gauge slippage and spread.

- Track funding rates and open interest if you trade futures, they hint at crowd mood.

- Set price alerts on the app, then step away and let alerts call you back.

Fees in plain language

Fees are simple, and they matter more than people admit. Spot fees start at 0.1 percent each side. Futures maker and taker fees are lower at entry level, which helps scalpers. Holding KCS can shave a bit more, and higher tiers reduce costs as your 30 day volume grows. Withdrawal fees depend on the network you choose, so check the table before you send. Tiny changes here can add up over time.

Bottom line

KuCoin blends range, speed, and tools in a way that suits curious traders. It gives you early access to many narratives, yet it still feels stable during routine sessions. Security has sharpened since 2020, and the focus on proof of reserves is a step toward better transparency. Compliance is still evolving across regions, so keep a careful eye on your own rules. Build a plan, keep detailed records, and move profits to cold storage. You want staying power, not just a lucky streak.