Kraken has been part of crypto for so long that some traders treat it like a familiar coffee shop. You know where things are. You know who to ask when you get stuck. And most days, it just works. But what makes a veteran exchange still feel relevant when the market moves fast and loud? Let’s walk through the real stuff, the kind you actually use, from fees and funding to security and staking.

What Kraken is, and why that matters

Kraken is a global crypto exchange founded in 2011 that serves retail traders, active pros, and institutions. It offers spot markets, margin for eligible regions, and futures for non‑US clients. There is a simple app for quick buys and a Kraken Pro interface for active trading. It’s a bit like having a commuter bike and a racing bike in the same garage. Grab the one that fits your day.

Stability is part of the brand. So is a long memory of what can go wrong in crypto. That culture shows up in its security stack and a habit of publishing proof of reserves. More on that in a minute.

Fees without the fuzz

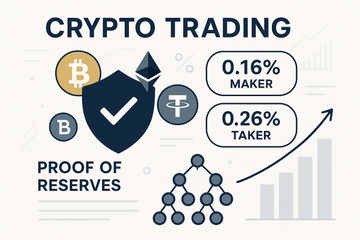

Here’s the thing. Fees shape behavior. If you are cost sensitive, use Kraken Pro. The maker and taker schedule starts at 0.16% maker and 0.26% taker at the lowest volume tier, with discounts as your 30‑day volume grows. The Pro book has deeper liquidity and tighter spreads on majors, so your total cost often lands lower than it looks at first glance.

The regular buy flow is convenient but pricier. It charges a simple percentage on each purchase, and card payments add processing costs. Bank transfers tend to be cheaper. For frequent traders, Pro usually wins. For a quick small purchase, the simple flow feels fine, especially if you are time‑pressed.

Order types and the day‑to‑day experience

On Pro, you get limit, market, stop loss, take profit, and conditional orders, plus post‑only and reduce‑only toggles. Charts are robust, with TradingView tools, drawing and indicators. The mobile Pro app mirrors the desktop experience well enough that active traders can actually work from a phone without hating it.

API access is available for quants and builders. Key permissions let you separate read‑only, trading, and funding, which is how it should be. There is a learnable rhythm here. Once you set hotkeys and templates, placing safer entries and exits gets pleasantly boring, which is a compliment in trading.

Staking, rewards, and the US wrinkle

Kraken offers staking on select assets in many regions. Rewards vary by network and change with conditions, so always check the current rate in the app. If you are in the United States, you likely remember the 2023 settlement that halted Kraken’s staking service for US clients. Outside the US, staking still exists for supported assets, with regular payouts and clear unbonding rules.

Is staking worth it? Sometimes. If you hold long term and the protocol rewards are steady, it can add a useful trickle. If you need fast liquidity or you are trading around events, plain holding might be simpler. You know what? A small, boring strategy you actually follow usually beats a fancy one you abandon.

Security culture, not just security features

Kraken’s security stack reads like a checklist built by people who have seen things. Cold storage for the majority of funds. Strict internal controls. PGP‑signed emails. And client tools that save you from your future self.

- 2FA the right way: Use an authenticator app or a hardware key with WebAuthn support. Avoid SMS.

- Withdrawal whitelists: Lock down addresses so a slip or a phish does not drain funds.

- Global Settings Lock: Freeze critical settings for a set time. If something changes when you did not touch it, you have a window to react.

- Hardware wallets: Store long‑term holdings on a Ledger or Trezor, then move funds to Kraken only when you plan to trade. That one habit changes everything.

One more detail for Bitcoin users. Kraken supports the Lightning Network for fast, low‑fee BTC transfers. It is ideal for smaller amounts or quick repositioning between wallets.

Proof of reserves you can actually check

Trust is nice. Verify is better. Kraken publishes proof of reserves using a Merkle‑tree model that lets you confirm your balances were included at the time of the attestation. Inside your account you can pull a record ID, then verify inclusion without exposing your identity. Independent attestations add an extra layer, and the math gives you something more solid than a press release.

Does proof of reserves solve everything? Not quite. It shows assets at a snapshot and provides cryptographic comfort that your balances were counted. It does not cover liabilities that are off the books or future risk. Still, it is a strong signal when combined with long operating history and conservative treasury practices.

Funding, withdrawals, and small frictions

Bank transfers are the workhorse. In Europe, SEPA transfers are popular. In the US, domestic wires and ACH are common. In other regions it may be SWIFT. Fees depend on your bank and location, and deposit times vary from minutes to a couple of business days.

Card purchases are convenient but cost more. For larger amounts, plan a bank transfer. For quick trades, fund a bit in advance so you do not buy at the worst possible moment while a deposit waits in limbo.

Withdrawals are straightforward. Set a whitelist and cool‑down period. Split amounts if you are moving a lot. And if funds are leaving the exchange for long‑term storage, point them to your Ledger or Trezor and sleep better.

Futures, margin, and rules by region

Kraken offers margin on select pairs for eligible clients, and a separate futures venue for non‑US traders. Leverage can reach high numbers, but practical risk limits and position protections are in place. That gives experienced traders room to express a view, while still nudging you to think about liquidation price and maintenance margin. Leverage magnifies wins, and it magnifies mistakes. Let me explain. If you would not hold the position unlevered, you likely should not hold it levered.

Customer support and the human layer

Crypto traders remember support interactions. Good or bad, they stick. Kraken’s help center is solid, and live chat tends to be responsive during peak hours. Identity verification is usually quick, but the first time you push through larger funding limits, expect extra checks. It is mildly annoying and entirely sensible.

Recent headlines and how to read them

Big platforms live under a spotlight. Kraken has had its share of regulatory actions and public security conversations. US staking ended after a 2023 settlement. In 2024 a bug bounty dispute made noise across social media, which highlighted how messy disclosure can get when money is at stake. The takeaway for most users is simple. Use the platform for what it does well. Use hardware wallets for savings. And keep a calm filter for headlines, good or bad.

Who actually benefits from Kraken

Newer crypto users

The standard app is clean. KYC is straightforward. Small recurring buys are easy to set up. If you want to learn price action, graduate to Pro when you feel ready.

Active traders

Kraken Pro has the essentials. Deep books on majors, fast order entry, volume‑tiered fees, and APIs that do not fight you. It is not flashy, which is exactly the point.

Institutions and high‑volume desks

Expect account management, OTC services, and predictable settlement. The brand’s age and controls can ease internal approvals, which matters when compliance folks raise an eyebrow.

Pros and a few tradeoffs

- Strengths: Long track record. Transparent proof of reserves. Kraken Pro fees that start at 0.16% maker and 0.26% taker. Solid security features. Lightning support for BTC. Good EUR liquidity.

- Tradeoffs: Retail buy fees are higher than Pro. Some features restricted by region. Futures not available to US clients. Verification or funding checks can slow you down at the worst possible time, although that is part of staying safe.

A quick note on taxes and tracking

When tax season rolls around, clean records feel like a gift from your past self. Kraken exports statements and connects with portfolio tools like Koinly or CoinTracker. Reconcile early, especially if you stake outside the US or trade futures abroad. Waiting until midnight on deadline day is a uniquely painful sport.

Practical setup that just works

Small checklist, big impact:

- Create a separate email for the account. Add a hardware security key. Turn on 2FA.

- Enable withdrawal whitelists and a cool‑down.

- Keep long‑term funds on a Ledger or Trezor. Fund Kraken only when you plan to act.

- Favor Kraken Pro for trading to keep fees low.

- Test Lightning with a small BTC transfer so you know the flow before you need speed.

Final thought

Kraken’s appeal is simple. It treats trading like a craft, not a circus. Prices change, narratives swing, and new platforms pop up with shiny promises. A steady venue with clear fees, strong security, and tools that respect your time is not boring. It is useful. If you pair it with a hardware wallet, a whitelist, and a realistic plan, you will probably feel calmer in a market that rarely sits still. And calmer usually trades better.