You hear the term hash rate tossed around a lot if you’re dipping your toes into crypto. Whether you’re browsing Reddit forums, chatting with mining pals, or considering your first Trezor or Ledger wallet, people love to talk about how vital hash rate is. But what does it really mean? Why do so many seasoned old-timers—and not just the whitepaper readers—get passionate about hash rate?

Hash rate, explained like you’re grabbing coffee with a friend

Let’s make it simple. A hash rate just measures how much computational muscle a crypto network flexes per second. Think of it as the number of guesses or attempts a computer (or an entire network of computers) makes every second to solve these mind-bending puzzles that secure your favorite coins—whether that’s Bitcoin, Ethereum, or something more niche. The higher the hash rate, the more horsepower under the hood. It’s kind of like measuring engine size, but for decentralized ledgers.

Crypto mining involves throwing out trillions—yeah, with a T—of random guesses to solve complex math. Picture a massive lottery where the winner gets to record transactions and snag some fresh coins. Hash rate is how many lottery tickets you’re generating per second. Back in the early days of Bitcoin, a laptop could compete. Now, entire warehouses of specialized machines fight for just a sliver of the action.

From kilohashes to exahashes: Numbers that melt your brain

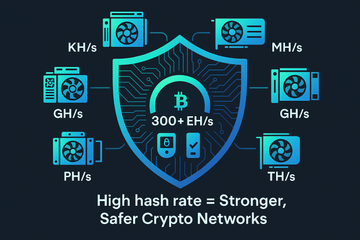

Here’s where things get a bit technical. Hash rate is measured in units that climb faster than a price chart in a bull run:

- Kilohash (KH/s) – A thousand hashes per second (pretty much obsolete now)

- Megahash (MH/s) – A million guesses per second (common for small miners)

- Gigahash (GH/s) – A billion hashes (entry level for many mining rigs)

- Terahash (TH/s) – A trillion, now the basic building block for Bitcoin miners

- Petahash (PH/s) – A quadrillion (yep, that’s a thing!)

- Exahash (EH/s) – A quintillion; the largest networks like Bitcoin dance in this league

Today, the Bitcoin network clocks in at well over 300 exahashes per second. Sure, that number looks like someone’s phone number, but it makes Bitcoin one of the most secure digital fortresses on the planet.

Okay, but why should you care about hash rate?

Here’s the thing: hash rate isn’t just another vanity metric. It’s at the very heart of crypto security. When the hash rate is high, it means more miners are working to validate transactions and create new blocks. That also means it becomes nearly impossible—no joke—for malicious players to pull off a so-called “51% attack.” They’d need to control more than half the computational firepower, which, in giant networks like Bitcoin, is as likely as winning the lottery multiple times in a row.

Hash rate also nudges mining difficulty up and down. Imagine a traffic light that changes to keep things flowing smoothly. If more miners show up, the network cranks up the challenge so blocks don’t get solved too quickly. If miners bail, it eases up. This automatic balancing act keeps everything fair and predictable—at least as predictable as crypto ever gets.

Wait, does hash rate mess with your transactions?

Not directly. But here’s where it gets interesting: when hash rate is healthy, transactions sail through quickly and the network resists congestion. If there’s a sudden drop—maybe an energy crisis or regulatory hiccups—block times might slow, and fees can spike.

What about your trusty Trezor or Ledger wallet?

Now, let’s connect the dots between hash rate and your favorite cold storage gadgets. Fun fact—while hash rate shapes network security, devices like Trezor and Ledger protect your individual slice of the pie, not the whole bakery. They don’t contribute to the global hash rate; instead, they keep your keys offline, way out of reach from hackers and digital pickpockets.

But, a robust hash rate means your coins stored in a Trezor or Ledger are less likely to be at risk from network-level attacks. So, while you might not be spinning up ASIC miners in your garage, a strong global hash rate still has your back—kind of like having a lock on your door and armed guards patrolling the street.

Mining hardware: The unsung heroes (and electricity hogs)

Let me paint you a quick picture. Picture an Antminer S21 XP+ breezing through 500 terahashes per second. Or a powerhouse graphics card like the RTX 4090 hitting 115 megahashes. These are the physical workhorses that drive up the total hash rate and rake in block rewards. They’re noisy, hot, and suck down energy like a milkshake on a summer day—but they keep proof-of-work networks running smoothly.

Meanwhile, if you’re just holding crypto or moving coins between your Trezor or Ledger, you don’t need to worry about hash rates slowing you down. If anything, it’s a useful mental metric: high hash rate usually means stable, healthy networks (and less drama on Twitter).

Trends, troubles, and tea leaves

Hash rate isn’t static. Crypto price swings, energy prices, and government regulations send it bouncing all over the place. In bull markets, hash rate spikes as miners pile in hungry for profits. If prices crater, less-efficient miners switch off, and hash rate drops. It’s a constant push-and-pull, a dance of supply and demand, faith and fear.

Honestly, if you find yourself glued to hash rate charts, you’re not alone! For some, it’s a barometer of network health. For others, it’s a speculative signal—will a sudden jump mean a big move in price? Sometimes yes, sometimes it’s just noise. But whether you’re mining with purpose-built machines or just HODLing, understanding hash rate gives you a window into how secure and active these networks are.

Quick takeaways for the wise and the curious

- Hash rate = the network’s muscle. Higher is stronger, safer, and more robust.

- It’s measured in hashes per second, and the numbers are huge—like, planet-sized huge.

- More hash rate means safer coins for everyone, even if you’re just chillin’ with your Trezor or Ledger.

- Mining hardware sets the pace, but wallets keep your stash protected on a personal level.

Honestly, whether you’re mining for profit, stacking sats on your cold wallet, or just spectating from the sidelines, hash rate is a number worth understanding. It’s the heartbeat of the crypto world—and now, next time someone brings it up at a meetup, you’ll have more to say than just nodding along. Pretty neat, right?