If you've spent any time in the wild world of cryptocurrency, you've probably stumbled across the term 'fork.' Maybe it was tossed out in a discussion about Bitcoin, or perhaps you heard Trezor or Ledger wallet support mention it during a particularly fraught upgrade window. But, honestly, what is a fork, and why do folks treat it like a make-or-break moment for a blockchain? Let's break it down in everyday terms and see why these splits have everyone from hobbyists to hardware wallet companies on their toes.

Wait, Did You Say Fork? Like, Actually Splitting?

Yep, exactly. Imagine your favorite recipe passed down through generations. One day, your cousin decides it's time for a twist—add a pinch of this, swap out that. Suddenly, there are two versions of the same dish roaming the family table. In blockchain, a fork is much the same: developers make a change to the core software, and bam, you've got two different sets of rules, both still recognizable but not always compatible.

Hard Forks vs. Soft Forks—Not All Splits Are Created Equal

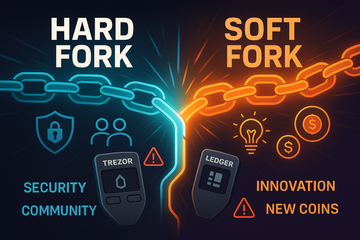

Let me explain. Not every fork flips the whole crypto ecosystem upside down. There are two main types:

- Soft fork: Think of this as a subtle tweak. It's backward-compatible, so most of the network just rolls with it. If you stick with the 'old recipe,' you can still enjoy the meal.

- Hard fork: This one's more like swapping salt for sugar in a savory dish. Totally different flavor. It splits the network in two, and after that, they aren't talking to each other. Holders on the original chain just can't use the new version unless they upgrade—it's a clean break, no looking back.

Some famous hard forks? Well, you can't miss the Bitcoin Cash split from Bitcoin or Ethereum’s fork following the DAO hack. These events weren’t just technical; they were soap operas, with drama, strong opinions, and lasting effects you still feel in the market.

Why on Earth Would Anyone Fork a Blockchain?

That’s a fair question. Sometimes, a fork is a battle of philosophies. One side wants bigger blocks and lower fees, the other argues for security and decentralization. Or maybe there’s a bug that simply can’t be solved from within the old box. In other cases, it’s about reclaiming stolen funds or adding snazzy new features.

Let’s not pretend it’s always amicable. Occasionally, a fork is more like a messy breakup. Disagreements over leadership, direction, or even politics can cause schisms that split developer teams and, by extension, the entire community.

What Does All This Mean for Crypto Owners?

Okay, you might be thinking, 'This sounds important, but I just want my coins safe.' And you’d be right to worry about that! Every time there’s a major fork, there’s confusion—sometimes coins are duplicated on both chains, leading to unexpected windfalls or, occasionally, loss if you’re not careful.

Wallets play a huge role here. Companies like Trezor and Ledger have to scramble during fork events. Not only do they have to make sure their devices support both chains (if they’re both sticking around), but they also have to warn users. If you send your Bitcoin Cash to an old Bitcoin address, for instance, it could be as good as gone. These wallet companies release urgent updates, FAQ guides, and flood social media with do's and don’ts every time a major fork comes around. If you follow them on Twitter, you've probably sensed the tension when a big split is on the horizon.

It’s Not All Drama—Sometimes, Forks Fuel Innovation

You know what? Not every fork spells disaster. Sometimes it kicks off fresh ideas. The Ethereum/Ethereum Classic split, while rocky, led both projects to chart different courses. One pursued DeFi and NFTs with full speed, the other doubled down on immutability. Even small, obscure coins get their start through forks—sometimes just because a creator wants to see if a new tweak makes the ecosystem better or more fun.

How Do You Know if a Fork’s Coming?

Here's the secret: you usually hear about it. Developers, exchanges, wallet providers like Trezor or Ledger, and even Reddit threads get noisy the closer a fork approaches. Software upgrades, activation dates, the technical nitty-gritty—they all come pouring out. Crypto communities are passionate, and news travels fast. But you still have to keep your ears open if you want to navigate safely.

Miss an upgrade or ignore wallet warnings, and you could end up unable to access your coins on the new chain, or worse, lose them trying to move funds at the wrong time. It's a bit like an airline switching terminals and not telling you—your ticket still works, but only if you’re boarding at the right gate.

Keeps Crypto Exciting, Doesn’t It?

Let’s pull back a little. Forks might sound like troublemakers, but they’re part of what makes blockchain technology so alive. If you’ve ever wished banking was less stuffy, less rigid, and more responsive to people’s needs, this is one way crypto delivers on that promise: change is possible. New rules, fresh starts, wild experiments—they all come through forks.

Still, it’s worth tracking the news, especially if you’re holding significant amounts in a hardware wallet or trading on exchanges. Watch how Trezor or Ledger communicate; they can be your lifeline, offering support and step-by-step guides whenever things get twisty. And remember, the next big fork could be just around the corner—will it unlock new opportunities, or send you scrambling for backup keys? Only time will tell.

Quick Recap: Forks in a Nutshell

- Forks are updates or changes that split a blockchain’s rules.

- Hard forks create new blockchains; soft forks tweak the old one and are backward-compatible.

- They happen because of technical issues, philosophy clashes, bugs, or just pure necessity.

- Major forks impact wallets like Trezor and Ledger, sometimes duplicating coins or changing how they’re managed.

- Stay in the know when holding crypto, since fork missteps can cost you dearly or double your luck.

And there you have it. Forks—a little chaotic, a little thrilling, always full of surprises. Welcome to crypto, where even the rules can split and grow!