Let’s be honest: when people first heard about Bitcoin and the wave of coins that followed, the picture was a bunch of walled gardens—each blockchain with its own logic, rules, and, frankly, its own little quirks and stubbornness. If you’ve ever tried to move assets from Ethereum to another chain, you know the headache. But then, a new player began shaking things up—cross-chain technology.

Wait, What Exactly Is Cross-Chain?

Picture a group of islands, each with its own language and currency. Now imagine you’re vacationing. Wouldn’t it be helpful if there was a universal translator and an ATM that spat out whatever you needed, wherever you landed? That’s what cross-chain does for blockchains. Cross-chain technology lets one blockchain talk to another directly, sharing data or assets without needing a centralized middleman. It’s like blockchain Esperanto, only way more valuable.

Why Should Anyone Even Care?

You might wonder, 'Isn't crypto already sort of open and borderless?' Well, not quite. Each blockchain is a silo, and historically, sending Bitcoin to Ethereum was like mailing a letter to Mars. Cross-chain changes that. Here’s why it matters:

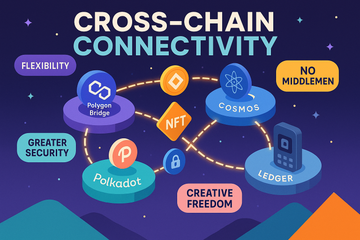

- Flexibility for Users: Move assets where you want, when you want. Suddenly, your tokens aren’t trapped.

- No Middlemen: No need to trust a random exchange or custodian. You're back in the driver's seat.

- More Creativity: Developers can build apps that reach across multiple blockchains, making everything richer and more interconnected.

- Greater Security: With the right protocols, cross-chain doesn’t mean opening new holes. Robust bridges and validation keep assets safe.

Is This Magic? Not Quite—Here’s How It Works

Let me explain, but we’ll keep it simple. At the core, cross-chain solutions are like secure bridges. Picture tiny little ferries running back and forth between two islands. They use things like smart contracts and cryptographic signatures to safely shuttle tokens or information.

Some popular examples include:

- Atomic Swaps: These swap tokens directly between users on different blockchains, all without an exchange.

- Wrapped Tokens: Like wrapped BTC on Ethereum—a representation of BTC you can use in Ethereum’s universe.

- Bridges: Projects like Polygon Bridge, Wormhole, and Synapse let users move assets between blockchains easily.

- Interoperability Networks: Polkadot and Cosmos create frameworks where blockchains can plug in and share info more freely.

Where Are You Seeing This in Action?

Let’s get practical for a second. Real-world cross-chain examples actually matter! Without them, it’s just a pipe dream. Here’s where people are already using it:

- DeFi Aggregators: Platforms like 1inch and Celer Network let people swap tokens across many chains, often hunting for the best rates.

- NFT Marketplaces: Tools like OpenSea have started supporting multiple blockchains, meaning you can buy or sell NFTs not just on Ethereum, but now also on Polygon, Solana, and more.

- Bridges for Game Assets: Some blockchain games let you trade or transfer in-game items across ecosystems using cross-chain protocols.

It’s not just a fad—nearly every crypto conference buzzes about the next cross-chain breakthrough.

Now, Let’s Talk Challenges—Because There’s Always a Catch

Honestly, it wouldn’t be crypto if there weren’t speed bumps. Cross-chain is powerful, yes. Perfect? Not so much. Here are a few weak spots:

- Security Risks: Some bridges have been hacked, with millions lost (the Wormhole incident comes to mind). If you cross a rickety bridge, things might get shaky.

- Complexity: The more moving parts, the higher the chance something goes wrong. Sometimes, using a bridge can feel like defusing a bomb—one wrong move and poof, assets gone.

- Speed and Fees: More steps often mean slower transactions and higher costs, especially during busy network times.

You want to trust your assets are safe, but it pays to read the fine print and pay attention to audits or security guarantees.

What About Hardware Wallets? (Because Safety Freaks Are Welcome Here)

If you’re serious about crypto, you’ve heard the gospel: Not your keys, not your coins. That’s where cool gadgets come in—the Trezor and Ledger devices. These keep your private keys safe from prying eyes.

Now, crossing chains raises a question: can hardware wallets keep up? Good news—they’re catching on. Ledger, for instance, continually adds support for new blockchains and bridges. Trezor isn’t far behind, especially as protocols like Cosmos and Polkadot get more popular in cross-chain space. The more chains these wallets understand, the safer cross-chain transactions become. You keep control, even as you move assets between worlds.

Is There a Catch Using Hardware Wallets With Cross-Chain?

Well, there’s always a little friction at first. Sometimes the wallet firmware needs updating, or a third-party bridge app won’t work out-of-the-box. Still, the trend is positive: cross-chain tools and hardware wallets want to work together. And frankly? If you like sleeping easy, don’t skip the extra security step.

Where’s It All Heading?

The future’s looking more connected by the day. We’re moving towards a world where you can hop chains as easily as you send an email. Cross-chain isn’t just a techie obsession—it’s about freedom, creativity, and, maybe most of all, real ownership. Projects like Polkadot and Cosmos may sound futuristic, but they’re pulling this vision into the present.

Will it be perfect overnight? Not a chance. But that’s kind of how progress works, isn’t it? Little by little, beachhead by beachhead, the islands are becoming a vibrant, bustling archipelago—and this time, everyone can visit. Just remember to keep your Trezor or Ledger close. Adventure’s more fun when your treasure is safe.