Coinbase is the exchange people mention when a friend asks, where do I start. It is big, highly regulated, and fairly friendly, which matters when prices swing on a random Saturday night. The company sits in a unique spot. It runs a major exchange for retail traders, provides custody for institutions, and even ships Base, a low cost Layer 2 network that keeps on-chain fees gentle. That is a lot of roles for one brand, and yes, it can be both convenient and confusing at the same time.

So, what does Coinbase actually offer

At a glance, you get two trading paths. The simple buy and sell flow, with a clean interface and a clear quote. Then there is Advanced Trade, a full order book with maker and taker pricing, charts, and conditional orders. Moving money in and out is usually the secret sauce here. Coinbase supports bank transfers, cards in some regions, and fast rails in select markets. If you care about liquidity and fiat ramps, this is one big reason why many traders pick it for their first steps.

On the professional side, Coinbase Prime serves institutions with custody, execution, and reporting. That part matters more than you think, because the same cold storage systems behind Prime help keep retail assets safe. Large portions of customer funds sit offline. The company also maintains a crime insurance policy for hot wallet incidents. It sounds soothing, but let me explain. It does not cover individual account breaches or market losses. Good security still starts with you.

Fees without the fog

Fees on Coinbase vary by product and region. The simple buy flow often includes a spread and a fee. Advanced Trade uses a maker and taker model that gets cheaper with higher volume. Some users join Coinbase One, a subscription that reduces certain trading fees and adds support perks. None of this is a magic coupon. If you place market orders in volatile conditions, you will feel slippage. If you place limit orders and wait, you tend to pay less. A small habit shift can change your effective cost over time.

Security habits that actually hold

Coinbase gives you a good baseline. Turn on passkeys or 2FA with an authenticator app. Add an address allowlist, so withdrawals can only go to saved addresses. Set alerts for logins and withdrawals. Use a strong password that does not repeat. Boring, yes, but these steps block many common attacks. Coinbase handles a large stack of security. Still, account hygiene is personal. Your device, your email, your phone number, those are often the soft spots.

Where hardware wallets fit in

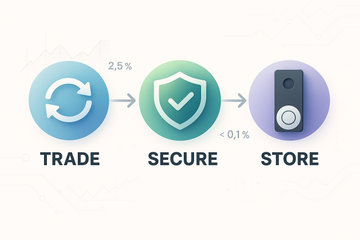

Here is the thing. Exchanges are for liquidity and speed. Cold storage is for sleeping well. If you hold long term, consider a Trezor or a Ledger. Many traders keep a trading stack on Coinbase, then sweep profits to a hardware wallet once a month. It is simple, and it keeps temptation at bay. Coinbase Wallet, the self custodial app and browser extension, can connect with Ledger for signing, which is handy for DeFi sessions. Even if you never touch DeFi, withdrawing to a hardware wallet you control adds a strong layer of calm.

Set up a withdrawal allowlist with your Trezor or Ledger address. Test with a small transfer. Label the address, and archive the note somewhere safe. People skip the test, then worry. You do not need that drama. A ten dollar rehearsal is cheap insurance.

What about Base and on chain activity

Base, built with the OP Stack, gives you fast, low cost transactions that feel smooth. If you want to send stablecoins, mint an NFT, or try a new app, fees stay friendly. Coinbase supports Base across its wallet stack, and you can bridge from Ethereum with a few clicks. Do you need it for day one trading, probably not. But as more projects launch on Base, it becomes a useful lane for experiments that would be pricey on mainnet. Keep your security brain on though. New tokens appear daily, and not all of them are kind.

Staking, rewards, and a few caveats

Coinbase offers staking and rewards in supported regions for assets like ETH and selected proof of stake coins. Rules can change by location. Some users in the United States face limits or different terms compared to other markets. Read the details. ETH staking through Coinbase is straightforward, and you can track rewards inside the app. Just remember, staking has lockups or unbonding periods. Prices can move while you wait. Rewards are not guaranteed, and they can change with network conditions.

For stablecoins, USDC sits at the center of a lot of Coinbase flows. Conversions between USD and USDC can be low friction, and many traders use USDC as a neutral holding area between moves. It is a clean way to pause without going all the way back to a bank account. That said, stablecoins are still crypto assets. Understand the issuer, the reserves, and the policy language before you grow a large balance.

Custody for bigger stacks

If you are running a fund, a DAO treasury, or a company treasury, Coinbase Custody and Prime offer separate legal entities and audited controls. You get segregated cold storage, role based approvals, and reporting that plays nice with auditors. That is not for everyone, and it comes with fees. For many institutions, the trade off is worth it. Coinbase also serves as custodian for several spot Bitcoin ETFs, which signals how institutions read its security posture. It does not make retail accounts risk free. It does suggest that the plumbing is serious.

Common myths, cleared up

- My crypto on Coinbase is insured. Not quite. The company has a crime policy for certain platform breaches. Your account level mistakes are usually not covered.

- Coinbase is the cheapest place to trade. Sometimes yes, often no. Advanced Trade helps, but spreads and slippage still matter.

- Self custody is scary. It can be, until you set it up once. Trezor or Ledger, written recovery phrase, small test sends, and a simple routine, then it becomes second nature.

A simple playbook you can stick to

- Create your account, complete KYC, and enable every security control you can.

- Fund with a method that has fair fees. Bank transfers are usually cheaper than cards.

- Learn the Advanced Trade layout, even if you still place simple market orders.

- Whitelist your hardware wallet address. Run a small withdrawal test.

- Trade with limits when you can. Keep a journal for entries and exits.

- Sweep profits to Trezor or Ledger on a set schedule. Mark your calendar.

- Track taxes early. Export CSV files or use a tool that connects to Coinbase.

Where Coinbase shines, and where it does not

Onboarding, fiat rails, security culture, and liquidity, that is where Coinbase shines. Support response times can vary, especially during busy markets. Fees can bite if you trade impulsively. Regional features may differ. These trade offs are normal in crypto, and they do not make or break the platform. They simply nudge you to build a routine that fits your goals and your nerves.

One small contradiction, then a fix

Coinbase wants to be your everything app, and yet, the best move is sometimes to use it less. Keep your trading flow there, then park savings in cold storage. It sounds like a knock. It is not. Exchanges are built for motion. Hardware wallets are built for stillness. Use each tool where it sings, and your setup gets safer and calmer, not harder.

Final thoughts

You know what, the secret is not a secret. Keep costs visible, keep security tight, and keep temptation low. Coinbase gives you a clean path to markets, with enough depth for serious trading if you grow into it. Pair it with a Trezor or Ledger for your long term stack, explore Base when fees elsewhere sting, and keep learning in small, steady steps. Markets will keep moving. Your plan can stay simple. That balance is where most people finally breathe a little easier.