If you've spent any time in the crypto markets, you've likely heard the warning: 'Don't get caught in a bull trap!' But what does that really mean, and why does this sneaky little phenomenon manage to trip up even experienced traders?

So, What Exactly Is a Bull Trap?

A bull trap happens when an asset that's been sliding downward suddenly breaks out with a strong rally, convincing traders that the worst is over — only for the price to reverse and tumble lower. Think of it like a mirage in the desert; everyone rushes toward it, believing relief is near, just to find the sand hotter and drier than ever. In markets, the pain is financial. This isn't just theory — it's a pattern that's been confirmed across stocks, forex, and, quite viciously, in the wild world of crypto. Bull traps don’t care about your optimism. They punish impulsiveness without remorse.

Has This Happened to You?

You’re keeping an eye on Bitcoin or your favorite altcoin — let’s say you notice a strong candle pushing prices above what's looked like an unbreakable ceiling. Social media is ablaze. Influencers are posting rocket emojis. Your heart rate ticks up. FOMO creeps in. You hit “Buy” just as thousands of others do. For a moment, it feels like you made the right call. Then, the rug gets pulled: the price collapses, sellers step in with force, and your new position is underwater — fast.

What Causes a Bull Trap?

Markets are clever, and psychology plays a big part. When everyone expects more downside, even a small rally can spark hope. Technical traders will spot the asset 'breaking resistance,' a move that often signals a true trend reversal. But here's the thing: Bull traps are propelled by a lack of sustained buying power. There may be a burst of enthusiasm, but not enough real momentum to keep prices climbing. Sometimes big players — whether whales in crypto or institutional traders in equities — will push the price up just to trigger stop-losses and lure in more buyers. Once the trap is set, they sell into the very uptrend they've created, leaving latecomers holding the bag (source).

The Chart Patterns You Need to Watch For

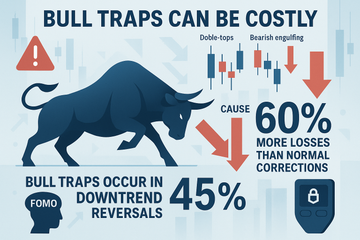

- Double-top rejection: Price reaches a recent high twice but can’t break through, then reverses sharply.

- Bearish engulfing candle: After a bullish surge, a strong bearish candlestick swallows the previous one whole, signaling a reversal is coming.

- Fake-outs above resistance: Price briefly closes above a key level, only to fall right back below it soon after.

These aren't the only traps out there, but in crypto, they’re the usual suspects. And unlike in traditional finance, the speed and ferocity of crypto moves mean bull traps can trigger and close in minutes — leaving no time for second-guessing.

Why Bull Traps Hurt So Much in Crypto

The market’s 24/7 nature and its wild swings — sometimes 10% or more in a single hour — mean emotional trading is shockingly common. Plus, crypto's reputation for moonshots makes people more susceptible to FOMO triggers. Honestly, there's nothing quite like being caught wrong-footed in crypto: you feel a mix of disbelief, regret, and that unique sting that only comes when your favorite meme coin is involved.

And here's a bit of trivia: research suggests bull traps occur in about 45% of apparent reversals during downtrends and are responsible for 60% more losses than normal price corrections (source). That's a lot of people getting fooled, more often than many would like to admit.

Hardware Wallet Digression: Protecting Gains Is Half the Game

While we’re talking risk, let's get a little tangential for a moment — have you noticed how many traders nail the entry but lose their crypto due to weak security after chasing a bull trap? It feels pointless to pick the bottom or top if you’re still relying on exchanges for storage. Using a hardware wallet like Trezor or Ledger is as important as avoiding market hazards. You can recover from a loss in a trade; you can't recover stolen coins. Food for thought, right?

How Can You Avoid Getting Caught?

Let's face it, nobody has a crystal ball. But there are ways to protect yourself from bull traps that don't involve constant second-guessing.

- Volume really matters: If an apparent breakout isn’t supported by a meaningful spike in trading volume, it’s suspect. Thin volume means the rally can vanish the moment sellers wake up.

- Wait for confirmation: Don’t rush your entry. If the price holds above resistance for a couple of candles, or on higher timeframes (think 4-hour or 1-day), the probability of a bull trap drops.

- Set stop-losses below key support: Not glamorous, but when the trap closes, you’ll be glad you exited gracefully instead of stubbornly hoping for a rebound.

- Study the context: Broader market trends, news cycles, and even sentiment shifts among major traders can all telegraph trouble. If everything feels euphoric, be suspicious.

- Embrace skepticism: Honestly, if something feels too good to be true in crypto, it almost always is. You know what? That old cliché survives for a reason.

The Emotional Side: It’s Not Just About Charts

Here’s what most trading forums won’t tell you: Getting trapped isn’t just about a bad read of the charts — it’s the emotional rollercoaster that comes after. One minute you’re high on the thrill of 'being early;' the next, you’re watching a losing position eat away at your confidence. Some traders will chase losses, doubling down out of hope, which is how small mistakes become legendary blow-ups.

Developing discipline — sticking to plans, accepting losses, walking away from the screen — sounds simple in theory. But in practice? Let’s just say there’s a reason veteran traders talk about 'psychology over strategy.' Good tools like Trezor and Ledger protect your coins, but only strong habits protect your account.

Wrapping Up: Bull Traps Will Always Be Lurking

Bull traps are as old as markets themselves. They play on hope, impatience, and sometimes plain greed. But they're not unbeatable. If you focus on solid risk management, use technical and volume signals wisely, and maybe keep your coins safe in a hardware wallet for good measure, you'll be in a stronger position the next time a bullish breakout comes calling.

Crypto’s wild nature means fast profits — and fast mistakes. Learn from those burned by bull traps instead of joining their ranks. That way, when the true uptrend finally arrives, you’ll be ready to act with confidence and maybe, just maybe, enjoy the real rally instead of chasing phantoms. Stay curious, stay cautious, and trade smart.