Block rewards feel simple at first glance. You send a transaction, someone packages it into a block, and the network says thanks with some coins. Easy, right? Well, kind of. The idea is simple, the mechanics and the incentives behind it are where things get interesting. Let me explain.

So, what is a block reward, really?

A block reward is the sum of crypto paid by a blockchain protocol to whoever proposes and finalizes a valid block. In proof of work, that is a miner who solves a cryptographic puzzle. In proof of stake, that is a validator chosen by the protocol. The reward is how the network pays for security and liveness. No payment, no one spends energy, hardware, or capital to keep the chain moving.

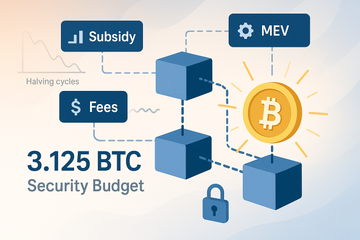

Most block rewards have two parts. There is the protocol reward, often called the subsidy, and there are transaction fees. Fees come from users who want their transactions included. Subsidies are minted by the protocol itself, governed by the chain’s monetary policy.

Why block rewards exist in the first place

Think of a blockchain like a public road that stays open only if someone maintains it. The block reward funds that maintenance. It attracts miners or validators to compete or coordinate, it pays them fairly, and it nudges them to follow the rules. Skip the reward, and attackers would have an easier time. Pay the reward, and honest participants show up, invest, and build a reliable network.

Bitcoin’s way, simple on purpose

Bitcoin pays a predictable block subsidy that halves roughly every four years. After the 2024 halving, the reward fell to 3.125 BTC per block, plus transaction fees. The idea is elegant. Over time, new issuance trends toward zero, and miners rely more on fees. The fixed schedule gives everyone a shared expectation, which helps with planning and, some would argue, trust.

There is a twist. When fees spike during busy periods, miner income can soar even if the subsidy is low. When fees are calm and the price dips, margins compress and inefficient miners shut down. That cycle, harsh as it sounds, helps keep the network lean and resilient.

Ethereum’s approach after the Merge

Ethereum no longer uses proof of work. Validators stake ETH, run clients, and propose or attest to blocks. The reward comes from new issuance, priority fees from users, and sometimes MEV, short for miner or maximal extractable value. Another piece matters here. Since EIP-1559, the base fee burns. So part of what users pay disappears from supply. Some days, Ethereum runs net deflationary. Other days, issuance wins out. The balance shifts with usage.

Other chains, other flavors

Proof of stake networks like Solana, Cosmos, and Polkadot use different monetary policies. Some use dynamic issuance to target a staking rate. Some pay commissions to validators who then share rewards with delegators. Governance often tunes these parameters. That is powerful, and sometimes messy, because incentives need constant calibration as conditions change.

What actually lands in a block reward

- Subsidy, newly minted coins defined by the protocol.

- Transaction fees, paid by users for inclusion and speed.

- MEV, extra value captured by reordering or including certain transactions, especially on smart contract chains.

Not every chain exposes these the same way. The mix affects economics, behavior, and even user experience when the network is busy.

Game theory with real money on the table

The block reward only works if it nudges honest behavior. In proof of work, miners risk sunk costs, like electricity and hardware. Cheating means wasting that investment. In proof of stake, validators risk their bond. Misbehavior can lead to slashing. Both designs push rational actors to play by the rules. Perfect, no. Effective, usually.

Fees versus subsidies, a slow handoff

Over time, many networks want fees to carry more of the security budget. Bitcoin is the classic case, since the subsidy halves on schedule. Ethereum took a different path with base fee burns and staking rewards. Other chains tweak rates by governance. The long term question is simple. Will fees be high and steady enough to fund strong security, especially during quiet periods? No one knows for sure, and that uncertainty keeps researchers busy.

Halvings, seasons, and the human factor

Markets add flavor. Halving years tend to feel charged. Headlines pop, miners recalibrate, and traders start telling stories. Sometimes fee markets get wild when the network hosts a trend, like inscriptions or memecoins. Other months pass quietly. Human behavior, not just code, shapes rewards and revenue. You know what? That mix is part of the appeal and the challenge.

Misconceptions worth clearing up

Block rewards are not free money. Miners pay for rigs and energy. Validators post capital, run infrastructure, and carry slash risk. Also, high rewards do not always mean high security if they are not durable. The source matters. Stable fee revenue, broad participation, and healthy competition tend to build stronger foundations than short bursts of subsidy-driven income.

Where the rewards actually go

Once a miner or validator earns rewards, those coins need custody. Some sell a portion to cover costs. Some hold for upside. Many move funds to cold storage. For individuals or small teams, hardware wallets like Ledger and Trezor are common choices because they keep keys offline. If you are staking from self-custody, tools like Ledger Live can help manage assets while the keys stay on the device. Trezor Suite offers a clean flow too. The goal is simple, control your keys, reduce hot wallet exposure, and sleep better.

A quick tangent, taxes and reporting

Rewards often count as income when received, then you have capital gains or losses when you sell. Rules vary by country. Keep records. If you are running a validator or a small mining setup, separating wallets for operations and savings helps. It sounds fussy. It saves headaches later.

MEV in a nutshell

MEV adds another layer. Validators or builders can capture extra value by ordering transactions in a profitable way. Think of liquidations, arbitrage, or sandwich attacks. The community has built tools to route MEV in less harmful ways, like proposer-builder separation on Ethereum and private order flow. Does MEV boost rewards? Yes. Does it complicate fairness and user protection? Also yes. The work to balance both is ongoing.

Security budgets and price, a two way street

Higher coin prices raise the fiat value of rewards. That tends to attract more miners or stakers, raising security. But rising security can also boost confidence, which supports price. It is a feedback loop, sometimes positive, sometimes not. Sharp drawdowns can squeeze margins, push miners to sell, and cool hash power. The pendulum swings. Good designs try to absorb those swings without breaking.

Design choices that shape the future

Should Bitcoin add a tail emission, a tiny ongoing subsidy, or trust fees alone over time? Monero chose a tail emission to keep miner incentives predictable. Should Ethereum tighten issuance or adjust burn mechanics again? Should staking networks tweak commission caps to keep decentralization healthy? These are lively debates, and they matter because incentives quietly steer everything from node diversity to latency to user costs.

Why regular users should care

If rewards are right, blocks arrive on time, fees stay relatively fair, and your transaction confirms without drama. If rewards are wrong, you see slow blocks, stale proposals, or higher fees as competition dries up. Incentives do not sit in some theory textbook. They show up right in your wallet when you hit send.

Practical pointers for the curious

- If you mine or validate, set a clear treasury plan. Sell some rewards to cover costs. Hold the rest with intention.

- Use cold storage for long term holdings. Ledger and Trezor both provide solid hardware security, and they work well with common wallets.

- If you delegate stake, check validator commission, uptime, and community reputation. A small cut with poor performance can still cost you more than a fair cut with great reliability.

- Track taxes from day one. Even a simple spreadsheet beats guessing later.

A small contradiction, then a fix

Block rewards look like pure math. They are not. People tune parameters, deploy upgrades, and respond to markets. Yet math anchors the system. Predictable schedules, verifiable fees, and consensus rules keep the human parts pointed in a good direction. That mix, math plus messy reality, is what makes the topic endlessly interesting.

Wrapping it up

The block reward is the heartbeat of a chain. It funds the people who secure it, balances risk and reward, and guides the network through bull runs and quiet winters. Sometimes the subsidy does the heavy lifting. Sometimes fees carry the day. Either way, the design choices ripple into price, performance, and security. If you earn rewards, store them well. If you use the network, understand what you are paying for. And if you build, remember that small changes to incentives can echo for years. That is the real story behind every block that lands on chain, steady, paid for, and validated by a crowd that believes the next block is worth it.