A block reward sounds simple. It is the sum of crypto paid to a miner or validator for adding a new block to the chain. That payment is not just a tip. It is the fuel that keeps a network honest, fast, and secure. Without it, you would not get a reliable ledger or a reason for anyone to do the heavy lifting.

You know what? The term feels bigger than it looks. Under the hood, a block reward ties together inflation, fees, and incentives. It shapes miner behavior and validator habits. It even brushes against wallet security and your day to day experience sending a payment. Let me explain.

What sits inside a block reward

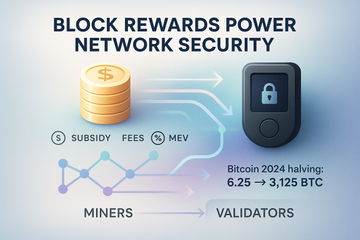

Three parts usually make up the pay packet that lands with a miner or validator:

- Subsidy: Newly minted coins that increase total supply. This is the classic Bitcoin model.

- Transaction fees: The fees users pay to get their transactions included. Fee markets rise and fall with demand.

- MEV (maximal extractable value): Extra value from ordering transactions, seen on chains like Ethereum. It adds a side stream of revenue, often shared via relays and software like MEV-Boost.

Different networks mix these parts in different amounts. Some add a burn to offset inflation. Some reduce issuance over time. The mix creates a security budget. That budget is the reason an attacker needs massive resources to rewrite history.

Bitcoin’s clean model, and why the halving matters

Bitcoin keeps it elegant. Every 210,000 blocks, the subsidy halves. In April 2024, the reward fell from 6.25 BTC to 3.125 BTC. Fees are still there, but they swing with demand. During hype, fees jump and miners smile. During quiet spells, the subsidy does most of the work.

This schedule points to a hard cap of 21 million BTC. People love the certainty. The catch is that miner income falls whenever the halving arrives, so fee pressure or price appreciation often needs to fill the gap. That is not a bug. It is the way Bitcoin shifts from inflation funded security to fee funded security over time.

A small twist here. Folks say fees will always replace the subsidy. That sounds neat, but it is not automatic. It depends on sustained demand for block space. So far, we have seen waves. Ordinals and inscriptions sent fees higher during bursts. When the buzz fades, fees ease. The long run trend is still unfolding.

Ethereum after the Merge

Ethereum switched to proof of stake in 2022. Miners exited. Validators with staked ETH entered. The idea stayed the same, pay those who secure the chain, but the mechanics changed. Issuance dropped a lot, and fees took a new path.

Here is the thing. With EIP 1559, a base fee is burned. Users also add a tip, called a priority fee, that goes to validators. MEV is an extra channel, often captured with MEV-Boost and shared across participants. When activity spikes, burns can outweigh issuance. That creates net negative supply for stretches, which people call ultrasound money. The meme is playful, but the math is real. More demand, more burn. Less demand, smaller burn.

Validators earn through block proposals and attestations. They also face penalties for going offline and slashing for severe faults. The yield is variable. It changes with the number of validators, MEV flow, and fee levels. It is not a fixed savings account, and that is fine. It is a security service with live conditions.

Other chains, other flavors

Proof of stake networks like Solana, Avalanche, and Cosmos chains like Cosmos Hub or Osmosis pay validators via inflation and fees. Many use a decay schedule so inflation falls over time. Delegators stake with validators and share rewards. Lockups and unbonding periods add friction so capital cannot flee instantly.

That variety matters. A chain with fast blocks and high throughput might rely more on inflation early on, then lean on fees as usage grows. A chain with low fees today could still pay validators from inflation while it builds an ecosystem. The reward is never just a number. It is a policy choice tied to growth and trust.

So what does this mean for you

If you mine, the block reward is your revenue line. You balance hardware costs, power, and difficulty against the reward. Margins can get thin. Halvings tighten them. Fee spikes bring relief. If you validate, your returns depend on uptime, MEV sharing, and network health. You need good ops. You also need a plan for incidents.

If you are a regular user, the block reward still touches you. It shapes the fee market and the security guarantees you rely on. On chains where fees rise, your transaction waits or costs more. On chains with strong issuance but low demand, your holdings may face more dilution. There is no one size fits all model.

Wallets, rewards, and staying safe

Block rewards usually land on addresses you control. That means keys matter. A lot. If you mine or receive staking rewards as a delegator, a hardware wallet like a Trezor Model T or a Ledger Nano X keeps your private keys offline. You sign transactions on the device, so malware on your computer cannot steal your keys. It feels like putting your house keys in a safe, not under a doormat.

One small caveat. Validators often need online keys for signing duties. That is different from a delegator who can stash funds in cold storage and stake through a smart contract or chain module. If you run a validator, split your keys, use secure enclaves where possible, and keep treasury funds in cold storage. If you delegate, hardware wallets fit nicely. Many staking portals, including Ledger Live for supported networks, make it simple to stake while keeping keys on device.

Seasons, cycles, and the fee weather

Crypto has seasons. Halving cycles draw headlines. NFT mints come in waves. Memecoin summers turn gas into fireworks. During these periods, fee markets heat up, so block rewards swell with fees. Then things cool. The pattern is familiar, like holiday shopping spikes in retail. Miners and validators plan for that swing. Users feel it in wait times and cost.

Myths to clear up

Free money, right

Not really. Block rewards pay for security work. They are earned with hardware, electricity, capital, and risk. They also change with network conditions, so the number you saw last month may not hold this month.

Rewards always inflate supply

Often, yes. But not always. On Ethereum, the burn can offset or exceed issuance. On Bitcoin, new supply is on a strict schedule that keeps falling, and the full cap is fixed. On other chains, inflation decays yearly.

Bigger rewards mean better security

Sometimes. A larger budget can raise the cost of attack. But if the reward is paid in a token with weak demand, real security may not rise. Market value and participation both matter.

A quick back of the napkin example

Picture a small Bitcoin miner with 100 TH/s in a pool, during a calm week after the 2024 halving. Network hashrate is high. Fees are modest. Their share of the pool gets them a tiny slice of the 3.125 BTC subsidy plus fees. If fees are 0.25 BTC per block on average, total per block is 3.375 BTC shared by the pool. Energy costs squeeze their margin, so they hope for a weekend fee surge or a price bump.

Now look at an Ethereum delegator. They stake through a validator who runs MEV-Boost and keeps strong uptime. Their yield comes from issuance, priority fees, and MEV sharing. When onchain activity spikes, their rewards grow. When it slows, they shrink. It breathes with the network.

Practical notes you can actually use

- Track the mix: Watch subsidy versus fees. On Bitcoin, halving cuts the subsidy. On Ethereum, burns and MEV move the needle daily.

- Secure the bag: Use a Trezor or Ledger for storing rewards. Keep cold storage for long term holdings. Hot wallets are for spending and operations.

- Mind your taxes: In many places, block rewards count as income when received, then gains or losses when you sell. Talk to a professional.

- Check validator performance: If you delegate, choose operators with clear fee structures, good uptime, and transparent MEV policies.

- Respect slashing: Proof of stake has penalties. Keep it in view if you run a validator or select one.

Why the block reward still feels a bit magical

It is a simple idea that does a lot. It pays strangers to keep a public ledger safe. It turns energy and capital into security. It balances math with markets, and rules with human behavior. That sounds like a contradiction, because it is. Yet it works because the incentives line up for long enough, and because people keep showing up for the next block.

So keep an eye on the mix. Watch how halvings change miner revenue. Watch how burns affect supply. Look for fee spikes during crowded moments. Most of all, protect your keys. If your rewards land on an address you control, a hardware wallet is not just gear. It is peace of mind. Store long term rewards on a Trezor or a Ledger, keep your hot funds tidy, and let the network do the rest.

The block reward pays the bills for security. It also tells a story about demand, culture, and timing. Next time a block lands and a miner or validator gets paid, you will know why that little payout matters so much.