Bitcoin inscriptions sound arcane, but the idea is simple. You take the smallest unit of Bitcoin, a satoshi, and attach a piece of data to it. That data can be text, an image, a snippet of code, or a short audio clip. Once recorded, it sits on the chain, traceable and part of Bitcoin’s history. People call these pieces digital artifacts, and the buzz has been real. Artists, collectors, and curious builders all showed up. Fees spiked, debates flared, and yet the curiosity did not fade. You know what? That mix of culture and code is exactly why it is interesting.

So, what is an inscription, really?

An inscription uses something called Ordinal theory. It numbers each satoshi, then lets you tag a specific sat with content. Think of a huge ledger of tiny slots, one slot per sat. When you inscribe, you fill one slot with your data. The sat becomes a carrier. Move the sat, and you move the artifact.

Technically, inscriptions live in Taproot witness data. That is the part of a transaction that holds signatures and extra info. Because of SegWit rules, this data is discounted for fees. Miners still include it, nodes still verify it, and the artifact becomes part of the chain. It is not a link to a server. It is the content itself, baked into Bitcoin’s record.

Why artists and degens care

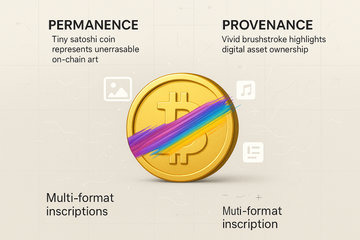

Two big reasons. First, permanence. On-chain art has a special ring. No dead links. No surprise takedowns. Second, provenance. A sat with a clear history feels like a collectible with a serial number. That story matters to collectors. Even meme culture found a home here. BRC-20 tokens, which are simple JSON text inscriptions, showed that people will experiment if it feels novel and fun. The result, love it or not, is a fresh niche right on Bitcoin.

But there is a catch

Inscriptions use block space. When demand is hot, fees rise. Regular users notice. Some say inscriptions clog the mempool. Others point out that miners follow fees, and fees reflect what people value. Both views carry weight. There is also UTXO clutter. Many small outputs can hang around and raise costs later. Wallets need to manage those carefully, or users risk spending an artifact by accident. A little care goes a long way.

How it works under the hood

Let me explain the rough flow. Most inscriptions use a commit and reveal pattern. The commit transaction sets up a Taproot output that quietly commits to your content. The reveal transaction spends that output and presents the content in the witness. Nodes verify it, miners include it, and your artifact is permanent once confirmed.

Taproot and SegWit V1 make this possible at scale for many small pieces. Each block has a weight budget. Witness data is cheaper per byte, which invites more data in the same block weight. Not free, just cheaper. That discount is a design choice, and it shapes the tradeoffs we are seeing now.

Wallets, safety, and not losing your rare sats

Here’s the thing. Wallet hygiene matters. If you mint or collect inscriptions, treat those UTXOs like collectibles. You do not want your wallet to use one as change in a random payment. That hurts. Hardware wallets help, because they keep keys offline and let you review details before signing. Trezor and Ledger both work with Ordinals workflows through tools like Sparrow Wallet and PSBTs. Many collectors use a watch-only wallet on a computer, then sign with the hardware device. It feels calm and careful, which is good in Bitcoin land.

Practical tips that save headaches

- Use coin control. Label your inscription UTXOs and freeze them if your wallet allows it.

- Keep a separate account. Create a dedicated Taproot account for inscriptions, and another for spending.

- Stick to bech32m addresses. That is the format for Taproot. It lowers confusion.

- Sign with hardware. Trezor or Ledger, plus Sparrow or another PSBT-friendly tool, cuts risk.

- Test on small amounts. Send a tiny transaction first. Learn the flow, then scale up.

Fees, mempools, and timing

Fees move like the weather. Weekends might be calm. A hot mint, or a halving party, can spike prices in minutes. Use mempool.space or your node to check live fee bands. Replace-by-Fee helps you raise a stuck transaction without panic. Batch when you can. Set a ceiling for your inscription size, since larger files mean higher fees. Small and neat often wins over huge and pricey.

Common myths, cleared up

Myth 1, inscriptions break Bitcoin. No. They follow the rules. They do compete for space, and that can raise fees. That is part of the fee market. Policy debates are fair, but the chain is not broken.

Myth 2, zero impact. Also no. Inscriptions change incentives, and they shape how people use block space. They push wallets to improve coin control. The social layer will keep debating it, which is healthy. Bitcoin has weathered heated debates before.

Should you inscribe?

Ask what you want to put on chain forever. Art with a clear audience makes sense. Certificates, open letters, micro games, even poems, can make sense too. If you are just testing, keep it tiny. Fees can sting. Permanence can be a blessing or a burden. A joke can feel less funny when it costs real sats and lives forever.

Getting started, gently

First, pick a tool you trust. Many use Ordinals-focused wallets like Xverse or UniSat for browsing and basic actions. For careful control, Sparrow with a Trezor or Ledger is popular. Create a new seed or a separate account, write down the backup, and keep it offline. Fund the Taproot account with a small amount.

Next, choose your content. Compress images. Keep file sizes modest. Prepare a simple description. Then follow a mint flow, either with a no-custody tool or a reputable marketplace that supports direct on-chain mints. Review addresses, review fees, then sign on the hardware wallet. You can track the sat number and inscription ID on an explorer. It feels a bit like sending your work into space, then watching it light up in the sky.

Trading and storage, going beyond the mint

If you plan to trade, use marketplaces that honor provenance and show the inscription content directly. Magic Eden and others list Bitcoin items now. For storage, split collectible sets into tidy UTXOs. If you treat them like cards in sleeves, you lower the odds of confusion. Keep a small hot balance for fees, and a cold stash for the precious pieces. That split keeps you sane.

Costs, limits, and a quick reality check

Large files can be pricey. You will pay more in a busy mempool. Pruned nodes might not keep the full history locally, but the chain holds the data forever. That is a key point. You are writing into the public record. Anyone can read it. Think twice, sometimes three times, before you push send. Honestly, restraint is a superpower here.

What about Runes and other trends?

Even as inscriptions keep rolling, new experiments keep popping up. Runes, launched near the 2024 halving, offer a different angle for fungible tokens on Bitcoin. The pattern is familiar. Builders try things, fees move, culture reacts. If you care about collecting, watch the fee market, watch the tooling, and watch how wallets adapt. Hardware support and PSBT workflows are getting smoother, which is good news for folks who want safety first.

A quick checklist before you hit mint

- Back up your seed, offline. No screenshots. No cloud storage.

- Confirm addresses twice. Taproot bech32m only for inscription flows.

- Label UTXOs. Your future self will thank you.

- Track fees live. Use mempool tools. Be patient if needed.

- Sign on hardware. Trezor or Ledger keeps the keys off your computer.

The road ahead

Bitcoin inscriptions blend art, collecting, and protocol design in a messy, lively way. Some days it feels like a gallery opening. Other days it feels like a shipping yard at rush hour. That tension is real. Still, the core insight stays clear. A sat can carry meaning. A tiny unit, a tiny canvas, and a permanent mark.

If you treat the process with respect, you can explore without burning your stack. Start small, keep your keys safe, and learn the tools. Ask questions in public channels, and read the docs. Then enjoy the simple thrill that never gets old. You pressed send, and a new artifact found a home on Bitcoin.