If you have been poking around Base and wondering where the real liquidity lives, you have probably bumped into Aerodrome. It is a decentralized exchange built for speed, incentives, and, frankly, a bit of friendly competition. Traders get straightforward swaps. Liquidity providers get emissions. Voters steer the flow. It is familiar if you know Velodrome on Optimism, yet it fits Base like a glove.

So, what exactly is Aerodrome?

Aerodrome is an automated market maker on Base, Coinbase’s Layer 2 network. It launched in late August 2023 with a clear mission, become the central liquidity hub for Base. The protocol is stewarded by contributors connected to the Velodrome ecosystem, and it borrows Velodrome V2’s proven design. That means stable and volatile pool types, deep incentives, and a governance engine that keeps the flywheel spinning.

Here is the thing. Aerodrome does not try to be everything for everyone. It focuses on efficient swaps, strong incentives for liquidity, and a weekly rhythm of emissions and votes that keeps projects engaged. If you are a builder launching a token on Base, you want your pool to attract votes. If you are a voter, you want fees and bribes. If you are a trader, you just want tight pricing. Everyone knows the rules, and that clarity helps.

How the ve(3,3) engine really works

The heartbeat of Aerodrome is the ve model, the same philosophy introduced in Solidly and refined by Velodrome. The native token is AERO. You can lock AERO for up to four years and receive veAERO, which is an NFT that represents your voting power. Longer locks grant more voting weight, and that weight decays as time passes.

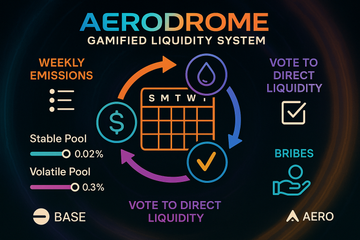

What do those votes control? Gauges. Each liquidity pool has a gauge, and every epoch, typically weekly, veAERO holders vote on gauges to decide where new AERO emissions go. Pools that earn more votes receive more AERO for their liquidity providers. Projects can add external incentives, often called bribes, to attract those votes. It sounds a little political, and it is, but the result is simple, liquidity gets directed to where users want activity.

There is a mild contradiction here. Voters get protocol fees, but LPs get emissions. Why split it like that? Because it lets each group specialize. Voters focus on governance and fee capture, while LPs target yield from emissions and potential bribes. Over time, this separation tends to reduce mercenary capital and reward long term participants.

Stable versus volatile pools, and where fees land

Aerodrome uses two pool types:

- Stable pools for correlated assets like USDC and DAI, designed to keep slippage minimal around the peg.

- Volatile pools for uncorrelated assets, the classic constant product curve you know from Uniswap v2 style AMMs.

Fees are set per pool and can vary. In practice, volatile pairs often sit in the ballpark of 0.3 percent, while stable pairs are commonly a fraction of that, sometimes near 0.02 percent. Exact values depend on the pool configuration. Here is the twist that trips up newcomers, most swap fees go to veAERO voters, not LPs. LPs earn AERO emissions routed by the weekly gauge votes, plus any partner incentives layered on top. That split is by design, and once you see it, the weekly vote game makes more sense.

AERO tokenomics in plain English

Emissions are distributed every epoch, and the schedule typically decays at roughly one percent per week. That slow decay helps the system find balance, enough fresh AERO to lure liquidity, not so much that it overwhelms fees and demand. veAERO positions are NFTs that can be merged or split, so power users can manage positions without much friction. Rewards to voters come from two places, protocol trading fees and bribes. Some weeks the bribe market is the real show, especially when new tokens launch and teams compete for attention.

Why projects care about Aerodrome

Base has grown fast, helped by cheap gas and a steady stream of new apps. When a new token lands, seed liquidity matters. Aerodrome makes that a weekly ritual. Teams can pair their token with ETH, USDC, or another asset, then post bribes to draw gauge votes. If they succeed, LPs chasing emissions will pile in, deepen liquidity, and reduce slippage for traders. That tighter spread helps price discovery, which helps everything else.

For traders, the experience is just clean. Pick a route, confirm, done. For LPs, it is a numbers game. Which pool has strong emissions this epoch, and does your position make sense after gas and price risk? For voters, it is fee math and a hint of game theory. You know what, it is a bit fun if you like spreadsheets.

Security, audits, and being realistic about risk

Aerodrome’s contracts are based on Velodrome V2, which has been heavily scrutinized and audited. Aerodrome itself has undergone external reviews and maintains public repositories and documentation. Still, no smart contract is risk free. If you are providing liquidity, you carry smart contract risk, potential oracle quirks for pegged assets, and the possibility of governance capture where large ve holders drive outcomes that do not favor you.

One more safety point that rarely gets enough airtime. Keep your assets in a wallet you control. Hardware wallets like Ledger or Trezor add a physical layer of approval, which is more forgiving of human mistakes. If you vote, claim, or compound weekly, that extra click on a hardware device can prevent a bad signature from draining funds. It is not glamorous, but neither is getting phished.

Where Aerodrome stands on Base

Aerodrome is consistently among the top protocols on Base by TVL and volume. You can confirm current figures on aggregators like DeFiLlama. The protocol’s edge is not only raw liquidity, it is the weekly governance rhythm that draws teams into the system. That rhythm creates stickiness.

Competitors worth watching

- Uniswap v3 on Base, concentrated liquidity and a massive brand. Great for deep majors and active LPs.

- PancakeSwap on Base, multi chain reach and frequent incentives.

- BaseSwap and DackieSwap, native AMMs that serve long tail and community tokens.

- Alien Base, another Base focused venue that sometimes wins on newer pairs.

Uniswap v3 specializes in concentrated ranges, which suits different LP behavior than Aerodrome’s emissions model. PancakeSwap brings broad awareness and partner campaigns. Aerodrome, on the other hand, offers a predictable cadence of emissions and a bribe market that keeps governance lively. Different tools, different tradeoffs.

What it costs to trade and LP

Trading fees are shown per pool at execution, and gas on Base is usually inexpensive. For LPs, the hidden cost is not hidden at all, it is impermanent loss. You earn AERO, maybe extra incentives, and you face price divergence between your pair. If a token moons relative to its partner, your LP position harvests less of that upside. The emissions can outweigh the loss, but that is a calculation you should run, not a hope you should hold.

Common risks, said plainly

- Smart contract risk, bugs or integrations can fail.

- Governance capture, big veAERO holders can swing emissions.

- Bribe volatility, external incentives can dry up, yields can drop fast.

- IL and volatility, especially on volatile pairs and during listings.

- Network and MEV, Base sequencing, mempool quirks, and sandwich risk still matter.

- Stablecoin assumptions, if a stable loses its peg, stable pools can suffer.

None of these are unique to Aerodrome, but the weekly cadence can amplify the swings. Some epochs are rich. Others are quiet. Plan for both.

Practical tips before you click confirm

- Check the pool’s current fee tier, volume, and emissions for the current epoch.

- Peek at the bribe market. If a pool has strong bribes, voters will likely steer emissions there.

- Look at historical APRs, not just today’s number. Weekly shifts can be meaningful.

- Use a hardware wallet like Ledger or Trezor and verify contracts before approvals.

- Set realistic slippage, and consider routing stable pairs through stable pools first.

A quick word on culture and cadence

Aerodrome feels seasonal. New tokens arrive in waves. Memes heat up on Fridays. Votes cluster near epoch close. That rhythm creates community habits. People build dashboards. Teams host bribe campaigns. Traders watch for fresh emissions that thicken the books. It is a weekly market, and it rewards those who show up on schedule.

Final take

Aerodrome did not reinvent the wheel. It refined a model that works on a fast, low cost chain where attention moves quickly. If you want concentrated liquidity and manual range management, you know where to go. If you prefer a weekly game of incentives where gauges and bribes shape the map, Aerodrome is the Base native choice that keeps proving itself.

Start small, learn the cadence, and keep your keys safe. Honestly, that simple recipe takes you farther than any hot tip.